Career Development Plan: Achieving Success in Fund Accounting

Question

Task: How can I develop and execute a career development plan to advance in fund accounting within the financial sector?

Answer

Career Objectives:

With a concentration on private equity and hedge funds, my professional goal is to grow within the financial sector and work in the field of fund accounting. I want to land jobs with the renowned CITCO Group services as a Senior Fund Accountant, Supervisor, and Manager. I am qualified to take on these tasks and contribute to the growth of the organisation because of my solid educational foundation and my employment at CITCO as a fund accountant (Niati, Siregar, & Prayoga, 2021).

In light of the results of my own Indigo TriMetrix DNA exam, I'm eager to use my DISC type, competencies, motivators, and driving factors to pursue my professional goals. I will be able to interact and negotiate with clients and colleagues in the financial business more successfully if I am aware of my DISC style, which includes my dominant qualities of influence and compliance. Additionally, it will be quite important for me to use my top analytical thinking and attention to detail abilities to complete the difficult fund accounting jobs precisely and accurately.

Preferred Province: Ontario (Toronto)

My favourite province in Canada is Ontario, especially the city of Toronto. A thorough review of the employment market that supports this decision identifies the following factors:

Employment chances: Toronto's work market is dynamic and broad, with several chances in the finance industry. It is home to a sizable number of financial organisations, such as banks, investment companies, and asset management businesses, which fill a variety of tasks linked to fund accounting.

Field Attractiveness: Toronto's financial sector is quite appealing, with a focus on private equity and hedge funds. The city is a major financial centre in North America and provides a supportive environment for those working in this industry to prosper. The sector in Toronto is appealing due to the presence of significant financial players and networking possibilities.

Current Positions Available: According to current data from federal and provincial sources, Toronto consistently has a need for finance experts, notably those in positions involving fund accounting. The continuous number of job vacancies in this industry suggests a good job market for those with the necessary training and expertise.

The financial industry in Toronto provides favourable compensation rates, notably for employment in fund accounting. Given the high cost of living and the degree of knowledge necessary, according to federal and provincial wage benchmarking data, experts in this area may anticipate good compensation packages in the city.

I want to take advantage of the chances that the robust employment market, appealing sector, and competitive wage potential provide by selecting Ontario, and more particularly Toronto, as my chosen province (Bridgstock, Grant-Iramu, & McAlpine, 2019). This choice maximises my opportunities for professional development and success in the finance sector, particularly in the area of fund accounting, and is consistent with my career goals.

Promotional opportunities for career development plan

There are several prospects for professional advancement inside the company when working with CITCO Group services. The senior level jobs I'm aiming for include Senior Fund Accountant, Supervisor, and Manager responsibilities, based on my career development plan. I will be able to manage teams, have greater responsibility, and participate in strategic decision-making in these jobs (Bagdadli & Gianecchini, 2019).

The timing for receiving the following promotion would rely on a number of variables, including performance, experience, and organisational criteria. To advance from the position of Fund Accountant to that of Senior Fund Accountant, it typically takes two to three years. Additional two to three years of work experience and evidence of leadership abilities may be needed to advance to the position of Supervisor. Finally, it may take 4-5 years of experience, a history of effective team management, and a history of strategic contributions before one reaches the Manager level.

It would be advantageous for me to get the Financial Risk Manager (FRM) certification to boost my professional development and raise my chances of advancement. The ability to manage risks effectively is demonstrated by this certification, which is very important in the financial sector, particularly in the context of private equity and hedge funds. The FRM accreditation would improve my standing within the company in terms of competence, credibility, and opportunity for progression.

The amount of experience necessary for each promotion will vary depending on the candidate's performance, achievements, and the particular standards established by the company. Before attempting to advance to the position of Senior Fund Accountant, it is often advised to have at least 2-3 years of fund accounting experience. Similarly, 4-6 years and 8–10 years of experience, respectively, would place me favourably for consideration for the Supervisor and Manager jobs.

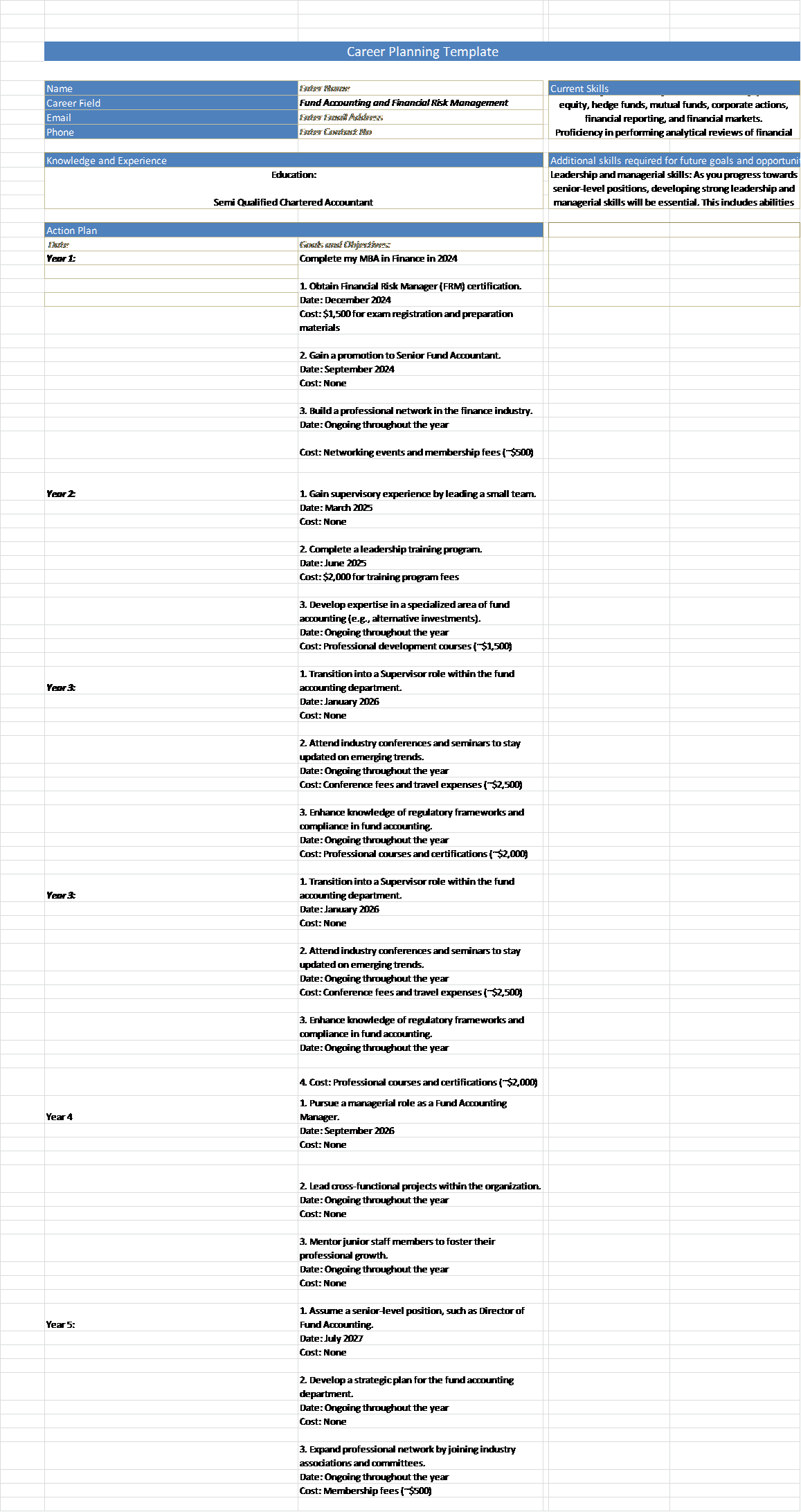

The professional development plan will include explicit milestones reflecting the projected promotions at each step, taking into account the timing and promotional chances. The required times, related expenses, and the acquisition of essential certifications like the FRM designation will be included with these milestones. The timeline will give a visual depiction of the intended career development and indicate the anticipated timing of each promotion in light of anticipated experience and competence levels.

Inventory of skills, abilities, training, and education and the required qualifications for your desired position

|

Education |

Skills, Certificates, and Training |

|

Semi Qualified CA |

Currently pursuing my MBA in Finance course from University Canada West |

|

|

Semi Qualified Chartered Accountant knowledge areas (Private Equity, Hedge Funds, Mutual Funds, Corporate Actions, Financial Reporting and Financial Markets) |

|

|

broad understanding of financial markets, hedge funds, mutual funds, corporate actions, and financial reporting |

|

|

effective at analysing financial operations, understanding financial data, and making suggestions. |

|

|

Knowing how to evaluate the equity market to assess risk and forecast corporate growth using fundamental and technical analyses |

|

|

enough familiarity with MS Excel and comprehension of macros |

|

|

Analytical and problem-solving skills |

|

|

Ability to work effectively in a team and meet deadlines |

|

|

Keen interest in global economy and stock market monitoring |

|

|

Strong communication and interpersonal skills |

|

|

Proficiency in English and Telugu languages |

|

|

Knowledge of FRS and US GAAP |

|

|

Basic understanding of fair value hierarchy and IFRS 13 |

|

|

knowledge of accounting for mutual funds and calculating NAV |

|

|

Understanding of ETFs, index funds, closed-ended funds, and open-ended funds |

|

|

Practical knowledge of trading in derivatives and OTC derivatives |

|

|

Knowledge of bond markets, types of bonds, and factors impacting bond prices |

Required Qualifications for Desired Position (Senior Fund Accountant, Supervisor, Manager):

• Completion of a bachelor's degree in accounting, finance, or a related subject

• Certified Chartered Accountant (CA) status (working towards semi-qualified CA status)

• Certification as a Financial Risk Manager (FRM) (Intended)

• At least 2-3 years of completed experience as a fund accountant

• Knowledge of fund accounting concepts and procedures (Acquired).

• Comprehensive knowledge of the life cycle of hedge funds and private equity (Acquired)

• The capacity to carry out statutory and internal audits (Acquired).

• Acquired expertise in the preparation of financial accounts for diverse businesses

• Acquired knowledge of taxes and tax audits

• Understanding of company actions and how they affect stock values (Acquired)

• Expertise with MS Excel, including the use of macros (Acquired)

• Financial data analysis and recommendation-making skills (acquired)

• Strong analytical and problem-solving abilities (Acquired)

• Effective leadership and communication skills (in process)

• Prior management or supervision of a team experience (Intended)

• Knowledge of performance metrics for hedge funds and private equity (Acquired)

• Acquired knowledge of financial statements and terminologies used in fund accounting

• Acquired familiarity with the rebalancing procedure in follow-up closures (Succi & Canovi, 2020)

Three action steps required for the career development plan

Obtain Financial Risk Manager (FRM) Certification:

The Financial Risk Manager (FRM) certification is a vital action step in accomplishing the indicated professional development strategy. The finance sector, especially the area of fund accounting, finds great value in this accreditation. In the context of hedge funds and private equity, it exhibits competence in risk management, a crucial skill set. The FRM certification will boost credibility, create new job options, and improve the likelihood of getting promoted to senior-level roles (Jedynak & B?k, 2020).

Gain Supervisory Experience and Leadership Skills:

Developing supervisory experience and excellent leadership abilities is another crucial action step. This entails aggressively looking for chances to assume new duties, coach less experienced team members, and participate in the strategic decision-making process. It will become more probable to advance to positions of higher responsibility, such as Supervisor and Manager responsibilities, by exhibiting excellent leadership talents, such as team management, communication, and problem-solving skills (Griffith, Baur, & Buckley, 2019).

Continuously Enhance Knowledge and Stay Updated:

It is essential to consistently advance knowledge and keep up with industry trends and advancements to ensure long-term professional progress and success. This level entails actively participating in professional development opportunities, such as going to conferences, seminars, and workshops in your field. Maintaining a competitive edge in the banking sector also depends on keeping up with modifications to accounting standards, rules, and developing technology. The likelihood of moving up the corporate ladder and gaining promotions within the intended career development plan path will be considerably increased by exhibiting a commitment to continual learning and professional development (Manita, Elommal, Baudier, & Hikkerova, 2020).

Potential Career development barriers

Potential Barriers:

• Insufficient Canadian work experience: For someone beginning a professional career in Canada, this might be a possible roadblock. There may be difficulties while looking for work prospects and career development plan inside the Canadian labour market because many employers favour local experience.

• A small professional network: For job success, developing a professional network is essential. Starting over in a new nation, however, can entail having few ties and contacts in the business. It could take some time and energy to build a solid network and relationships with experts in the subject.

• Language and cultural barriers: Getting used to a new language and culture can be difficult, especially when it comes to efficient communication and assimilating into the workplace culture. For effective job advancement, it is crucial to get through language obstacles and grasp cultural subtleties.

• Recognition of credentials: Obtaining overseas credentials recognised in Canada may be difficult, depending on the profession and subject. It can take a while to get degrees and certificates recognised or examined for equivalence, and it might be necessary to take extra classes or take examinations to match Canadian criteria.

• employment market competition: The Canadian employment market, particularly in some sectors, may be very fierce. It might be difficult to find relevant job positions, land interviews, and stand out from other competent applicants.

• Developing new skills and knowledge: Keeping up with industry developments and trends is essential for job advancement. To stay competitive in the changing employment market, it can be necessary to commit time and money to upgrading skills and learning new information.

• Personal responsibilities and work-life balance: Maintaining a healthy work-life balance while juggling personal obligations and job obligations may be difficult. It may be difficult to balance professional goals with responsibilities to one's family and other personal interests.

It is crucial to be aware of these possible obstacles and create plans to get around them (Stentoft, Adsbøll Wickstrøm, Philipsen, & Haug, 2021). These difficulties can be lessened and the possibility of accomplishing stated professional goals and objectives increased by looking for networking, internship, and volunteer opportunities, as well as by continuing education and adjusting to the Canadian work climate.

Reference

Bagdadli, S., & Gianecchini, M. (2019). Organizational career management practices and objective career success: A systematic review and framework. Human Resource Management Review, 29(3), 353-370.

Bridgstock, R., Grant-Iramu, M., & McAlpine, A. (2019). Integrating career development learning into the curriculum: Collaboration with the careers service for employability. Journal of Teaching and Learning for Graduate Employability, 10(1), 56-72. career development plan

Griffith, J. A., Baur, J. E., & Buckley, M. R. (2019). Creating comprehensive leadership pipelines: Applying the real options approach to organizational leadership development. Human Resource Management Review, 29(3), 305-315.

Jedynak, P., & B?k, S. (2020). The role of managers in risk management. Contemporary Organisation and Management. Challenges and Trends. Micha?kiewicz, A., Mierzejewska, W., Eds, 407.

Manita, R., Elommal, N., Baudier, P., & Hikkerova, L. (2020). The digital transformation of external audit and its impact on corporate governance. Technological Forecasting and Social Change, 150. career development plan

Niati, D. R., Siregar, Z. M., & Prayoga, Y. (2021). The effect of training on work performance and career development: the role of motivation as intervening variable. Budapest International Research and Critics Institute (BIRCI-Journal): Humanities and Social Sciences, 4(2), 2385-2393.

Stentoft, J., Adsbøll Wickstrøm, K., Philipsen, K., & Haug, A. (2021). Drivers and barriers for Industry 4.0 readiness and practice: empirical evidence from small and medium-sized manufacturers. Production Planning & Control, 32(10), 811-828.

Succi, C., & Canovi, M. (2020). Soft skills to enhance graduate employability: comparing students and employers’ perceptions. Studies in higher education, 45(9), 1834-1847.