Corporate Finance Assignment: Impact of Covid-19 on Share Prices of BHP Group

Question

Task:

Corporate Finance Assignment Task: Assume that you work as a research assistant of a middle manager of BHP Group ltd (the largest mining company in Australia) sees bhp.com. Your boss does not know much about financial markets, but he needs to prepare himself for an important meeting.

Therefore, he asked you to write 1500-word reports on the impact of the Covid-19 pandemic on the company share prices. He does not give you much information, but he wants to know what drives the BHP shares prices, and how the Covid-19 pandemic impacts the shares of the company. You are also encouraged to use data and data analysis (freely available).

Answer

Introduction

The report on corporate finance assignment will be based on the impact of the ongoing pandemic on the stock price of the mining firm, BHP Group Ltd. The world has been upside down due to the might of COVID-19 and its impact is on the Australian mining segment as well affecting the performance of BHP. Thus the report will state a brief on the current financial market and its impact on the stock price of the company. To do so, the report will determine various factors that influence the stock price and its impact on the BHP stocks as well. Indeed, the spread of COVID-19 has made the world standstill and so has been the situation with BHP.

Impact of COVID-19 on production capability of BHP

Statistics reveal that the major economies across the world like the US, European Union, and India has contracted drastically in the June quarter of 2020(BHP, 2021).The pandemic situation has affected deeply the labour market across Australia and BHP also felt the heat as some of its mines were temporarily shut. For instance, the Antamina copper mine and Cerejjón coal mine were temporarily closed due to the spread of COVID-19(BHP, 2021). The phenomenon affected production and mining activities leading to a decline in its revenue. The company took special care of its employees so that the virus cannot spread among the workforce and contemplate it, suspended substantial business operations across its operating market.

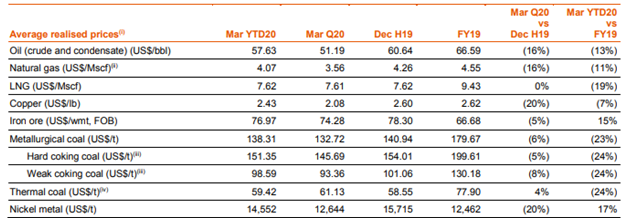

Source: (BHP, 2021)

The above table shows the declining price of the commodities manufactured that is due to create an impression in the operational ability and financial performance of BHP. In most cases, there is a downward trend in the realisable price showing the weaker demand in the marketaffectingBHP’s stock price.

Impact of COVID-19 on BHP stocks

The stock price of BHP declined by 7.4% on September 02, 2021, which is the steepest fall since May 2020(Reuters, 2021). The Australian market as a whole, say the ASX 200 index declined by 1.1% to 7,444.3 and this constant decline is steered by the ongoing pandemic situation(Brewer, 2021). The mining segment recorded a decline in the stock price by 3.1% for consecutive three days and trading at its lowest in one and a half weeks(oedigital, 2021). This comes at a time when Australia is on the verge of announcing another series of lockdowns to contain the spread of coronavirus, especially in a populated city like Melbourne. It is noteworthy that BHP is a major constituent of ASX 200 and the decline in its price, pulled down the stock market by 70%(Reuters, 2021). Further, BHP is currently trading ex-dividend as it is scheduled to announce dividends worth $2.73 per stock on September 21 due to reducing the stock price(Business-standard, 2021).

The decline in the stock price of BHP can be attributed to the poor demand for iron ore in the market which is one of the major produce of the miner. This is due to the declining industrial activities in China, the major consumer of BHP iron ore owing to strict COVID regulations. Besides COVID, the Chinese authorities are curtailing its manufacturing in steel companies to reach its carbon neutrality goals that account for 15% of carbon emissions in the country(Brewer, 2021). If the trend continues, BHP will suffer heavy losses in the upcoming future even if COVID wipes out. It is a concern in the market as BHP declined by 7.4% whereas its rivals like Rio Tinto and Fortescue Metals had a fall of 11.2% and 0.3% only(oedigital, 2021). It is assumed that BHP’s decision to exit the London Stock Exchange did not go well with the investors leading to its underperformance in the market. Recently, BHP Group decided to divest its petroleum business creating a spree in the market as 10% of its market capitalisation fell since the announcement(Brewer, 2021). The divestment is a strategic move by BHP to focus on nickel and copper acquisitions. Simultaneously, it will expose the miner to the widespread fluctuations of the iron ore that reflects in the stock price of the company. The phenomenon of continuous reduction in stock price will affect its credit ratings as well as BHP will lose the advantage of a diversified portfolio(oedigital, 2021). The plausible downgrading of BHP from ‘A’ ratings to BBB+ will affect the stock pricevigorously(Business-standard, 2021). Thus in the short-term, there is a COVID restriction that pushes the market down affecting BHP and the entire mining segment and other sectors. But in the long run, there are issues like declining iron ore demand from China, over-dependence on iron ore, and reducing diversification that affects the BHP stock price.

Factors affecting stock prices

Stock markets are the ideal place wherein the stock prices are determined based on the demand and supply of the desired stocks. Higher the demand and lower the supply, the stock price will shoot up and vice versa(Kim, et al., 2018). The stock market is quite unpredictable in its approach and is subjected to various factors that influence the stock price as follows:

Fundamental factors

The financials of the company alongside its financial and operating performance impactthe stock price drastically. The knowledgeable investors will go through various financial determinants like EPS, P/E to determine the worth of the stock(Vishny & Zingales, 2017). It helps to understand whether the stock will keep up the hopes of the investors to deliver a better return. BHP paid dividends worth $3.3 billion in December 2019(Reuters, 2021).Further, itisscheduled to pay dividends of $2.73 per stock in September 2021 indicating its capability to deliver an adequate return for the investors(oedigital, 2021).

Demand and supply

The stock market functions based on the simplistic economic principle of demand and supply.For instance, when BHP manufactures excessive iron ore and exports it to other countries, its profitability will rise and so does the demand for BHP shares. But as the demand for iron ore decreases in the market, BHP is experiencing a decline in its share price leading to a lesser demand despite a steady supply of stocks(Brewer, 2021).

Economy

The state of the economy plays a significant role in determining the idle price of the stock. Accordingly, the stock market will be influenced by domestic investors and Foreign Institutional Investors (FII)(Kim, et al., 2018). Any sort of slowdown as it happened during the ongoing pandemic invited a recessionary state in the economy affecting trading and price of the overall stocks.

Announcement of dividends

The declaration of dividends by the company affects the pricing of the stocks as a dividend-laden enterprise is considered a value-oriented company(Farag & Johan, 2021). Periodicdeclaration of dividends often surges the stock price as the investors develop trust in the company to deliver suitable returns.

Investors’ mindset

It may happen owing to a crisis period, the investors become hysterical and tends to sell off their holdings leading to a crash in the stock market. So an updated and knowledgeable investor can create a difference in the market and not be wary of the short-term phenomenon like COVID and stay invested for a longer tenure.

Conclusion

The report states three major reasonsthatled to the decline in the stock price of BHP in recent times. Firstly, the impact of coronavirus has been severe across the world and neither Australia nor BHP is immune to it. The world came to a standstill and so does the business activities of BHP leading to the temporary shutdown of some of its mines. The phenomenon affected the earnings of the company which got reflected in its stock price but it applies to the entire industry as well.

Secondly, BHP is too dependent on iron ore which is its major revenue earner by exporting in China. Since China has decided to restrict operations of it steel industries to cut down emission, there has been a reduced demand in iron ores. As iron ores are not in demand, the profitability of BHP is at stake and so does the stock price.

Thirdly, BHP has decided to sell off its petroleum business and this decision was not taken well by the investors. It is because it will lead to reduced diversification of the company’s product portfolio and expose it to iron ores more. The phenomenon will downgrade the company ratings to BBB+ and the stock will further fluctuate in the market.

Besides, there are other factors like the current state of the economy as Australia is thinking aggressively for another series of lockdowns in Melbourne paved a pessimistic market scenario. So certain reasons are specific to BHP while some common to all that are making a difference in the stock price of the company. Thus BHP needs to think strategically to undergo a market correction and stay relevant in the stock market in the upcoming future overcoming the business hurdles.

Bibliography

BHP, 2021. COVID-19. [Online]

Available at: https://www.bhp.com/news/covid-19

[Accessed 11 September 2021].

Brewer, R., 2021. Why BHP Group Stock Fell 15% in August. [Online]

Available at: https://finance.yahoo.com/m/e7d186ba-8be7-3e9b-b434-cfd2e513f35d/why-bhp-group-stock-fell-15-.html

[Accessed 11 September 2021].

Business-standard, 2021. Australia Market drags down by BHP going ex dividend. [Online] Available at: https://www.business-standard.com/article/news-cm/australia-market-drags-down-by-bhp-going-ex-dividend-121090201108_1.html

[Accessed 11 September 2021].

Farag, H. & Johan, S., 2021. How alternative finance informs central themes in corporate finance. Journal of Corporate Finance, Volume 67, p. 101879.

Kim, K., Kim, M. & Qian, C., 2018. Effects of corporate social responsibility on corporate financial performance: A competitive-action perspective. Journal of Management, 44(3), pp. 1097-1118.

oedigital, 2021. BHP at Risk of Credit Rating Downgrade on Oil Business Sale. [Online]

Available at: https://www.oedigital.com/news/490085-bhp-at-risk-of-credit-rating-downgrade-on-oil-business-sale [Accessed 11 September 2021].

Reuters, 2021. Australian shares drop over 1% on BHP losses, COVID-19 worries. [Online]

Available at: https://www.reuters.com/article/australia-stocks-midday-idUKL4N2Q346Z

[Accessed 11 September 2021].

Vishny, R. & Zingales, L., 2017. Corporate Finance. Journal of Political Economy, 125(6), pp. 1805-1812.