The Circular Flow Model Of Economy Evaluation

Question

Task: Explain the role of circular flow model in evaluating the economic growth. What are the factors affecting the circular flow model? Discuss the domestic economy growth of UK in the past years.

Answer

Introduction

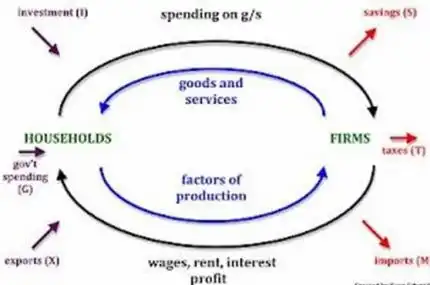

The concept of circular flow model in the economy could be displayed as the depiction of two-cycle moving in a contrary direction. The two cycles represent the movement of goods and services form customers to the manufacturing source and vice versa. In short, this model is being employed to symbolize the economic operations in an economy. It majorly is used to signify the links among various factions of the economy. Especially the transactions between the sources of manufacture and the consumers are being displayed using this tool. It shows both the earning and spending process done in the economy by the citizens. The basic units in an economy would be the basic households which would provide basic working units, for example, the workers. These basic units are being used by various organizations in the process of manufacturing goods and services. The earnings received by these households are again utilized to buy the goods and services. This repetitive cycle of spending and earning is termed as the circular flow of income.

The Circular Flow of Income Model

If contemplated the above-given figure, you could notice that the factors flowing in the economy could be classified into two. The first classification could contain the spending on physical materials like goods and services, whose value is being paid by the households and second being the factors of production which include denominations like interest, profit, rent, wages, etc. A certain configuration could be noticed in the circular flow model which indicates the transmission of money in the following arrangement: Production – Income – Expenditure – Production. The above-provided figure also provides us with the theory that the total amount spent by various units in the economy would tantamount to the aggregate amount of earnings received by households. This idea could be denoted by the expression National Income = National Expenditure.

The fact that all the earned salary would not be exclusively spent on the products which are manufactured in the domestic economy. The consumers may buy the items which are being imported from distant companies. A substantial part of the earnings made by the consumers is being paid to compensate the taxes and additional cess levied by the government. Thus, by making savings, paying for taxes and imports would create a gap or leakage in the cycle of this model. Apart from there are some other cases which would cause an additional expense in the domestic economy which includes the investments made by the government for the development of the export and import activities, expenditure made by the government on various schemes, special provisions like subsidies to encourage the exporting activities, etc. These factors which would affect the circular flow model are called injections.

Although the actual meaning of the term aggregate is the overall sum, in this context the term brings the amount of money spent by the citizens, governing body, various organizations and the citizens who are practicing their occupation abroad.

The idea of Aggregate demand could be expressed using the below-given expression.

Aggregate Demand (AD) = Total spending on goods and services.

The mathematical formula to estimate the value of aggregate demand is expressed below.

“Aggregate demand = C+ I + G + (X – M)” (Riley, n.d.)

C - This variable denotes the consumers that denote the expenditure or the consumption made by them. This could also be denoted by the overall amount that is spent by the household units to buy goods and services. In this transaction, the purchase of a new house or buildings is avoided.

I – This variable denotes the value of the capital investment. In other words, it is the sum of the total spent on the purchase of capital goods. This includes the purchase of new land, machinery, buildings, etc. that may contribute more towards the manufacture of goods and services in demand.

X – This variable depicts the total value of goods or values being exported to other countries. The earnings made by the export of goods and services to other countries turn out to be a very substantial injection in the circular flow model.

M – Variable M indicates the total cost of the goods and services imported from other countries to the domestic economy. Opposite to the context of export, this value is considered to be the seepage or leak of money from the circular flow model of the money.

The term Net Exports signifies the gap between the values of export and import in a certain time limit.

The overall and inclusive study of the economy along with the decisive factors is termed as Macroeconomics. The most significant and focal concept in the field of the macroeconomy is "growth". Concerning the provided limit of time, the increase in the ability to produce goods and services by an economy is termed as growth. Roughly saying it is the economic development in the given period. If contemplated from the societal point of view, the economic growth is very crucial since it is the sole decisive factor which has the potential to increase the per capita income of the nation and consequentially addressing the social issues like poverty, low living standard, unemployment, etc. The increase in the salary would encourage the demand for better and premium quality products among the customers and thus enhances the standard of living in the nation.

The factor of inclusive employment could be taken as another factor in the stream of macroeconomics. The instance of inclusive employment signifies the situation in which whole the labor power is used for the optimum performance of the manufacturing process. The governments of the nations all over the world have made it their primary focus to attain the condition of inclusive employment since it would bring an end to most of the prevailing social issues. Although 100 % employment is not possible practically because of the situations like frictional unemployment, inclusive employment is declared when the overall unemployment plunges to a level below 5.5%.

The component of price stability could be considered as a third variable in macroeconomics. If the overall prices or the rate of inflation is constant or showing minimal growth then the situation could be termed as of having price stability. By this variable, the sudden and unexpected occurrence of inflation or deflation could be avoided and thus provides security to the elements operating in the domestic economy. The abrupt increase in the prices of every commodity and services inclusively leads to a situation called inflation and the plunge in the prices would cause a contradictory situation called deflation.

The last but the crucial factor in the discipline of macroeconomics is the constructive figure in the balance of payment. It is very hard and important to keep a positive record of the balance of payments with all the countries since it requires a much accelerated rate of export and maintaining strategic relationships with a lot of nations. It could also display the current status of the relationship with the contrary nation. This factor in the circular flow model also displays the need for any new trade policies with other countries. The monetary transactions made by all the consumers, organizations and the governing bodies in one nation to another nation are being recorded in the accounts of Balance of Payment. The term inflow would signify the positive entries in the trade and the outflow would signify the negative entries in the existing trade.

Growth of the domestic economy of the United Kingdom in the past two years

If looked at the growth rate showcased by the domestic economy, it tantamounted to the rate of 2.6 %. This is considered to be the highest rate of growth since the financial year of 2007. It had been surveyed by ONS that the last three months in the financial year of 2014 have showcased 0.5 % growth in the domestic economy which was comparatively lower to the rate of 0.7 % in previous months. Although the economy of the UK had displayed an overall growth of 0.5 % in the ending months of 2015, the economy was very sluggish and down. As compared to the growth rate of 2.9 % in the financial year of 2014, the rate of growth has not crossed the mark of 2.2% later. The optimistic figure of 0.6% growth rate was displayed in the last quarter of 2016. The overall annual growth of 2 % was considered to be a very good sign after the substantial decision of Brexit. The main factor behind achieving this growth is the heavy expenditures made by the customers in their domestic economy.

|

National Unemployment Rates 2014 – 2017 |

||||||||||||

|

Jan |

Feb |

Mar |

Apr |

May |

June |

July |

Aug |

Sep |

Oct |

Nov |

Dec |

|

|

2017 |

4.8% |

4.7% |

/ |

/ |

/ |

/ |

/ |

/ |

/ |

/ |

/ |

/ |

|

2016 |

4.9% |

4.9% |

5.0% |

5.0% |

4.7% |

4.9% |

4.9% |

4.9% |

5.0% |

4.9% |

4.6% |

4.7% |

|

2015 |

5.7% |

5.5% |

5.5% |

5.4% |

5.5% |

5.3% |

5.3% |

5.1% |

5.1% |

5.0% |

5.0% |

5.0% |

|

2014 |

6.6% |

6.7% |

6.7% |

6.3% |

6.3% |

6.1% |

6.2% |

6.1% |

5.9% |

5.8% |

5.8% |

5.6% |

Source: National Conference of Legislatures

In the table provided in the above section of this report o the circular flow model, the fluctuation in the rate of unemployment between the financial years of 2014 and 2017 is being displayed. If looked very carefully, it could be observed that the rate of unemployment has reduced to an extent of 1.8 % from the year 2014 to 2017.