Corporate Law Assignment: Impact of Moratorium Implemented by Western Australia on REIWA

Question

Task:

Background:

In April 2020, the Western Australian Government (State Government) introduced a sixmonth moratorium on residential tenancy evictions and rental increases. These laws were designed to protect tenants during the COVID-19 pandemic.

The emergency residential tenancy laws applied to those in private and public housing, residential long-stay parks, as well as boarders and lodgers.

In September 2020 the State Government extended the moratorium until 28 March 2021 in an effort to preserve stability and certainty in the rental market.

There has been considerable media coverage and public commentary on the emergency residential tenancy laws which come under the Department of Mines, Industry Regulation and Safety.

You can explore the laws and the various elements of the State Government’s residential tenancies COVID-19 response at https://www.commerce.wa.gov.au/consumerprotection/residential-tenancies-covid-19-response

But according to a series of reports by WA Today, COVID-19 has had an additional impact on Western Australia’s rental property market – a lack of rental properties. This is largely due to an increase in demand from people returning or moving to Western Australia and looking for a new property.

According to REIWA President Damian Collins constrained supply is also exacerbating the issue, with properties not being made available because of the moratorium and a lack of investment.

“Normally when you would get a vacancy rate this low, you would expect a significant number of investors to come back into the market,” Mr Collins said.

“But we have got investor finance at about 30 to 40 per cent of where it should be and that’s because the downturn has made investors gun-shy, the moratorium has then made them even more cautious and there is a shortage of properties with a lot of competition from owner occupiers.” Properties listed for sale in Perth dropped to a ten-year low in February, with just 7899 properties listed with REIWA, down 36.5 per cent year-on-year.

The emergency measures implemented during the onset of COVID-19 will be revoked on March 29. The overnight ‘shock’ is expected to trigger a wave of movement in the market. Landlords can again ask existing tenants to pay more rent, and they can ask tenants to leave if they are on a periodic lease, in rent arrears, or have not met other standards and responsibilities.

During the moratorium, fixed-term leases automatically converted to periodic leases unless they were re-signed, meaning a larger number of renters are now on periodic leases and able to be terminated with 60 days’ notice. This may happen if the landlord is selling or moving back into an investment property, for example.

You can explore WA Today’s stories on this topic at https://www.watoday.com.au/politics/western-australia/off-the-charts-perth-rentalmarket-braces-for-shock-when-eviction-ban-lifts-20210226-p5766y.html

Task:

Choose one of the following four organisations:

• REIWA (Peak industry body representing real estate agents)

• Department of Communities and Housing (Western Australian Government)

• Ray White Real Estate (real estate company)

• Mission Australia (non-profit provider of crisis services)

Taking on the role of Public Relations Manager, prepare a corporate law assignment presenting a Report for the CEO of your chosen organisation on the issue of the end of the residential tenancy laws in Western Australia.

Answer

Executive Summary

As per the research on corporate law assignment, it is stated that in order to reduce the impact of COVID-19 on tenants and people facing financial troubles and the fluctuations faced by real-estate market during the pandemic, the West Australian Government placed a moratorium on most loan expulsion and price rises to help those affected by COVID-19. The depth and extent of the economic effect on the property market is unknown, as the impact of pandemic is widespread and impact every level of the society. However, behavioural changes which lead to an outdated space in a post-corona virus setting appear inevitable. The study focuses on the kind of issues that are being faced by REIWA due to the moratorium implemented by the Western Australia in which the tenants cannot be forced to leave the property and landlord cannot force tenants to pay the rent if it is not being paid on time due to which there is scarcity of renting property which is leading to downfall of the property market. The study also focuses on the impact of the new regulations on both internal and external stakeholders of REIWA and focuses on steps to mitigate the issues.

Introduction

REIWA is the real estate institution of Western Australia, the state's highest real estate corporation. It exists for all Western Australians to make the sale, lease and purchase of land as straightforward as possible. The company serve more than 1,100 agencies and 90% of them working as real estate agents in WA. If someone wants to purchase or rent a property in WA or if anyone is considering selling his or her house, contact the organisation via the website reiwa.com is a robust and reliable source of local information, with everything a person needs to help make one of the greatest choices of life.

Purpose

The main aim of the study is to find out the impact of moratorium on the residential tenancy evictions on REIWA and its potential impact on its stakeholders.

Operations of REIWA

The activities of REIWA Real Estate Company are primarily concerned with investments in the operation and maintenance of residential and non-residential assets, including the leasing and management of properties. The company also covers the valuation, purchase, sale, administration or rental of properties for other persons. The company is authorised in their State or operating jurisdiction. REIWA real estate company manager supervise on behalf of a company or private investor the buying or selling of real estate land. They are charged with finding good investment options for land, evaluating the consequences of tax law and tracking current developments in real estate.

Stakeholder Mapping

The stakeholders of REIWA include the landlords, investors, consumers, etc.

|

+ High |

Keep Completely Informed |

Manage most Thoroughly |

|

|

|

· Landlords · Investors · Renters |

· Landlords · Renters |

|

|

|

Regular Minimal Contact |

Anticipate and Meet Needs |

|

|

|

· Architects |

· Local Government · Landlords · Bankers |

|

|

- Low |

|

|

+ High |

Issues

Unavailability of properties due to the moratorium

A six-month moratorium that was proposed on the residential tenancy evictions and the rentals by the Western Australian government in April 2020 has increased (Tanr?vermi?, 2020). There are few laws and rules designed to protect the rentals during the COVID-19 pandemic. These emergency residential tenant rules are applied to private and public housing, residential long-stay parks, boarders as well as lodgers. With the high demand for rentals across the state, the government of the respective place is experiencing a very high rent price which will become difficult for the already struggling people (Mirzaet al., 2020). Even the real estate agents of REIWA also experienced the lowest availability of the rentals ever seen in their lifetime. The chief executive of Anglicare WA, Mark Glasson has stated that he is worried about the low availability of rentals and the condition of homelessness in the near future.

Increase in Rent

Mark Glasson has also warned the rentals that they would be having a tough time if the price predictions would fall right. Near and about 15,000 Australians would fall for public housing if there would be just a 20 percent increase in the rent. State governments are also informed and ordered to invest in social housing as much and as soon as possible to meet the future demand and situations (Marona&Tomal, 2020). WA’s rental market is facing high pressure in providing the space for rent since the beginning of the pandemic and now the situation has arisen that they are not even having even a 5% property to provide on lease to meet with the increased demand of 9%.

Employment issue

Due to the impact of COVID-19 many has lost their jobs and have to return back to Western Australia which has led to the situation where the tenants are unable to pay their rents. Even there has been a crisis in getting new jobs for which Landlords are more focussed in changing their contract terms to 60 days as tenants are unable to pay their rents. There has been an accommodation facility for the labourers facing a crisis that cost around $14.3 million in Perth. A record of lowest vacancy rate that has been seen over 40 years. In some areas, such the Bunbury and Albany, a record 0.5% vacancy rate is seen which is even low that people residing there are unable to afford food, petrol, and their basic utilities (Rogaris&Hanrahan, 2020). It has been reported that as soon as the moratorium ends, the investors would come out for the investment which will hopefully create a balance in the market because now is the condition that the laborers are facing homelessness due to no jobs.

Rent support

The residential relief grant commission has decided to help the tenants with the scheme that would offer the rent support to the struggling individuals with the finance, who cannot pay the rents in the emergency kind of situation prevalent (Arnold, 2020). They provide them with the rent arrears assistance to pay their debts. The government has asked the landlords to compromise with the tenants and understand their problems and negotiate with them by not increasing the rent value. Dealing with the issues of the rentals of the country, the respective government has also passed a law stating that nobody will increase the rent value and there is a permanent ban on the rent increase which is the only hindrance for the landlords in increasing the rent price (Barbozaet al., 2020). People are struggling up to an extent that they have decided to put off all the things of their house on the road and are forced to live in their car only.

Political issues

The politicians have been in a continuous process of making promises of creating jobs and providing property but, nothing has been seen till yet by the people of Western Australia, and the results are seen in this pandemic situation, where people are struggling from homelessness, jobs and even food.

Impact

Internal Stakeholders

The impact of the moratorium has a mixed impact on the internal stakeholders of REIWA including both positive and negative impact. First of all, the tenants are being protected from being forceful evacuation from the property by the landlord during the pandemic situation. Secondly, the new buyers or borrowers are unable to find place to take rent. Thirdly, due to scarcity of empty property the landlords are not keen in renting their place and also due to the new policy the landlords are not favouring long term contracts.

The internal Stakeholders of REIWA can be categorised as follows.

- Borrower

- Landlord

As stated by REIWA’s president, Damian Collins, the pandemic has pressurized the market so badly which was not at all stable earlier also. They are stuck in a no-investor, no-construction zone. Rents would touch the sky as soon as the landlords would feel comfortable (Evans, 2020). The state governments have an intuition that there would not be the extension of the moratorium or the implementation of soft exiting to maintain the price of rentals.

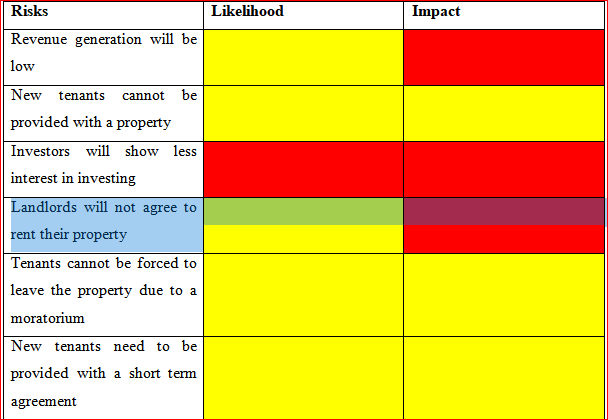

External Stakeholders Due to the scarcity of property and lack of customers, investors are showing less interest in investing to the property market as the revenue generation in the renting has declined due to the moratorium. Even construction new property has decreased as the developers are not getting enough consumers to purchase and banks are not keen to provide loans as it is difficult to cover up the loan provided due to the pandemic situation (Majumder&Biswas, 2021). The travel industry of Western Australia is being favoured with the amount of $3 million to retain their value in the market in this phase of a pandemic. The funding committee of WA has decided to support the home-based agents and brick-and-mortar businesses with the funds of around $5000 and $10,000 respectively as they have faced a decline in the turnover of around 75 percent in their business. As far as the Planning and Development Amendment Act 2020, is being concerned the act is temporary and is just to provide the job-creating projects a green slip in areas such as Perth and will also support the states and national economic condition. In the time of a critical situation, the apprentices and trainees are provided with higher incentives around $6000 and $3000 respectively, for their help. PESTLE analysis Political and Legal factors Economic factors Social factors Technological factors Environmental factors Risks The banks are aware that any rise in loan rates would probably cause the WA real estate market to further deteriorate as attempted to manage lending conditions. WA has recently seen an adjustment of the prices of properties, similar to Sydney and Melbourne (Martin, 2020). It is utterly needless to implement any more loan limits which would be harmful to the industry rather than positive. It should not be discouraged by making it more difficult for people to gain finances by promoting home-ownership and investing in property within the WA. Currently, 35% of all state credit accounts for a significant part of the demand in lending for investment (Beck &Hensher, 2020). If banks decide to raise investment borrowing rates as a result of the strengthening rules, landlords will be left with very little option but to pass on the extra costs to tenants. This will worsen the situation more since during the pandemic situation many of the tenants have lost their jobs or having a hard time paying back their rents. As a result, the landlords have changed their terms to 60 days to leave the premises for new tenants and are not allowing long-term contracts. Issue management goals Recommendations Conclusion References Barboza, G. E., Schiamberg, L. B., &Pachl, L. (2020).Corporate law assignmentA spatiotemporal analysis of the impact of COVID-19 on child abuse and neglect in the city of Los Angeles, California. Child Abuse & Neglect, 104740.

Beck, M. J., &Hensher, D. A. (2020).Insights into the impact of COVID-19 on household travel and activities in Australia–The early days under restrictions. Transport policy, 96, 76-93. Callis, Z., Seivwright, A., Orr, C., &Flatau, P. (2020). The Impact of COVID-19 on Families in Hardship In Western Australia. In The Impact of COVID-19 on Families in Hardship in Western Australia.The University of Western Australia. Evans, R. (2020). Housing affordability crisis looms as eviction moratoriums end. Green Left Weekly, (1271), 6. Ingram, T. (2021). Off the charts’: Perth rental market braces for shock when eviction ban lifts. Retrieved from watoday.com.au: https://www.watoday.com.au/politics/western-australia/off-the-charts-perth-rental-market-braces-for-shock-when-eviction-ban-lifts-20210226-p5766y.html

Majumder, S., &Biswas, D. (2021). COVID-19: impact on quality of work life in real estate sector. Quality & Quantity, 1-15. Marona, B., &Tomal, M. (2020). The COVID-19 pandemic impact upon housing brokers' workflow and their clients' attitude: Real estate market in Krakow. Entrepreneurial Business and Economics Review, 8(4), 221-232. Martin, C. (2020). A brief history of Australian Residential Tenancies Law Reform: From the Nineteenth Century to Covid-19. Parity, 33(5), 4-6.

Mirza, N., Naqvi, B., Rahat, B., &Rizvi, S. K. A. (2020).Price reaction, volatility timing and funds’ performance during Covid-19. Finance Research Letters, 36, 101657.

Rogaris, N., &Hanrahan, S. (2020). COVID-19: Real estate and infrastructure tax issues. Taxation in Australia, 54(11), 636-638. Stratton, J. (2020). Afterword: And then Novel Coronavirus Happened…. In Multiculturalism, Whiteness and Otherness in Australia (pp. 261-274). Palgrave Macmillan, Cham. Symington, A. (2021). Migrant workers and the COVID-19 crisis in Australia: an overview of governmental responses. Australian Journal of Human Rights, 1-13. Tanr?vermi?, H. (2020). Possible impacts of COVID-19 outbreak on real estate sector and possible changes to adopt: A situation analysis and general assessment on Turkish perspective. Corporate law assignmentJournal of Urban Management, 9(3), 263-269. Uma, K., &Gujar, S. (2020). Impact of Covid-19 Pandemic Crisis on the Real Estate Housing Sector. Psychology and Education Journal, 57(9), 4037-4042.

In order to understand the impact of the moratorium that is imposed by the government to protect the tenants from eviction during the COVID-19 period for PESTLE analysis will help to understand all the external factors that will impact the company due to the extension of moratorium.

The government has announced that their priority is the health and safety of their citizens. Safeguarding them is the premier task, the rest all are secondary things. The government also ensures that their economy could recover side-by-side with their efforts (Uma &Gujar, 2020). As stated by REIWA’s president, Damian Collins, the pandemic has pressurized the market so badly which was not at all stable earlier also. They are stuck in a no-investor no-construction zone. Rents would touch the sky as soon as the landlords would feel comfortable (Evans, 2020).

Due to the moratorium only, the rents are under the control despite increasing demand and kept the economy of the respective region stable otherwise, the economy of WA is also sinking. It has become a very tough task for the youngsters to reside there. They are not provided with homes easily and are more prone to the situation of homelessness (Marona&Tomal, 2020).

Various kinds of steps are introduced to provide the stability and certainty to the rental market and the governments are trying hard to safeguard their citizens as well as the outsiders from the situation of homelessness in any case. They have explained that they would not extend the moratorium duration and would fight with the impacts of the pandemic on the social as well as an economic front in the other way (Majumder&Biswas, 2021).

Due to the impact of the COVID-19 and the moratorium implemented by the government the tenants cannot be forced to leave the rented property as a result the new tenants cannot be accommodated in those property. As a result, the company cannot purchase new technological tools for their construction work or technological tools needed for creating interior designs cannot be purchased leading to a decline market in the technological field. So, the stakeholders in the technological field associated with the company are negatively impacted.

The moratorium has a huge positive impact on the environment as the company cannot force the tenants to evict the lands as a result new construction cannot be made due to lack of investors. So, the environment is less damaged from the construction work.

COVID-19 has a considerable amount of impact on the Rental market in Western Australia since a large population is returning back to Australia due to the worldwide impact of COVID-19 and also due to the new moratorium standards imposed by the Western Australian government the existing tenants cannot be thrown out of the rental properties or being forced to pay rent by the Landlords. During the pandemic, the tenant already on rent has been given extended stay permission by the government till 28th March 2021 (Ingram, 2021). The main risk that is being faced by the REIWA is that the company is facing a scarcity of land and property that can be rented to the people coming back to the country and it has only 7899 property listings which are thelowest as compared to the past 10 years. The economy and property market of Western Australia faced their fair share of problems in 2020. As the population has increased because of a return from vast numbers of the population from other countries and the resulting downturn, the price of WA real estate has decreased significantly through a decrease in purchasing activity in the last decade (Calliset al., 2020). The new moratorium rules enforced by the WA government used to introduce new loans have a major adverse impact on the local property market since the investors have reduced financing by 30 to 40 percent due to the moratorium.

Management of Property and stakeholders

REIWA must centralize the management of cash to make portfolio decisions and to adjust how they are made (Symington, 2021). Stakeholders are more demanding such that the company focuses on digitizing such that the new tenants can be handled with effectiveness and new property owners can be contacted such that the property scarcity can be mitigated. Using digitalized platform the stakeholders can be kept informed of the current situation and the initiatives that are being taken to cope with the situation this will lead to the better collaboration with the stakeholders and better handling of crisis period will be easy(Stratton, 2020).But the uncertainties about the length and the depth of the crisis, top management needs need to focus more on company-level balances and credit lines in order to have more centralized guidance on property-level cash management (Majumder&Biswas, 2021). Both management levels, including at the property and corporate levels, must define and draw productivity levers based on the intrinsic success of assets and of the entire enterprise by maintaining the moratorium implemented by the WA government.

When several tenants in different asset groups call for lease concessions or reductions, every landlord is facing tough consequences of the slowdown of incoming payment from the tenants and facing tough situations due to the moratorium implemented by the government. It is important for the company to focus on discussing with the landlords to reduce the rents such that the tenants can pay their rents which help in maintaining the overall cash flow and also will help in maintaining the investors during the crisis period. This will help in gaining new tenants for the property and also the stakeholders associated with the company will get benefit equally. While a single approach can be simpler to enforce for all tenants and landlords and decisions on each case should be taken, beginning with the welfare and well-being of the tenants. Better choices should be made such considerations on property prices, likelihood of renewal for tenants and probability of tenant default payment, city regulations must be considered in order to maintain the market such that any property that is empty can be filled with new tenants with proper policy implementation and future credibility damage can be avoided.

As the recession is affecting the commercial tenants to contract payments, the company need to make a few broad portfolio decision-making choices and change the payment of rent options such that it facilitates the consumers as well as the landlords and other stakeholders to remain a part of the industry during the pandemic situation. Real estate property lending must be extremely decentralized and critical decisions must be taken at the property level that affects cash flow positively.?

Arnold, K. (2020). Holding docas in the context of COVID-19. Australian Restructuring Insolvency & Turnaround Association Journal, 32(2), 13.