Economics Assignment: Q&A Based On Fiscal & Monetary Policy

Question

Task:

Prepare an economics assignment addressing the following questions:

Answer

Q 1. FISCAL POLICY

-

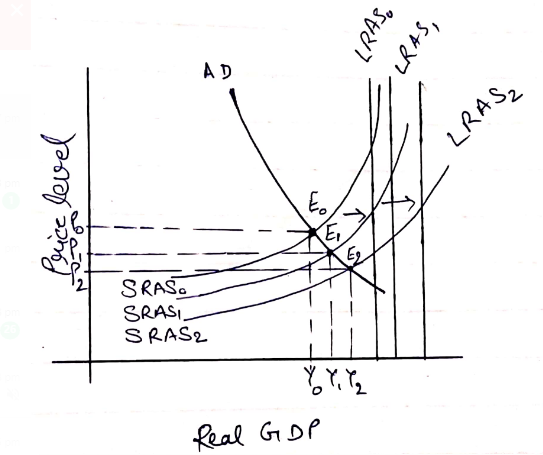

Draw a diagram indicating the primary shifts you would expect in AD and AS in this economics assignment. Explain the shifts, and the effects on major macroeconomic variables. To simplify, you can draw your diagram so that the Australian economy was at potential GDP before the shock.

AD-AS model is being sued to reflect and descript about the business cycle. In the case of fiscal policy, the AD curve shifts rightwards (with a primary shift). It indicates the increment in demanding goods. Majorly the macroeconomic variables like interest rates, inflation, and unemployment has been effected by the shift in demand in the form of increasing the inventory investments.

- What fiscal policy options would you expect from the Australian government? Illustrate the effectsthat the government would be hoping for with their fiscal policy in AD-AS.

From Australian government, I would be expecting Expansionary fiscal policy. According to this, government should made a specific tax cut or the increment in spending. It make the AD shift possible in rightward direction.

The government by this fiscal policy would be hoping about an increment in goods demand though due to decrement in labour force, the firms overall cannot reflect in the output. So, in their fiscal policy government would hope about the increment in the demanding factor in market by a shift in AD (Furlanetto and Robstad, 2019).

- Explain the transmission mechanisms and comment on the likely effects to the main macroeconomic variables of interest: inflation, GDP, unemployment.

Transmission mechanisms reflects the change in economy by considering the monetary policy decisions. It also affects the macroeconomic variables in determining the interest rates by having the monopoly powers for the issuing of amount. The transmission mechanisms also affect the inflation rate expectations for future.

In turn, the fed directly targets nominal interest rates with a short-term period. If there is any changes found then it would direct to the long-term. It make a leading change over the real GDP by transmission mechanisms.

Transmission mechanisms made a stable recessionary effect by having structural shocks over the unemployment dynamics. Mainly, its effects based on the US and euro area as a major. So as a result the effects over unemployment plays a major role in the resolving of severe policy mistakes.

- Comment on some of the key economic factors that will determine how successful the fiscal responses will be? Please focus on economic factors, as opposed to issues related to transmission, vaccine, second peaks, etc.

Land, labour and capital are some of the key factors of economy that determines the success of fiscal responses by maintaining the tax rates based on the real GDP. These factors help to produce the goods and services with appropriate demand and supply measures. The making and distribution work of goods has been circulated with the help of natural resources under Land factor.

Further, the labour includes the employees along with their abilities that can help to produce these goods and services. To efficiently produce the goods, human-made equipment has been covered under the capital factor (Bova et al., 2018).

This is how these factors are opposing somewhere the transmission, vaccine measures, etc. so that the scarcity of resources could be fulfilled and the demand could be accomplished.

Q 2. Monetary Policy

- What monetary policy response would you expect the RBA to implement in response to COVID-19? Illustrate the expected effects of this response, if the response is successful, in AD-AS.

I would expect that Reserve bank of Australia (RBA) should use expansionary monetary policy. By this, it would have been lowering the cash rate targets to at least 0.25% in the response to COVID-19 so that the business cash flow could be boosted. By the medium of exchange rate, the industries can also get required help in trade-expose scenarios. After getting discussed, it is being cleared that the decrement in lower rates will definitely benefit the whole community whether it is industrial sector of household.

In the context of AD-AS, the response received from the expected policy and its effect is successful. Because, even by lowering the cash targets RBA is getting benefited the Australian economy is being supporting and the cash flow. By making a shift in AD, the expansionary monetary policy would get RBA benefited.

- Explain the transmission mechanisms of such a monetary response and comment on the likely effects to the main macroeconomic variables of interest: inflation, GDP, unemployment.

In such an expansionary monetary policy, the transmission mechanisms are supposed to get affected by the policy decisions. In this mechanism, the asset prices and the economy conditions affects to influence the interest rates as well the money. The major macroeconomic variables gets effected by the transmission mechanisms in the form of aggregating the demand factor. It would have been a larger impact over the real GDP by having the expansionary monetary (Martins et al., 2017).

So, this is how the macroeconomic variables get affected by the categorization of interest rates in the context of transmission mechanisms.

- How is such a monetary policy response (as you have discussed in parts a) and b)) normally implemented in Australia? How has it been implemented in response to COVID-19?

The expansionary monetary policy response can be implemented by regulating its financial conditions by RBA.

It can be implemented by following some of the major steps:

- By incrementing the target rates along with a risk-free interest.

- By lowering the cash targets by 0.25% to boost the cash flow situation.

- By increasing the target bond by 2-3% under inflation.

- By providing Term Funding Facility (TFF) so that banking funding cost could be minimized (Mumtaz and Theodoridis, 2019).

In response to COVID-19, it can be implemented to facilitate the boost in the business in context of cash flows to the whole community. This will include each sector i.e. household, trade-exposed industries, etc.

- Comment on some of the key economic factors that will determine how successful the monetary policy response will be. Please focus on economic factors, as opposed to issues related to transmission, vaccine, second peaks, etc.

Land and capital are some of the key economic factors that mainly provide a success parameter for the monetary policy. It is because the monetary majorly focus on the increment in boosting the economic growth factors. Capital factor is mainly indicates the money supply in monetary policy where the land factor fulfil the reserve bank requirements (Wu and Xia, 2016).

- Does the observed data confirm your analysis? Briefly cite some available data. Due to time constraints and data availability, you may not be able to find data on macroeconomic variables of interest. In these cases, you can simply indicate that up-to-date data is not yet available. [This DQ will be assessed assuming a working time of approximately 45 minutes for the entire DQ (parts a to e), so allowances will be made for the time constraint].

Yes, as there is the cash rate target has been lowered by RBA in the time of pandemic COVID-19 to 0.25% and on the other part, the inflation will be sustained along 2-3% bond.

As per the data available for actions taken by Australian government, in the corona period they have lowered the cash rates though it is increasing the companies’ cash flow statement.It is benefiting for each sector working in Australia and mainly over the people who are so sure rely over the interest rates (Meinusch and Tillmann, 2016).

So, this is how the data was somewhere available to analyze and conclude the results. It helped to make a research over the monetary and fiscal policies that are being properly managed by Australian government in COVID-19.

DQ 3. Microeconomics

- Draw and explain a simple diagram that shows why rice prices rose.

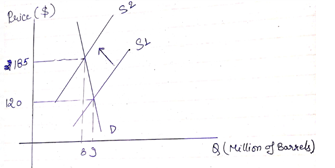

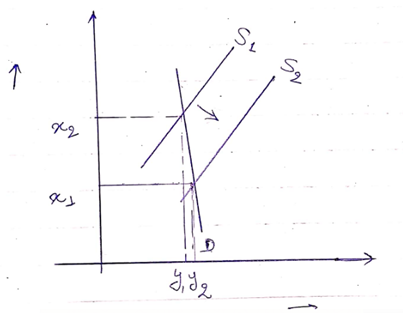

According to the above figure, the supply has been shifted to the left that leads to the increment in the rice prices and fall in the demand factor of rise in market. The rise in rice prices is about 64.86% that is nearly 65%.

There can be some major reasons behind this shift and the increment in rice prices.

- High taxes implemented on the products

- A major breakdown in the productivity due to these products

- Cost of production is high.

These are the reasons why rice prices rose by around 65% and subsequently the demand percentage got decreased (Hofmann et al., 2020).

- What would be the effect on an Australian firm that produces rice? Illustrate in an appropriate diagram, using the appropriate market structure.

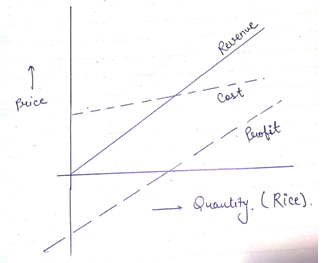

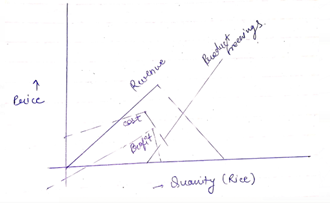

An Australian firm would have been expecting about an increment in their overall revenue system per item. Usually based on the demand-price system, if the demand gets increase price gets down and vice-versa for the other case.

- Explain the diagram in part b), explaining the price and quantity decisions of the firm, and the effects on cost and profit.

In part b, the raised revenue of SunRise with a trading name of Ricegrowers limited is being reflected by the increased in prices of rice and subsequently decrement in rice demand. The price being increased by 64.86% and due to that increase, the demand decreased. It effects over the firm to provide a greater profit but if see in the context of costing then for long-term it would not correct for the revenue stream of the firm (Hodges et al., 2018).Because, if demand subsequently decreasing then sometimes it would also have an adverse effect at a point. So, with the help of above diagram the cost, profit, and revenue functions are illustrated.

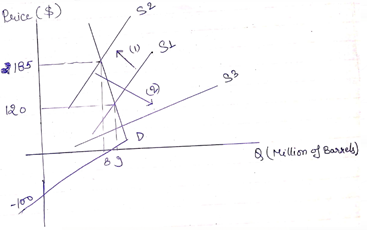

- In reality, some of the restrictions on rice exporting have now eased. Consider an alternative counterfactual where the restrictions continued, i.e. if restrictions did not ease. If countries such as India, China and Vietnam had continued to freeze their rice exports, what would you expect to happen in the world rice market in the long term? Illustrate this in a diagram, updating your diagram from part (a), and explain.

In the condition of freezing the rice exports by other companies, the long-term business for rice would not be sustained. Because, if the demand continues to fall and price increase, then seller and buyer would not be proceed with the rice exports and buying decisions.

Here, -100 refers to the decrement in usual price of rice due to further export freezing in upcoming years. Also, the shift would be now in right if it will happen with the rice exports (Naumenko and Moosavian, 2016).

- If restrictions had continued, i.e. if countries such as India, China and Vietnam had continued to freeze their overseas shipments, how would you expect this to affect an Australian firm that produces rice? Illustrate this in a diagram.

Above diagram illustrates a major breakdown in revenue, cost, and profit as well when product freezing being started.

DQ 4. Microeconomics: Monopoly or Monopolistic Competition

- Example and Shock:

- Give an example of a firm and industry that could be analysed using the model of Monopoly or Monopolistic Competition. Justify why it would be appropriate to use the model of your choice. You only need to choose one: either Monopoly or Monopolistic Competition, not both.

Woolworths is an Australian supermarket firm that present 80% of the market as supermarket, it possess monopoly. There are a lot industries and firms that possess monopoly competition like ANZ, NAB, Commonwealth bank because they are willing to maximizing the overall share and profits and to become in this race.It would be appropriate so that data can be easily fetched and the companies running in same race can be analysed by the chosen model.

So, this is how the chosen supermarket is in the race of monopoly and thus also called one of the monopoly company in Australia (Scahill, 2020).

- Give an example of a major change that has affected the firm.

In this monopoly behaviour, Woolworths also faced a shock as a major change in order to introduce the strict purchasing limits. It has been faced by them in the period of COVID-19 pandemic.

- Give an example of a firm and industry that could be analysed using the model of Monopoly or Monopolistic Competition. Justify why it would be appropriate to use the model of your choice. You only need to choose one: either Monopoly or Monopolistic Competition, not both.

- Analysis

- The shifts in curves

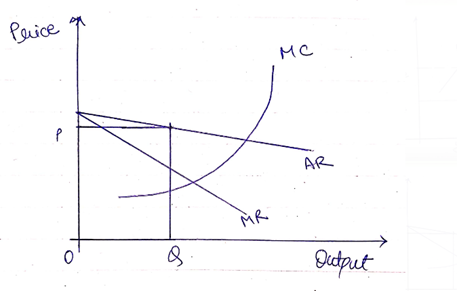

The right shift in curve here reflects that the demand is being increasing and subsequently pricing decreasing.

- The output and pricing decisions of the firms

The output and pricing decisions can be determined by having the identification of company cost as well the market demand.

- Effects on the firms and the industry

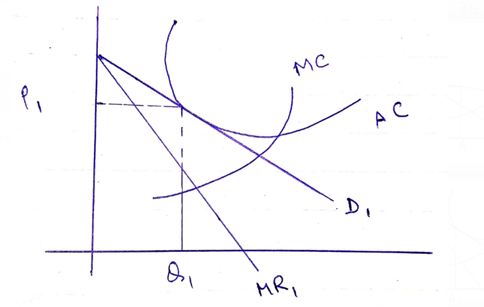

Here MC denotes to the marginal cost that is equal to Marginal Revenue (MR1) for the above shock of the firm. It has happened at Q1 (the output level) where price has been chosen as (P1). AC is the average cost curve and D1 is the demand curve.

- The shifts in curves

- Empirical Evidence: Present some quantitative data that gives further context to your analysis. Given the time constraints, it is not necessary to create charts etc, but you can use your data to quantify some of the variables from your Analysis in part b), above.

- In a monopoly competition for a firm, it is required to have the equation satisfied (MR = MC). Note* - For that price should be decided as P = AC. For example - In the figure shown in part b above, it has been shown that the MR and MC are meeting and the criteria is being satisfied as per the effect of monopoly competition.

- Under this competition, the consumer demand inspires trading when it is being openly occur between two countries with MC markets (Bonciani and Van Roye, 2016).

- MC market trading would focused to increase the variety of products available to the intended customer also increase the demand factor under monopoly competition. In above figure, the MC increment lead to increase the pricing, availability, and demand factor too.

References

- Bonciani, D., & Van Roye, B. (2016). Uncertainty shocks, banking frictions and economic activity. Journal of Economic Dynamics and Control, 73, 200-219.

- Bova, E., Medas, P., &Poghosyan, T. (2018). Macroeconomic stability in resource-rich countries: The role of fiscal policy. Journal of Banking and Financial Economics, (1 (9)), 103-122.

- Furlanetto, F., &Robstad, Ø. (2019). Immigration and the macroeconomy: Some new empirical evidence. Review of Economic Dynamics, 34, 1-19.

- Hodges, H., Durham, Y., & Henson, S. (2018). Economic Education Production Functions for the Principles of Macroeconomics and the Principles of Microeconomics: Is There a Difference?. Journal for Economic Educators, 18(2), 22-41.

- Hofmann, B., Shim, I., & Shin, H. S. (2020). Emerging market economy exchange rates and local currency bond markets amid the Covid-19 pandemic (No. 5). Economics assignment Bank for International Settlements.

- Martins, N. M., Pires-Alves, C. C., Modenesi, A. D. M., &Leite, K. V. B. D. S. (2017). The transmission mechanism of monetary policy: Microeconomic aspects of macroeconomic issues. Journal of Post Keynesian Economics, 40(3), 300-326.

- Meinusch, A., &Tillmann, P. (2016). The macroeconomic impact of unconventional monetary policy shocks. Journal of Macroeconomics, 47, 58-67.

- Mumtaz, H., &Theodoridis, K. (2019). Dynamic effects of monetary policy shocks on macroeconomic volatility. Journal of Monetary Economics.

- Naumenko, A., &Moosavian, S. A. Z. N. (2016). Clarifying theoretical intricacies through the use of conceptual visualization: Case of production theory in advanced microeconomics. Applied Economics and Finance, 3(4), 103-122.

- Scahill, E. (2020). Monopoly and Monopsony Power in a Market for Mud. Journal of Economics Teaching, 5(1), 30-36.

- Wu, J. C., & Xia, F. D. (2016). Measuring the macroeconomic impact of monetary policy at the zero lower bound. Journal of Money, Credit and Banking, 48(2-3), 253-291.