Economics Assignment Analysing Macroeconomic Concepts in a Global Context

Question

Task

Prepare an economics assignment answering the below questions:

Q1a. On 6 th April 2021, RBA made the following announcement: “At its meeting today, the Board decided to maintain the current policy settings, including the targets of 10 basis points for the cash rate.”

https://www.rba.gov.au/media-releases/2021/mr-21-04.html

Using the Statistical Tables on the RBA website, find data on monthly Money Market interest rates (In Column B of the relevant spreadsheet you’ll find data on the Cash Rate Target: monthly average, starting from August 1990 to March 2021).

Use this data to construct a graph of the monthly cash rate from August 1990 to March 2021. Use the graphing tool (line charts) in Excel. Please describe interest rate changes over this period, in particular the big drops, and briefly discuss the reason of the big drops.

Q1b. Please briefly discuss the relationship between inflation rate and unemployment rate over the period 1980-2019, by collecting data from the Australian Bureau of Statistics website. Please also briefly explain why the inflation rate became less volatile after 1990s. In particular, you can find unemployment and inflation rates from the following statistical series:

6202.0 Labour Force, Australia, and then select Table 1. Labour force status by Sex, Australia - Trend, Seasonally adjusted and Original. From here download the following series: Unemployment rate, Persons; Seasonally adjusted, for the years 1980 – 2019 in monthly frequency.

6401.0 Consumer Price Index, Australia, and then select TABLES 1 and 2. CPI: All Groups, Index Numbers and Percentage Changes. From here, download the following series: Percentage Change from Previous Period ; All groups CPI ; Australia ; Original, for the years 1980 – 2019 in quarterly frequency.

Now present the data for unemployment rate and inflation rates in a graph. From the graph, discuss the relationship between inflation rate and unemployment rate over these years. Please also briefly explain why the inflation rate became less volatile after 1990s.

Note that converting the monthly data into quarterly frequency is by taking only the monthly values corresponding to each quarter like, for example: take the data for March 1980, June 1980, September 1980 and December 1980 to get the quarterly series in 1980.

Q2. From Sep 2019 till Feb 2020, Australia experienced serious bushfires around the country. Please use the Aggregate Expenditure function and the 45-degree line diagram to explain how the bushfires could affect the Australian economy.

Q3. Because of COVID-19, Australian economy was influenced heavily. Please discuss how COVID-19 affects aggregate demand and supply respectively, and use the AD and SRAS and LRAS diagram to discuss how COVID-19 affects the equilibrium price and real GDP in Australia. In the content of the AD, SRAS and LRAS model you just derived earlier, please discuss what policies the government should use to stimulate the economy and its impact in the short and long run.

Answer

Answer to question 1 of economics assignment:

1a.

Figure 1: Interest rate of Australia

Source: (abs.gov.au 2021)

Through the figure 1, here interest rate of Australia during 1990 to 2020 has been presented. As per the same, it can be seen that interest rate has fell sharply between 1990 to 1994 and then it increased again sharply during 1995. Main reason for this fall in interest rate was global recession that led to fall in aggregate demand. To keep the money supply in market interest rate was reduced. Post 1995 there has been continuous fall in the interest rate and a major fall can be observed post 2008 onwards. major reason for the fall in interest rate post 2008 is Global Financial Crisis that led to investment fall and savings increase. To check the money supply, interest rate has been reduced during this time. This big fall in the interest rate can be seen 2019 onwards when it became 0.10 (rba.gov.au 2021). Major reason for this fall is Covid19 that has impacted the money market hard.

1b.

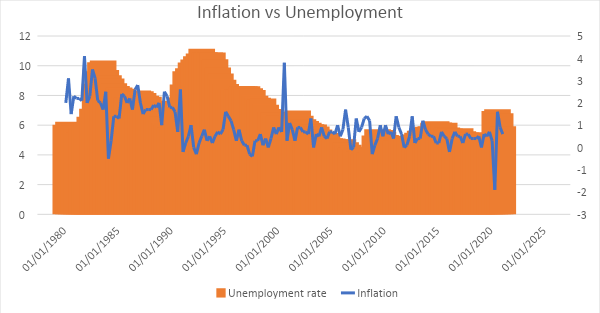

Figure 2: Inflation and unemployment relation

Source: (abs.gov.au 2021)

As per the figure 2, it can be seen that there is a positive association between the inflation rate and unemployment. As the unemployment increased, inflation also increased and vis-à-vis.

Inflation become less volatile post 1990s as the government tired to control the inflation with frequent revision in the interest rate. Besides, expansionary monetary policy increased the employment and lead the economy toward natural output level. Thus, over the period, inflation was controlled and maintained as per target of Reserve Bank of Australia.

Answer to question 2:

The Australian bushfire season starting in September 2019 is very bad. As a result, more than 10 million hectares of busheswere destroyed. There have been human sacrifices, deaths and major livestock losses. It is also estimated that more than one billion wild animals have been killed. More than 2,000 houses were destroyed when during Christmas and NewYear, the fire intensified. Residents of New South Wales on the eastern coast of Australia have received warnings from health officials to stay at home because dangerous air is affecting outdoor sports and work. On a particularly smoky day, a fire alarm sounded in an office building in Sydney's business district. Together, thetowering towers show that the impact of climate disasters is not limited to the land.They affect companies, people, infrastructure, and the economy.As the numbers change, the general lesson for investors remains the same. Agriculture, manufacturing, transportation, tourism and economic activities in the affected areas have generally reduced sharply. Injuries affect approximately 2-3% of the population and are concentrated in the March 2019 quarter (Celermajer et al. 2021).Ifthe affected people have to bear expenses that they should not have, this will also be partially compensated. They suppressed consumer spending because fires and haze continued to spread in several capital cities, which suppressed emotions. Wage growth continues to be weak and under employment. Many surveys also show that consumers lack a senseof security and frustration,which seems to have intensified since Christmas. As Australians haveno incentive to consume when their compatriots are suffering, this has exacerbated consumer weakness. Fire insurance premiums will only highlight this. Inbound tourismmay also be affected by large-scale forest fires around the world. The processed map shows that most parts of Australia are on fire, which may have a negative impact on Australia's perception. They will last about a year.

Underpinning the Aggregate Expenditure (AE) function and the 45-degree line diagram impact of the bushfire on the Australian economy can be explained.

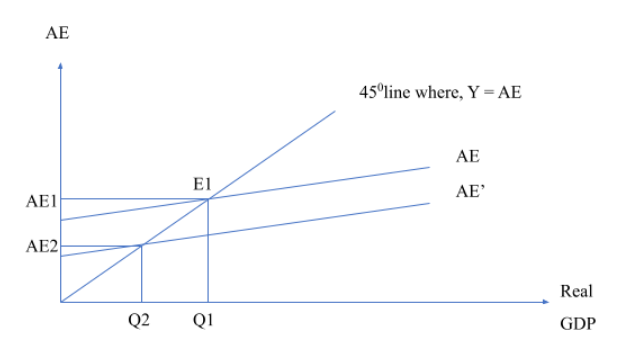

Figure 3:AE function model

Source: (Created by Author)

Through the utilisation of the AE function model, market equilibrium situation for AE and Real GDP can be explained. 450 line is the presentation of the all-equilibrium points in the market where AE and Real GDP equates. Let assume that E1 is the equilibrium situation of Australian economy, where aggregate expenditure in the economy is at AE1 and output is at Q1. Now, with the bushfire, there has been fall in the economic operation of the state, thus the market demand falls. Now, let assume that new market demand is represented by AE’ line and the new equilibrium takes place at AE2Q2 point, where AE2 is market demand and Q2 is output. Hence with the bushfire, there has been fall in economic operation leading to fall in aggregate demand and output of the economy.

Answer to question 3:

Global economy has been witnessing some unprecedented scenarios due to business disruption, rising unemployment and recession. Australia is also seeing a major decline in the economic activity, overseas trade which has taken a huge blow and most of the trading countries are devastated due to the pandemic causing interruptions in the entire supply chain. Australia mainly being a trading country has encountered declining demand of the export products that ranges from mining ores to tech-metals, thus, the result is drop in the economic performance of the region. The gross domestic product (GDP) of the country has shrunk 7% and this is been the sharpest fall after 1959 (bbc.com, 2020). Therefore, this foretells that Australian economy is set to witness a little more decline in 2021 as many business and travel have not opened up. The below illustration is Australia’s economic overview:

Underpinning the three major factors (GDP, inflation rate and unemployment), it can be stated that the Australian economy has faced sharp fall in overall market demand as there has been fall in employment. Output has faced negative growth during 2020 first and second quarter and household expenditure has reduced sharply. Considering the Aggregate demand and AS model, this situation can be explained further.

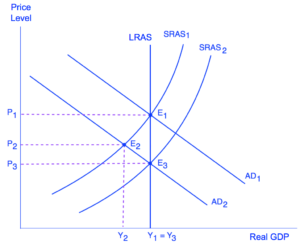

Figure 4: AD-AS model

Source: (Caballero and Simsek 2020)

As per the figure 4 it can be seen that, Aggregate demand has been represented through the AD curve and Aggregate supply has been represented by the short run supply curve (SRAS). Let, initial AD is AD1 and initial supply was SRAS1. Long run Aggregate Supply is resented through the LRAS curve. Now initial equilibrium takes place at E1, where the price is P1 and output is Y1. Considering this is the optimal output situation, if there is fall in the aggregate demand, then AD curve supposed to shift downward. With reference to Covid19 situation on the economy, aggregate demand has been reduced and this can be depicted by the shifting of AD1 curve to AD2. With the fall in the aggregate demand, price fell and as initially price is sticky in short run, this nee equilibrium takes place at E2, where price is P2 and output is Y2. Now, over the period, economy will face fall in price in production as the cost of production will fall due to lower wages to the labour. This will shift the SRAS curve to rightward until it intersects with the LRAS. At point E3, new equilibrium takes place in long run, where price will be P3 and output will be Y3 (optimal output). Thus, considering the economic impact of Covid19, it can be seen that in short run, there will be fall in aggregate demand that will keep the price moderately lower than pre Covid19 situation, however, output will fall by large amount. In long run, it is expected that supply will increase leading to a lower price but optimal output in the market.

As the recommendation, for short run and long run, following can be mentioned:

- Considering ZIRP policy: As the economy is falling investment and potential savings is increasing, to enable the economy move out from debt trap, it need to introduce Zero Interest Rate Policy in short run. It will ensure flow of money remain constant and disposable income increases allowing higher demand for market.

- Enhancing the market confidence: Increasing the market confidence at the short run is a crucial part of the Australian government as it will ensure demand remains constant in the economy so as to overcome any further demand shocks. With the higher market confidence, RBA can create investment potential in the domestic economy allowing ZIRP to work.

- Expansionary fiscal policy: through the expansionary fiscal policy government can enhance the government expenditure allowing higher investment for the public project in short run. This will allow higher amount of borrowing and economic revival.

- Quantitative easing policy: this is a crucial step for RBA need to be followed. With the quantitative easing as the RBA will purchase long term securities from market, it will enhance the market confidence and increase investment in long term. Investors will invest in the economy and this will create jobs as well as demand in the market through the backhand mechanism.

Reference:

rba.gov.au 2021. Statement by Philip Lowe, Governor: Monetary Policy Decision | Media Releases. Available at: https://www.rba.gov.au/media-releases/2021/mr-21-04.html

Caballero, R.J. and Simsek, A., 2020. A Model of Asset Price Spirals and Aggregate Demand Amplification of a" Covid-19" Shock (No. w27044). National Bureau of Economic Research.

Celermajer, D., Lyster, R., Wardle, G.M., Walmsley, R. and Couzens, E., 2021. The Australian bushfire disaster: How to avoid repeating this catastrophe for biodiversity. Economics assignment Wiley Interdisciplinary Reviews: Climate Change, 12(3), p.e704.

abs.gov.au 2021. Labour Force, Australia, March 2021. Available at: https://www.abs.gov.au/statistics/labour/employment-and-unemployment/labour-force-australia/latest-release#data-downloads

abs.gov.au 2021.Consumer Price Index, Australia, March 2021. Available at: https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/consumer-price-index-australia/latest-release#data-download