Block Chain assignment on strategies to help design a business solutions

Question

Task: how to design a business solution using Block Chain assignment research techniques?

Answer

Introduction

The Block Chain assignmentshows Block chain offers businesses a shared, unchangeable register which only validated users with permissions are capable of accessing. The employees of the group have complete ownership of the data on that network, and they also take the appropriate steps. Block chain contributes to stronger, more robust distribution networks and improved strategic partnerships by fostering trust amongst trading partners, delivering edge visibility, optimising operations, and addressing problems more quickly (Duttaet al. 2020). Nowadays various business organisations are adopting the block chain technology to develop smart consensus protocol to do away with the requirement for an external assessor. This Block Chain assignmentreport is prepared so as to develop a block chain solution that would benefit the banking industry in the long run.

Banking industry and their targeted customers

The category of tertiary industries includes banking. These are involved in operations related to commerce as well as delivering support and services to both primary and secondary sectors. These businesses offer facilities for services. These might be regarded as commercial activities since they support trade as auxiliary activities. The banking sector handles financial assistance, cash holding, investments, and other financial dealings. Since this distributes money to borrowers who have profitable assets, the banking sector is among the main forces behind most economies (Garget al. 2021). Payment methods, trading platform, international trading, and investment management are just a few of the many tasks that banks carry out. Additionally, it is observed on this Block Chain assignmentthat they serve as a conduit among depositors and lenders by offering banking facilities to those who wish to obtain financing using the money that clients deposit with them.

Nearly all customer groups and value levels, including low-, medium-, and high-value consumers, are represented in the banking business. Little value consumers are further classified into two groups: those with low incomes and little demand for payment services, and those who distribute their money around multiple banks (Kaur and Arora2019). The Block Chainassignment showsClients who have contributed a significant sum with a financial institution yet do not fit within the category of high valuable clients are considered medium-valued clients. High-value clients are a fund's most significant target market since they hold large amounts of savings or loans, which make them lucrative.

Banking industries are making an extensive use of automation and new technologies in order to empower the customers. This implementation not only benefits the cost structure of the financial institutions but it also empowers the customers. Banking industries make use of data based customer segmentation strategy creating opportunities to better understand the targeted customers and their need. The public can access financial services through retail banking, commonly referred to as commercial banking. Financial firms often provide savings and deposit accounts, secured loans, use of credit cards, and home loans. The customer segmentation strategy of a bank widely depends upon the business model that it follows. Using this strategy, retail banks can regulate the ways to attract new customers and thus helps in building brand loyalty.

Block Chain assignmentRole of trust

Among the most crucial elements for financial organizations identified on this Block Chain assignment is trust. In order to understand the new and intricate information in financial services, consumers make intellectual exertion. Customers sometimes don't comprehend the goods or services that a bank offers as a consequence, which leaves them feeling severely let down and causes them to lose faith in that bank. For a number of reasons, trust is crucial in interactions between banks as well as in relationships with clients in particular (Hasan 2019).The ability to negotiate with customers is facilitated by trust. Specific client demands, credit institutions resources, and financial assets customers already own or wish to obtain from the firm, such as insurance policies and settlements, are all well-handled of without the customers' involvement. Individuals who place a high level of trust in the business are certain that it is watching out for their best advantage. In certain cases, this high level of confidence may serve as a buffer against the negative experiences that potential clients could have (Sharma and Sharma 2019). Banking trust is essential, even in prosperous times. By fostering an enabling climate and ensuring economic stability, it helps to strengthen the economy.Without confidence, banks are unable to draw in savers or locate people that are eager to take out loans to fund their homes and companies.

No confidence is lost by using a blockchain. What is recognized in a blockchain is the database software, the regulatory or financial processes that control the behavior of computation elements that run the blockchain system, as well as the dependable outside entities. A blockchain is frequently referred to as a "shared trust" mechanism because, although it does not eliminate trust, it can eliminate the requirement to rely on a single specified third - party provider to preserve a ledger.

Block Chain assignmenttrustbuildingApproaches

In order to keep up with the customers and their preferences, banking industry need to build and maintain high level of trust within the products and services that they are providing. With the diversification of banking industry and its movement towards online platform the approaches that needs to be taken in order to build trust among customers are governed by five pillars for building trust which includes-security, human interactions, personalization, customer journey and radical transparency.

1. Security- the Block Chainassignment findings show that Customers are urged to place a greater and deeper level of trust in service suppliers in the internet world by voluntarily disclosing more facts and sensitive data digitally. It is typical to learn about data protection lapses or hacking incidents that can swiftly destroy any confidence a banking firm has created with its clients (Purwantoet al. 2020). The security and dependability of the digital technology used by banks must be ensured.

2. Human interaction- Despite technological advances, there are some circumstances when human contacts are necessary. People are trustworthy. Although technology may be utilised to enhance interactions, engagement, branding satisfaction, and commitment depend on the moral dimension.

3. Personalization- Consumers always prefer to receive new and high level of personalized services from banking industry (Islamet al. 2020). Besides providing customised and relevant services, it is required that the banking industry build trust among them. The consumer needs to be the focus of digital initiatives in order to establish trust, and data should be leveraged to give pertinent and beneficial information depending on the users' demands.

4. Customer journey- Building client loyalty and trust in banking services is crucial. The path that a client takes after being acquired by a bank must be taken into account (Toqeeret al. 2021).

5. Transparency- Trust is created by openness. By giving clients all the pertinent and required details regarding the products as well as offerings, the bank builds its reputation while also assisting customers in making wise financial choices.

Implementation of block chain solution in banking industry

Throughout the Block Chain assignmentfinancial lifecycle, the retail banking sector has a number of labour-intensive, expensive, and repetitive activities. Block chain technology lends itself perfectly to becoming a revolutionary tool inside this environment due to its distinctive propertiesAkramet al. 2020). There exists a different type of block chain solutions that helps banking sectors to implement block chain networks within them. Finacle Block Chain Framework is known to be one of the solution system offered by Infosys that allows banks to deploy the technology effectively based on varied services. Based on this framework, several solutions can be implemented within banking sector. One such solution is related to payment processes. The Block Chain assignmentsystem framework of Infosys helps banks to facilitate payment procedures through block chain technology. The block chain based solution that is applied here allows banking industries to reduce the transaction cost while enabling faster updates through a much more secured connection.

Role of block chain in creating trust within banking sector

With people experiencing virtually unrestricted access to their own records, block chain fosters accountability and trust while reducing time spent on infinite access. As a real peer-to-peer technology, it also eliminates the demand for middlemen. A technology for commercial interactions that blends usability, affordability, and restricted access has emerged thanks to distributed ledger technology. It establishes a new foundation of trust for commercial transactions, which might help the economy become significantly simpler and grow faster. Block chain promotes mutual trust amongst all peers (Dubinaet al. 2020). Data integrity is guaranteed via block chain technology. Users can utilise smart contracts to confirm that data manipulation has not taken place. By altering and enhancing the concept of faith, block chain is already positively affecting the industry. Regardless of the type of distributed ledger technology used, it suggests eliminating the centralised authority. By moving the focus of confidence from an organisation or authority, like a banking system, to faith in a Block Chain assignmentprogram, it modifies the focus of trust.

Business model to adopt block chain solution

There are different types of business models identified on this Block Chain assignmentthat are involved with block chain technology among which the P2P Block chain Business Model suits the best for the proposed solution. A peer-to-peer driven business is offered by the P2P financial model. Peer to peer has been a hallmark of block chain technology. Consumers may communicate with one another thanks to P2P block chain technology. As a result, it is included in practically all other network models (Rajnak and Puschmann 2021). Crypto currencies, BaaS, or processing fees are just a few of the various ways the P2P business plan may be made profitable. The way people deal has undergone a fundamental change in the contemporary era of digitization, saving us time and resources. A P2P platform connects people directly while carrying out a transfer without the use of a middleman. These Block Chain assignmentservices use technology to eliminate the necessity for dependable third-party facilitators by concentrating on the expenses of trust, compliance with the law, and knowledge anomalies.

Blueprint of the block chain system

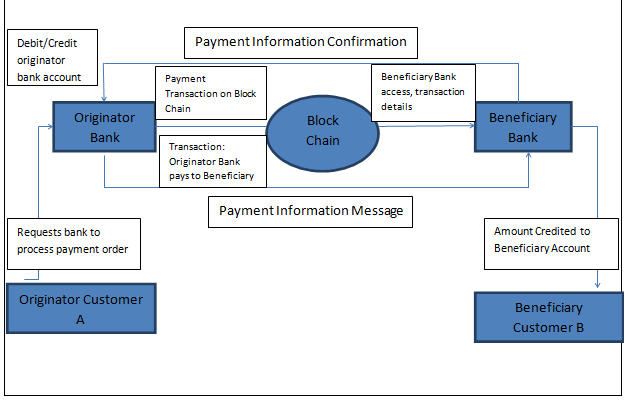

Fig:1. Block chain enabled Payment system

Governance mechanism

Leaders employ governance mechanisms built into the platform's technological design to resolve the trade-offs associated with the blockchain network (Kannengießeret al. 2020). Within the Block Chain assignmentsystem, this governance system establishes the guidelines for what users and actors may do. With this respect three types of governance mechanism can be used such as access, control and incentives.

First, the Block Chain assignmentsystem leader must specify what kinds of operators are allowed to engage in it, link participants to a technological platform, and assign managerial control for certain activities to the individuals in order to guarantee that players with compatible talents are connecting to produce value. The guidelines by which participants in the performance of these systems interact are established via regulatory systems. This needs a distinctly stated set of principles that also permits conflicting individuals to work together (Wanget al. 2022). Control methods also guarantee individual operators' responsibility and agreement in the instance of a conflict of involvement. The network leader also develops particular measures to encourage engagement and bonuses to encourage creative outputs (Konstantinidiset al. 2018). Value creation and capture amongst various players are significantly altered by governance systems that are BCT-enabled. The design methodology lessens the expense needed in traditional skills and, as either a result, the unpredictability connected with planned transactions (Schmeisset al. 2019). Additionally, it streamlines the transfer of money, which reduces the expense involved in keeping records of transactions.

Risks and challenges for the system

Some of the risks that are involved in Block Chain assignmentpayment systems include lack of privacy and confidentiality in some cases. A searchable archive of the entire transaction records is accessible to the general public, who are free to use it however they see fit.

Another risk that has emerged with this technology is with the use of private key and public key. Both public and private keys are crucial to the operation for distributed ledger technologies and indeed the network in general (Zhanget al. 2020). A user simply cannot retrieve the digital material contained inside the network if they do not possess the proper public and private key pairing. Targeting the customer's system, which is the main weakness, is how hackers attempt to obtain the keys.

Some of the challengesidentified on this Block Chain assignmentthat are involved with this includes legal challenges such as data privacy and ethical challenges such as meeting the prospects in terms of competence and veracity of the system (Basuet al. 2021).

In order to mitigate the risks involved it is to be ensured that the devices that are in use are updated regularly, good antivirus and firewalls should be used and not to store the details of the keys in email.

Future impact

Blockchain technology may be used by financial institutions and banks to build a centralised, highly secure common register of activities (Siekand Sutanto2019). Distributed ledger technology can speed up finance and banking operations while lowering liability exposure and origination and resolution times. It enables serious economic document verification including authenticated paperwork and Credit data, lowering risk exposures.

Conclusion

With the advent of block chain technology, the financial and financial services sector is experiencing considerable upheaval. Organizations that want to embrace newer capabilities and grow into fully network operators must take block chain into account. Block Chain assignmentsystems have the ability to revolutionize how bankers handle client enrolment, loyalty programmes, transactions, mortgage and credit administration, contract administration, and many more including its permanent, transparent, safe, and block chain based system.

References

Akram, S.V., Malik, P.K., Singh, R., Anita, G. and Tanwar, S., 2020. Adoption of blockchain technology in various realms: Opportunities and challenges. Security and Privacy, 3(5), p.e109.Block Chain assignment

Basu, S., Aulakh, P.S. and Munjal, S., 2021. Pluralistic ignorance, risk perception, and the governance of the dark side in peer-to-peer transactions: Evidence from the Indian banking industry. Journal of Business Research, 129, pp.328-340.

Dubina, O., Us, Y., Pimonenko, T. and Lyulyov, O., 2020. Customer loyalty to bank services: The bibliometric analysis. Virtual Economics, 3(3), pp.53-66.

Dutta, P., Choi, T.M., Somani, S. and Butala, R., 2020. Blockchain technology in supply chain operations: Applications, challenges and research opportunities. Transportation research part e: Logistics and transportation review, 142, p.102067.

Garg, P., Gupta, B., Chauhan, A.K., Sivarajah, U., Gupta, S. and Modgil, S., 2021.Measuring the perceived benefits of implementing blockchain technology in the banking sector. Technological forecasting and social change, 163, p.120407.Block Chain assignment

Hasan, E., 2019. The Functions of General Banking and the Marketing Implementations of Mutual Trust Bank Limited.

Islam, J.U., Shahid, S., Rasool, A., Rahman, Z., Khan, I. and Rather, R.A., 2020. Impact of website attributes on customer engagement in banking: a solicitation of stimulus-organism-response theory.

International Journal of Bank Marketing.

Kannengießer, N., Lins, S., Dehling, T. and Sunyaev, A., 2020. Trade-offs between distributed ledger technology characteristics. ACM Computing Surveys (CSUR), 53(2), pp.1-37.Block Chain assignment

Kaur, H. and Arora, S., 2019. Demographic influences on consumer decisions in the banking sector:

Evidence from India. Journal of Financial Services Marketing, 24(3), pp.81-93.

Konstantinidis, I., Siaminos, G., Timplalexis, C., Zervas, P., Peristeras, V. and Decker, S., 2018, July.Blockchain for business applications: A systematic literature review. In International conference on business information systems (pp. 384-399).Springer, Cham.

Purwanto, E., Deviny, J. and Mutahar, A.M., 2020. The mediating role of trust in the relationship between corporate image, security, word of mouth and loyalty in M-banking using among the millennial generation in Indonesia. Management & Marketing, 15(2), pp.255-274.Block Chain assignment

Rajnak, V. and Puschmann, T., 2021. The impact of blockchain on business models in banking.

Information Systems and e-Business Management, 19(3), pp.809-861.

Schmeiss, J., Hoelzle, K. and Tech, R.P., 2019. Designing governance mechanisms in platform ecosystems: Addressing the paradox of openness through blockchain technology. California Management Review, 62(1), pp.121-143.

Sharma, S.K. and Sharma, M., 2019.Examining the role of trust and quality dimensions in the actual usage of mobile banking services: An empirical investigation. International Journal of Information Management, 44, pp.65-75.Block Chain assignment

Siek, M. and Sutanto, A., 2019, August.Impact analysis of fintech on banking industry.In 2019 international conference on information management and technology (ICIMTech) (Vol. 1, pp. 356-361).IEEE.

Toqeer, A., Farooq, S. and Abbas, S.F., 2021.IMPACT OF M-BANKING SERVICE QUALITY ON CUSTOMER SATISFACTION WITH ROLE OF TRUST AND CUSTOMER VALUE CO-CREATION INTENTIONS. Journal of Marketing, 3(3).

Wang, L., Luo, X.R., Lee, F. and Benitez, J., 2022.Value creation in blockchain-driven supply chain finance. Information & Management, 59(7), p.103510.

Zhang, L., Xie, Y., Zheng, Y., Xue, W., Zheng, X. and Xu, X., 2020.The challenges and countermeasures of blockchain in finance and economics. Systems Research and Behavioral Science, 37(4), pp.691-698.Block Chain assignment