Blockchain Technology Assignment: Creation Of Cryptocurrencies

Question

Task:

Introduction to the topic

Cryptocurrencies are on the rise. Being the only currency in the world that is decentralized i.e. not monitored by any central bank, cryptocurrency has its share of problems in the industry. With increased awareness now, advocates believe that cryptocurrencies are known as one of the most easy, reliable and convenient ways of making transactions. However there are a number of problems faced by the currency. Even though the developed world has adopted the use of cryptocurrency, and a lot of transactions are conducted through it, many people are still shy of accepting them.

Considering the highs (its increasing value, being decentralized, paving way for people to make easy and convenient transactions)and lows (financial scams related to cryptocurrencies, its increasing use in illegal activities) associated with the use of cryptocurrencies, there is certainly a need to investigate the concept further. There are different types of cryptocurrencies today. Each has its own benefits and flaws, and for a better understanding each of them should be researched and investigated separately.

As a finance student, it is imperative that you understand the ins and outs of cryptocurrencies, how they work, the technology they use and their future. With the wide acceptance of this digital currency today, different types of currencies have been launched. However, bitcoin, ethereum and ripple still remain the most popular, so it might be better to concentrate your essay on those.

Blockchain technology assignment requirements:

You are required to undertake a review of the developments that led to the introduction of cryptocurrencies and to address the following issues:

- A short description of blockchain technology and how this is related to the creation of cryptocurrencies.

- Evaluate the growth of cryptocurrencies. For this part you should download data for some cryptocurrencies and produce time plots in excel and discuss their patterns.

Data can be found here:https://coinmarketcap.com/

- In your opinion, are cryptocurrencies important or not? Explain why?

Answer

Executive Summary

The concept of blockchain undertaken in this blockchain technology assignment has been the most innovative product of the current century. This report would discuss the functioning of blockchain technology and its working principles. Then the focus would be on explaining the process of creation of cryptocurrencies from this technology and the advantages that this new method of financial transaction will provide in this new digital era. This report would also analyze the growth of top two cryptocurrencies in the market. Based on the analysis, the importance of the cryptocurrencies would be explained.

Introduction to Blockchain Technology and Creation of Cryptocurrencies

Introduction to Blockchain Technology

Blockchain, in some cases is also known as Distributed Ledger Technology (DLT). It has the decentralized technique that allowing in making the historical backdrop within computerized resources. The hashing function allows in making quick money transfer to any country of the world (Berentsenand Schar, 2018).

A fundamental likeness for understanding blockchain development is a Google Doc. Right when we make a report and offer it with a few people, the record is scattered as opposed to repeated or moved. This creates a decentralized allotment chain that gives everyone access to history all the while (Glaser et al., 2014). Nobody is bolted out anticipating changes from another gathering, while all adjustments to the doc are being recorded continuously, making changes totally straightforward.

Obviously, blockchain is more muddled than a Google Doc, yet the relationship is well-suited on the grounds that it represents three basic thoughts of the innovation:

- No copy or transfer of documents, only distribution

- Decentralization of the assets takes place in real time

- Integrity of the ledger is maintained through transparency

Creation of cryptocurrencies

Cryptocurrencies have grown from the blockchain innovations and are the most well-known and broadly utilized being bitcoin, made in 2009 (Maxwell, 2019). The estimation of bitcoin is identified with comparable factors as other money markets, for example, the easy accessibility of cash. Clients can mine, buy, sell, or exchange bitcoin (Nadarajah and Chu, 2017). Trades have been set up to buy and execute with bitcoin, besides, bitcoin vouchers can be bought from retail scenes, and bitcoin ATMs have been set up in certain wards. Clients can send, get, and store bitcoin utilizing an online wallet programming or equipment (likewise alluded to as cold storage) (Stephenet al., 2017).

Digital forms of money are not sharedin a straightforward manner to a document recorded in an online server or vault. Or maybe, the code is situated in a square that is connected to frame a chain of squares, thus the term. Every exchange is time-stamped with records in a square inside a freely dispersed record (Lee KuoChuen, 2015). This square contains all data comparative with all exchanges going before the most recent exchanges and past exchange, to give a chain of exchanges that can't be modified. Clients can confide in the framework as all records of exchanges are openly accessible and appropriated (decentralized) rather than having to set up an exchange with a third party (Evelina Zigmantavic?iu?te Irma S?ileikiene?, 2019).

Growth of Cryptocurrencies

Bitcoin

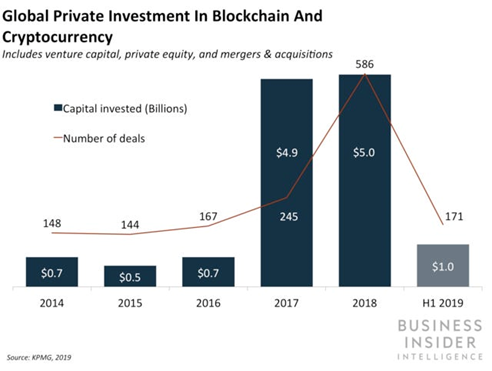

Below graph shows the growth of the value of bitcoin from its inception till date. Bitcoins are accessible in the commercial center for individuals to purchase and sell utilizing various monetary forms. Bitcoins can be utilized to buy stock secretly (Shaen, Grace Andrew, 2017). Exchanges are recorded in an open log wherein names of purchasers and dealers are not unveiled. Along these lines, clients can purchase or offer anything without being effortlessly followed to the thing they buy. This has utilized bitcoins worthwhile for individuals needing to purchase drugs on the web or do unlawful exercises(Makarova, 2018). The key points to be noted about bitcoins is:

- The value of a single bitcoin was more than $8500 in the first week of March 2020

- The value of all the bitcoins in the world is more than $160 billion, still it is just 0.4% of the total monetary value of the world operations

- All cryptocurrencies form 0.7% of the total monetary value of the world operations and

Figure 1: Growth of Bitcoin

(Source: Farrugia, Ellul and Azzopardi, 2020)

Ethereum

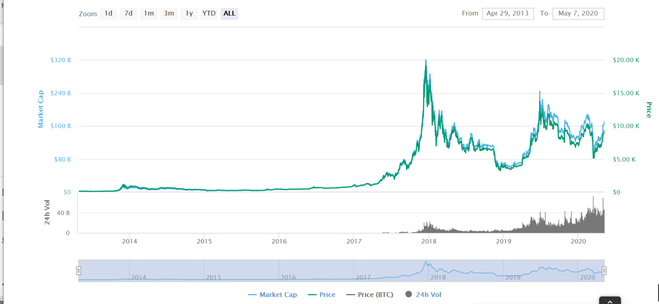

Below graph shows the growth of the value of Ethereum from its inception till date. Ethereum also a form of distributed ledger with the current market capitalization at $ 21 billion. Founded in 2103, it is the second most profitable cryptocurrency after Bitcoin. The ledger is consistently upgraded with the help of a set of protocols which are done by more than 1000 programmers across the world. The activity of increase in these protocols has increased significantly since January 2019 (Farrugia, Ellul and Azzopardi, 2020).

Figure 2: Growth chart of Ethereum

(Source: Cryptocurrency Market Capitalizations, 2020)

Importance of Cryptocurrencies and its justification

Cryptocurrencies can be truly significant to the worldwide economy. Cash has constantly assumed a basic job in the advancement of society, but digital forms of money can play an important part in our future society. Cash gives four essential capacities; it fills in as a store of significant worth, a trade of significant worth, a method for installments and a typical proportion of significant worth. Digital forms of money can fill in as a steady store of significant worth (Ruslan, 2019). They can be especially helpful for nations with a feeble national money or overabundance expansion. Since it is a digital form of money, no national government has command over its value.Cryptocurrency has the quality to make it a reasonable money. As an example, Bitcoin will be mined with unavoidable losses at regular intervals until the most extreme number of bitcoins are reached: a sum of 21 million. Because of the constrained measure of bitcoins, it will never get expanded from an excess of bitcoins. Additionally, bitcoin and different digital forms of money are by and large viewed as being shielded from national government changes or limitations (Douglas, Sofia, and Anshum, 2019). This makes a "place of refuge" for financial specialists to place their riches into, as it for the most part doesn't lose esteem dependent on swelling.

Cryptocurrency is rapidly demonstrating its quality as a shelter against blowing up national monetary forms. The blend of foreign interest and its value unpredictability encouraged Bitcoin to turn into the best performing money of 2018 utilizing the US Dollar Index. This implies Bitcoin was the most noteworthy esteemed cash in the whole world toward the finish of a year ago (Bashir, 2017). This is no little accomplishment in a worldwide economy with powerhouses like China and the United States running the scene.The volatility is high for the cryptocurrencies as we have seen the examples for Bitcoin and Ethereum in the above charts. Being in nascent stage, the security threats are all not known now and hence, there is hesitation by large corporate firms to accept it as a mode of transactions (Farrugia, Ellul and Azzopardi, 2020). The legal views and laws are different for different countries across the world and this non-uniformity leads to uncertainty in validity of cryptocurrency contracts (Glaseret al., 2014). The most impacting disadvantage of the cryptocurrencies is the anonymity involved in the transactions which leads to lack of trust among the stakeholders involved. The trust has been the most important factor in all the financial transactions from ages.

References

Bashir, I. 2017. Mastering blockchain : distributed ledgers, decentralization and smart contracts explained. Packt Publishing. https://oxfordbrookes.on.worldcat.org/oclc/981928401

Berentsen, A., and Schar, F. 2018. “An Introduction to the World of Cryptocurrencies” Federal Reserve Bank of St. Louis Review, First Quarter, 100(1), pp. 1-16.

Borgards, O. and Czudaj, R. L. 2020. “The Prevalence of Price Overreactions in the Cryptocurrency Market.” doi: 10.1016/j.intfin.2020.101194

Cryptocurrency Market Capitalizations | CoinMarketCap 2020. Available at: https://coinmarketcap.com/(Accessed: 7 May 2020).

Douglas, J. C., Sofia, J., andAnshum, P. 2019. Regulation of the crypto-economy: managing risks, challenges, and regulatory uncertainty. Journal of Risk and Financial Management, 12(3). https://doi.org/10.3390/jrfm12030126

Evelina Zigmantavic?iu?te?, & Irma S?ileikiene?. 2019. Analysis of mobile services in the financial sector / mobili?j?paslaug?analize? finans?sektoriuje. Mokslas: LietuvosAteitis, (2019). https://doi.org/10.3846/mla.2019.10423

Farrugia, S., Ellul, J., and Azzopardi, G. 2020. Detection of illicit accounts over the ethereum blockchain. Blockchain technology assignment Expert Systems with Applications, 150. https://doi.org/10.1016/j.eswa.2020.113318

Glaser, F., Zimmarmann, K., Haferhorn, M., Weber, M.C., Siering, M., 2014. Bitcoin- Asset or currency? Revealing users’ hidden intentions, in: Twenty Second European Conference on Information Systems, ECIS 2014, Tel Aviv, pp. 1–14.

Lee KuoChuen, D. (ed.) 2015. Handbook of digital currency : bitcoin, innovation, financial instruments, and big data. Amsterdam: Academic Press is an imprint of Elsevier. Available at:https://oxfordbrookes.on.worldcat.org/oclc/908550531

Mariana Makarova 2018. “The Influence of Bitcoin Ecosystem on Digital Economy,” 2(3), pp. 35–44. doi: 10.31520/2616-7107/2018.2.3-4

Maxwell, S. 2019. The application of behavioural heuristicsto initial coin offeringsvaluation and investment. The Journal of the British Blockchain Association, 2(1), 1–7. https://doi.org/10.31585/jbba-2-1-(7)2019

Nadarajah, S., Chu, J., 2017. On the inefficiency of bitcoin. Economics Letters, 150, pp. 6–9.

Ruslan, A. G. 2019. Review of the book by s. a. andryushin “money-credit systems: from sources to cryptocurrencies” (moscow: sampoligrafistllc, 2019. 452 p.). Aktual?nyeProblemyE?konomiki I Prava, 13(4), 1724–1731. https://doi.org/10.21202/1993-047X.13.2019.4.1724-1731

Shaen, C., Grace, M. H., and Andrew, M. 2017. The influence of central bank monetary policy announcements on cryptocurrency return volatility. Investment Management and Financial Innovations, 14(4), 60–72. https://doi.org/10.21511/imfi.14(4).2017.07

Stephen, C., Jeffrey, C., Saralees, N., and Joerg, O. 2017. A statistical analysis of cryptocurrencies. Journal of Risk and Financial Management, 10(2). https://doi.org/10.3390/jrfm10020012

Appendices

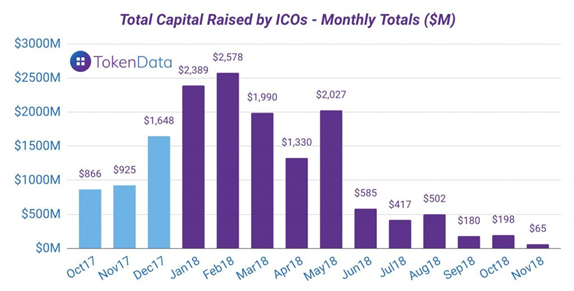

Appendix 1: Cryptocurrency Trend

Appendix 2: Global Private Investment on Blockchain and Cryptocurrency