Estate Planning Assignment: Statement Of Advice for Bruce & Samantha

Question

Task: Description / Requirements of Estate Planning Assignment Bruce and Samantha Lee are a married couple aged in their early 40’s and have come to you for some financial advice around the protection of their wealth and other risks that they face. They are concerned about accumulating sufficient wealth for their retirement, while at the same time living a relatively comfortable life and providing the highest possible education for their three children Andrea (19), Mitchell (9) and Taylor (5).

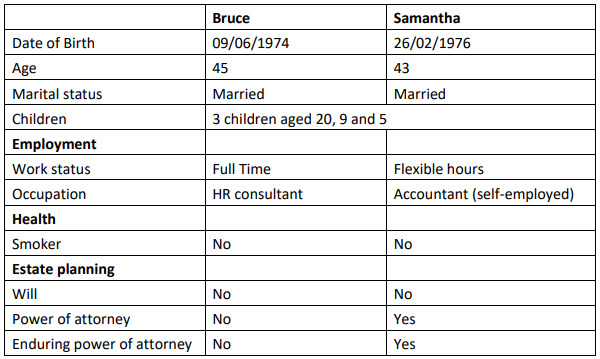

Personal details:

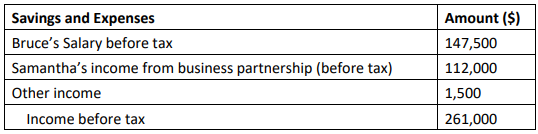

Income and Cash Flow:

Note: Figures are for the prior financial year

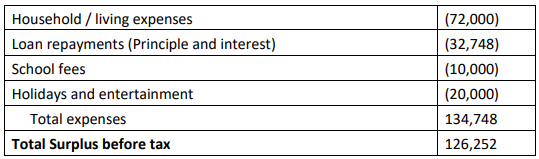

Liabilities:

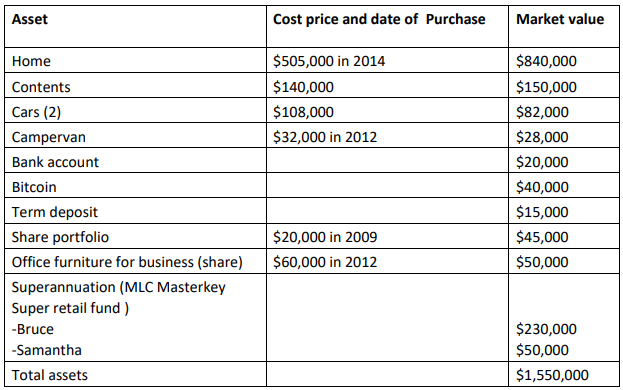

Assets:

Other information:

- The couple would like to send their 2 younger children to a private school when they move into secondary school at age 12. Andrea is at university in the second year of a Bachelor of Arts. Bruce and Samantha would like to pay her fees up front so she does not have a HECS debt and to that end have paid her first years fees already.

- Their 9-year-old child, Mitchell, has a physical disability but has normal cognitive function and learning capacity. The couple would like to provide some additional financial support for him when he becomes an adult.

- You can assume that funeral and final medical expenses would be $20,000. Assume that if either Samantha or Bruce were seriously injured, out-of-pocket medical expenses would amount to $25,000. Bruce and Samantha do not have private medical insurance nor have they considered or made any legal provision regarding medical treatment decisions

- Bruce’s father had a stroke at 53 and was unable to work after that.

- Samantha’s brother is her attorney. The power of attorney and enduring power of attorney were established 20 years ago before her brother moved to Hong Kong. She has not heard from him since that time.

- Samantha and Bruce intend to retire at 60 and 65 respectively, at which time they expect to be able to live off the income derived from their superannuation accounts.

- Samantha is a 50% partner of ‘All Accounts Accountants’ with her lifetime friend Mai from university. The business has made a consistent 45% profit on turnover over the past 7 years.

- All Accounts’ office furniture consists of a computer which holds all records of the business. All information is backed up via a USB memory stick and they annually update their Norton security software

- Assume a CPI rate of 2.5 per cent p.a.

- Samantha and Bruce’s life expectancy is estimated at 85 years and 83 years respectively. •Bruce works as a HR consultant for a major financial services business.

- Included in the contents list are several items of antique furniture items that were passed to Samantha from her grandmother and have a current value of $87,000.

- The couple are looking to travel to Europe next year with the children for four weeks on a family holiday that is expected to cost $40,000. (The couple intend to use Bruce’s substantial Qantas Frequent Flyer points, around 1,000,000 points, accumulated from his previous employment to book the best seats they can on the plane for the trip).

- Mai and Samantha have never made a formal written agreement regarding the business but have estimated that if one of them was to die then the value of the business would $1.20 per dollar of gross fee income received.

- Living expenses of approximately $700 per month per each child would end when they cease to be dependent, which can be assumed at age 24 for each child.

- You can assume that in case of one of the couple dying prematurely, the couple’s living expenses would fall by 20 per cent.

- Bruce and Samantha have life insurance and TPD cover with their superannuation. They elected to take the standard cover with MLC Lifestage insurance. Both are worried that they may be under insured and Samantha wants her TPD cover to come under the “own occupation” definition of TPD. Bruce also has an agreed income protection insurance policy of $4,000 per month payable to age 60 with a 90-day wait period for which he currently pays $300 per month. The couple has a Home Page 5 of 6 and Contents policy and Third Party policies on their cars and campervan. They have no other insurance policies in place.

- All Accounts currently rents premises for conducting its business.

- Samantha does not currently contribute any money to superannuation.

- Bruce made an investment in bitcoin during the year as he thought it was a good long-term investment.

- Bruce has a rather large iTunes collection but otherwise has minimal use of the internet while Samantha is a heavy Facebook user and All Accounts does most of its business digitally.

Required: 4000 words in total excluding any appendices or references

After analyzing their personal circumstances, prepare a limited Statement of Advice (SOA) to Bruce and Samantha. Ensure that you summarize their current estate planning and insurance positions, outline the potential risks and losses they are exposed to, justify and explain the types of cover you would recommended to cover their risks and the amount of cover you would put in place. It is expected that you will explain the various policy features as well as typical exclusions likely to be experienced and also discuss the merits for and against holding their various personal insurance policies within their superannuation funds including the tax implications of the cost of the premiums. You are not required to recommend specific policies. Include in your Statement of Advice analysis and recommendations that relate to the couples digital assets. The limited SOA should contain a Covering Letter addressed to the couple detailing the purpose and general content of the report and a Table of Contents.

Answer

Introduction

Statement of Advice (SOA) prepared in this estate planning assignmentsets out the goals and situations of people, and their financial advice as well. This is required when an individual requires financial advice in order to take care of their financial objectives. This report will make an SOA for a married couple named Bruce and Samantha. They are above 40 years of age and they want to take some loan about wealth and it will be described in this project. Their main message is that they want to save some money for future generations. They have three children in total and two of them want to go to private school first and will be admitted to Secondary school when they are 12 years old. The largest one of these is the second-year Bachelor of Arts and her name is Sandra. These married couples do not have any HECS debt because they want to pay their fees and they have already dropped the first step of the fee structure.

This will show through this project and discuss how they will solve this problem. Their 9-year-old son has a physical disability but his cognitive function is normal and he has enough running Capacitors to be able to study well in both schools and universities. They want to leave some financial support for this child because no one knows when someone dies in old age. Since the child has a physical disability, they want to leave all kinds of financial help for the child. Researchers estimate that their medical cost is $20000 and according to these researchers if Samantha and brews ever are severely damaged or ill then the amount it will come out of their pocket is $25000. Though this couple does not have any private medical insurance or even they do not have any legal medical provisions. Their main message is that they want to save some money for future generations. This report will give an account of their financial problems and a great idea of how they can get out of that financial crisis.

Summary of the insurance recommendations

I recommend Bruce Lee that he should replace his life and TPD insurance that stands for total and permanent disability insurance, retain his insurance regarding income protection, along with that extract trauma insurance. On the other hand, I suggestSamantha Lee for increasing the cover amount during her life, along with the TDP insurance as well as extracting trauma insurance (Jiménez-Martín, Mestres, and Castelló, 2019). The following tables will give an outline regarding the products, which have been recommended for Bruce and Samantha Lee. However, in the further section of the report, it will evaluate these recommendations along with a proper analysis of the demands of your needs as well as a proper justification.

Overview of the recommended product for Samantha Lee

|

Product and cover |

Owner |

Amount of cover |

Premium paid from |

Specification of features of the recommended policy |

The premium of the first year |

|

Trauma (establish) |

Samantha |

$235,000 |

Cash |

· The steeped premium has been considered as a major feature of this policy |

$1,300 |

|

TDP as well as Life Cover (amplify) |

Samantha |

$840,000 |

Super |

· Same as above |

$650 |

|

Sum |

$1,950 |

||||

|

Product and cover |

Owner |

Amount of cover |

Premium paid from |

Specification of features of the recommended policy |

The premium of the first year |

|

Protection of income (retain) |

Bruce |

$5,350 monthly excluding super contributions of $642 |

Cash |

· Provide a great benefit after the age of 65; · It follows level premiums, which is an emerging feature of this policy · 3 month of the waiting period |

$1,200 |

|

Trauma (establish) |

Bruce |

|

Cash |

· Steeped premium has been considered as a major feature of this policy · Terminal sickness improvement |

$900 |

|

TDP as well as Life Cover (replacement) |

Bruce |

$510,000 (TPD) $1,110,000 (life) |

$200 (cash) $1,840 (cash) |

· Steeped premium |

$2,040 |

|

Sum |

$4,140 |

||||

Demands of Bruce and Samantha

The main purpose of this part of the limited statement of advice is of demonstrating the understanding regarding the needs of you guys. From the declaration given by you both, different specific and significant has been identified by me, which are noted in the following section of this discussion:

o You guys have three children, among them, Andrea is the elder one. Andrea is studying in B.A. second year. However, you want to pay the fees for Andrea’s further study.

o In addition to that, you guys additionally stated that you want to send your rest two children towards a private school for your future study, and pay your fees too.

o Along with that, the couple also conveyed that Michel, who is 9 years old have some physical disability, for which you want to save more money for him in order to provide him extensive economical help in the future (Clark, Ygen Capital Inc, 2018).

o However, some additional requirements have also been analyzed from the information given by you guys that you need proper guidance regarding insurance policies, such as trauma insurance for the purpose of covering your children.

o In addition to that, it has been observed that both of them are planning to get your retirements at the age of 60 (Samantha) and 65 (Bruce). However, you want to save a significant amount of money each month accordingly with the comfortable present lifestyle, for making your future secure. Moreover, it has been observed that you are ready to spend a significant amount as Superannuation, such as Bruce confirmed to consume $230,000 for this purpose, and on the other hand, Samantha has confirmed for consuming $50,000 for this purpose.

o Apart from these, some additional information has also been gathered from your declaration, such as:

o Samantha wants to have a proper plan for maintaining your TDP or total and permanent disability insurance, for which Samantha is currently paying $300 for each month.

o Furthermore, you additionally have different types of expenses accordingly, for example, the children’s living costs and so forth (Clark, McGill, and Cuñado,2018). And Bruce also is expending his money for buying bitcoin, which has been considered as a long-term investment.

o Bruce is expecting that he will die at the age of 83 and Samantha expects that she will die when her age reaches 85 so that you have demanded a proper plan for living comfortably with goo financial condition for the rest of your life after your retirement.

o In addition to that, it has been defined from your declaration that Bruce is working as an HR and Samantha is doing business with her college friend Mia, and next year you want to move out for a tour, for which you assumed an expense of $40,000.

o Moreover, it has also been found that the married couple is having a total asset amount of $1,550,000, which includes various assets that are having a great market value during the present days.

What you should know about the advice

You should have a piece of significant knowledge regarding the given advice, for which this section has been included in this Limited Statement of Advice. This specific document is for providing a complete review concerning the personal requirements of you guys, regarding future saving, taxation, and insurance for covering your three children and your life after retirement (Clark, McGill, and Cuñado, 2018). Mainly, I am giving this adviceto you in order to help you out for the purpose of ensuring that your family is having proper and efficient economical support, during such cases of illness, disability as well as an accidental or normal death. However, the advice given in this document is specific to the following objectives:

o For the purpose of ensuring that you both are totally secured, in such cases of accidental or premature death, major injury, a major illness, along with the disability as well.

o This paper or limited statement of advice also aims for giving adequate and effective suggestions in case of proper insurance policy as well as product.

o It will also evaluate the way, which should be followed by you guys in order of paying your premiums for different insurances.

o Apart from that, it also aims for the purpose of giving suggestions regarding the planning in concern of the contribution of superannuation on behalf of offsetting the influence of the premiums of insurance on the advantages of retirement (Harris, 2017).

o Furthermore, this specific limited SOA also aims for giving proper and adequate information to you guys regarding the influence concerning these arrangements on your flow of cash along with the advantages of superannuation

o In addition to that, it also suggests making proper nominations for getting benefits on death, thus your superannuation properties along with the insurance cover have passed according to your needs as well as wishes too.

However, the advice made in this document is bounded according to the aforementioned aims as well as objectives. It does not aim to given suggestion regarding the following things:

o The advice for making an adequate as well as an effective strategy for home loan repayment is not included in the objective of this Limited Statement of Advice.

o Moreover, this document does not include advice regarding any different perspectives concerning economical affairs.

About: Bruce and Samantha

|

Attributes |

Samantha Lee |

Bruce Lee |

|

Age |

43 |

45 |

|

DOB |

26/02/1976 |

09/06/1974 |

|

Marital status |

Married |

Married |

|

Endorsement of power of attorney |

Yes |

No |

|

Wok |

Accountant |

HR consultant |

|

Working type |

Flexible hours |

Full-time |

|

Smoker |

No |

No |

|

Having Will |

No |

No |

|

Family health issue |

No |

Bruce's father got heart stoke when he was 53 years old |

|

Current Health condition |

Excellent |

Excellent |

|

Children |

3 children |

3 children |

|

Children information |

Andrea is 20 years old and studying for the BA course; Samantha and Bruce’s rest two children studying at primary school, who are having the age of 9 and 5 years. |

|

|

Health condition of children of Samantha and Bruce Lee |

9 years old Mitchell got some physical disability, but rest two children of Bruce and Samantha are having excellent health. |

|

|

Attribute |

Earning amount |

|

Samantha’s income each year |

$112,000 |

|

Bruce’s income each year |

$147,500 |

|

Other earnings from both of them |

$1,500 |

|

Sum |

$261,000 |

|

Attribute |

Spending amount |

|

Expenses for school fees |

$10,000 |

|

Expenses for Holidays and entertainment |

$20,000 |

|

Expenses for Loan repayments including interest |

$ 32,748 |

|

Household expenses |

$ 72,000 |

|

Sum |

$ 134,748 |

|

Owned Items |

Owner |

Value |

You're owe |

Amount |

Total |

|

Home |

Both |

$840,000 |

Mortgage |

$505,000 |

|

|

Contents |

Both |

$150,000 |

- |

$140,000 |

|

|

Two cars |

Both |

$82,000 |

- |

$108,000 |

|

|

Campervan |

Both |

$28,000 |

- |

$32,000 |

|

|

Share portfolio |

Both |

$45,000 |

- |

$20,000 |

|

|

Office furniture for business |

Samantha |

$50,000 |

- |

$60,000 |

|

|

Other assets |

|||||

|

Term deposit |

Both |

$15,000 |

- |

|

|

|

Bitcoin |

Bruce |

$40,000 |

- |

|

|

|

Bank account |

Both |

$20,000 |

- |

|

|

|

Superannuation |

Both |

Bruce -$230,000 Samantha- $50,000 |

- |

|

|

|

Total |

|

$15,50,000 |

|

$8,65,000 |

|

|

Net wealth |

|

|

|

|

$6,85,000 |

|

Cover and product |

Owner |

Monthly premium |

Insurer |

|

TPD that stands for total and permanent disability insurance |

Both |

$300 |

MLC Lifestage insurance |

|

Total Annual premium |

$3,600 |

||

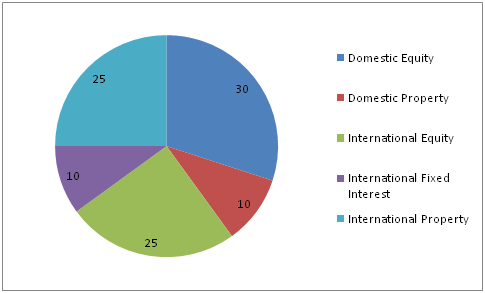

Risk profile

A specific and significant portion concerning the construction of the investment planning for you guys includes the determination of your attitudes towards hazard as well as the degree your preparation for the purpose of accepting for meeting the returns of investment. In addition to that, hazards as well as return are relevant closely. Generally, the extensive level concerning hazard organized regarding an expense, the higher the return rate the investor should assume for receiving in order to take on that hazard standard (Scottet al., 2017). It has been considered as the trade-off of risk/return, along with that considered as a major section concerning the procedure for the selection of proper allocation of the asset as well as particular investment in case of your entertainment as well as travel. The attitude towards hazards and the risk profile has been demonstrated in the following section:

|

|

Risk profile |

|

Bruce |

Moderate Growth |

|

Samantha |

Moderate Growth |

|

Joint |

Moderate Growth |

|

Asset |

Weight (%) |

|

Domestic Equity |

30 |

|

Domestic Property |

10 |

|

International Equity |

25 |

|

International Fixed Interest |

10 |

|

International Property |

25 |

|

Sum |

100 |

Figure 1: Assets of the family

(Source: Created by Author)

Recommendations

After analyzing your specific and significant needs along with your risk profile as well as different other details regarding your private life and property, in the following section of this limited SOA, I have explained my recommendations for you guys, considering the findings of the aforementioned analysis, including appropriate descriptions for each recommendation.

Insurance needs for Bruce

Life insurance

|

Financial requirement |

Covered amount |

Description |

|

Income replacement |

$760,000 |

If you get premature death, in that case, your family will get $760,000, which will be much helpful for your family in order to live comfortably with the present way of living(Harris, 2017) |

|

Funeral expenses |

$10,000 |

If you get premature or accidental death, then your family will receive an amount of $10,000 as support for expenses in your funeral (Clark, Ygen Capital Inc,2018) |

|

Clear mortgage |

$440,000 |

In the case of your death, the mortgage is capable of being cleared simply (Mousaet al., 2016). |

|

Subtotal |

$12,10,000 |

For the purpose of meeting your allrequirements, thesubtotal amount for each and every life insurance is$12,10,000 |

|

Total |

$9,80,000 |

For measuring this sum amount, yourtotal superannuation that is 230,000 has been deducted from the subtotal amount of insurance since it has been expected that your superannuation advantage will have existed when you die. |

|

Financial requirement |

Covered amount |

Description |

|

Income replacement |

N/A |

When you turn into fully as well as permanently disabled, your policy for protecting the income will be replaced by 75% of your salary along with that cover guarantee for contributing regarding the employer superannuation. In addition to that, the household costs will be decreased in this case, which results in the clearance of a mortgage(Haberman and Pitacco, 2018). |

|

Medical expenses |

$100,000 |

When you turn into fully as well as permanently disabled, you will receive an amount of $100,000 for the purpose of covering your medical expenses, which will be much helpful for him too (Black, 2018) |

|

Clear mortgage |

$440,000 |

When you turn into fully as well as permanently disabled, your mortgage is capable of being cleared easily (Jiménez-Martínet al., 2019). |

|

Subtotal |

$5,40,000 |

For the purpose of meeting your requirements the subtotal amount for the Total and Permanent Disability insurance is $5,40,000 |

|

Total |

$5,10,000 |

For measuring this sum amount your total superannuation that is $2,30,000 as well as the total tax, which is $70,000 has been deducted from the subtotal amount of Total and Permanent Disability insurance. In addition to that, when you turn into fully as well as permanently disabled your superannuation advantages are expected for being available. However, depending on your current position tax amount for you for this purpose will be $70,000. |

|

Financial requirement |

Covered amount |

Description |

|

Decrement of mortgage |

$50,000 |

If you go through a serious injury or illness, you will get $50,000 for the purpose of covering whole mortgage repayments for 2 years. |

|

Medical expenses |

$100,000 |

If you undergo from a serious injury or illness, you will receive an amount of $100,000 for the purpose of covering your medical expenses, which will be much helpful for him too(Scottet al., 2017) |

|

Total |

$1,50,000 |

For the purpose of meeting your requirements the Total amount for the specific and significant Trauma insurance is $1,50,000 |

|

Financial requirement |

Description |

|

You obtain coverage in case of your salary’s 75% including an extensive amount for the purpose of covering the guaranteed contribution of employer superannuation |

It has been considered as the maximum percentile of your salary, which he typically can insure |

|

Nothing that, you have $25,000 within an offset account of mortgage, along with that waiting period has been considered as 3 months as well as an advantage period towards 65 years of age is adequate and effective as well. |

o In this, you will have the capability of accessing sick leave of 90 days as well as hence you would not require the money instantly (Jaraet al., 2016). o In addition to that, you have been pointed out that you are expecting to take retirement at the age of 65(Clarket al., 2018). o Furthermore, it should be noted that these specific and significant policies do the payment in a monthly basis within arrears with the initial payment, thus this can be considered as significant for the purpose of retaining the access towards cash through your offset accounts of the mortgage as well as the savings |

|

Recommendation |

Description |

|

You do not perform any extensive contribution towards the superannuation for the purpose of offsetting the influence concerning the premiums of insurance during the present time. |

o You conveyed that one of your specific and significant objectives is of decreasing the mortgage. However, doing extensive contributions in the case of superannuation would help him for the purpose of meeting this specific and significant objective (Stanford, 2017). o In addition to that, your present employer contribution considerably increased the suggested premiums of insurance, which will be subtracted concerning the total superannuation. |

|

Financial requirement |

Covered amount |

Description |

|

Income replacement |

$2,40,000 |

If you got premature death, in that case, your family will get $240,000, which will be much helpful for your family in order to generate a yearly stream of income of $30,000. This will be highly supportive of your family for living the rest of your life comfortably and in the same way as of now(Clark,Ygen Capital Inc, 2018). |

|

Funeral expenses |

$10,000 |

If you got premature death, then your family will receive an amount of $10,000 as support for expenses in yourfuneral (Mousaet al., 2016) |

|

Clear mortgage |

$440,000 |

In the case of the death of Samantha, the mortgage is capable of being cleared. |

|

Subtotal |

$6,90,000 |

For the purpose of meeting your allrequirements regarding the life insurance, the subtotal amount for them each and every life insurance is $12,10,000 |

|

Total |

$6,40,000 |

For measuring this sum amount the total of your superannuation that is 50,000 has been deducted from the subtotal amount of insurance since it has been expected that your superannuation advantage will have existed if you die (Harris, 2017). |

|

Financial requirement |

Covered amount |

Description |

|

Decrement of mortgage |

$50,000 |

If you go through a serious injury or illness, you will get $50,000 for the purpose of covering whole mortgage repayments for 2 years. |

|

Medical expenses |

$100,000 |

If you go through from a serious injury or illness, you will receive an amount of $100,000 for the purpose of covering your clinicalexpenses, which will be much helpful for you too (Scottet al., 2017); |

|

Income replacement |

$85,000 |

If yougo through a serious injury or sickness, you will receive $85,000, which will enable your suppleness for the purpose of taking leave for one year from your job on account of supporting your family. |

|

Total |

$2,35,000 |

In order of meeting the requirements of Samantha, the Total amount for the specific and significant Trauma insurance is $2,35,000 |

|

Financial requirement |

Covered amount |

Description |

|

Income replacement |

$240,000 |

When you turn into fully as well as permanently disabled, you will get $240,000 for the purpose of generating a specific and significant stream of income, which will help you with $30,000 on a yearly basis(Haberman and Pitacco, 2018). |

|

Medical expenses |

$100,000 |

When you turn into fully as well as permanently disabled, you will receive an amount of $100,000 for the purpose of covering your medical expenses, which will be much helpful for you too(Low and Pistaferri, 2020) |

|

Clear mortgage |

$4,40,000 |

When you turn into fully as well as permanently disabled, your mortgageis able to be cleared. |

|

Subtotal |

$7,80,000 |

For the purpose of meeting your requirements, the subtotal amount for the Total and Permanent Disability insurance is $5,40,000(Black, 2018) |

|

Total |

$6,30,000 |

On account of estimating this whole sumsofyour complete superannuation that is $ 50,000and the all-out duty, which is $90,000, has been deducted from the subtotal measure of Total and Permanent Disability insurance. In addition to that, when you transform into completely and forever impaired, your superannuation favorable circumstances is normal for being accessible. In any case, contingent upon your present position the sum of tax for Samantha, for this reason, will be $90,000. |

|

Financial requirement |

Description |

|

You are not eligible for the insurance of income protection |

o The main reason behind your no-eligibility for this sort of specific and significant insurance policy is that you do not have any fixed period of working, and you are available at the work only in your flexible times (Clarket al., 2018). o However, several products of a homemaker are present there, which are likewise this specific and significant policy of insurance that pays a confirmed advantage on a monthly basis, when you turn into fully or majorly disabled. In addition to that, these sorts of products are recommended to Samantha, since the income covering has not been considered as high-priority in the case of Samantha. |

|

Recommendation |

Description |

|

I am recommending you to make a$10,000non-concessional contribution for your superannuationin between the current year. |

o It will allow you for the purpose of receiving a co-contribution amount. o A contribution that is non-concessional has been considered as a contribution of 'after-tax'. When you will income lower than $51,021 (ahead of giving tax) on a yearly basis, along with that make contributions for superannuation of after-tax, you are permitted for the purpose of receiving matching contributions concerning Government, which has been considered as co-contribution of the government. On the off chance that Samanthaearnslower than$36,021, the greatest co-commitment is $500 dependent on $0.50 from the Government for each $1 you contribute (Taylor, 2019). o However, these specific and significant suggestions would hold a few major influences on your objective for the purpose of reducing the mortgage. |

Conclusion

This report discusses a married couple whose names are Bruce and Samantha. Researchers have provided all the information related to their financial problems and their children's education in this project. This project describes how this married couple raised their children and what kind of money is safe for future generations; Researchers Gate information about their domestic and external life from this project and also their financial status through this project. According to the married couple, their youngest son is living with a physical disability but he has educational abilities and is perfectly healthy in other respects.

In this project, theresearcher’sshow that couples how much money they want to save for their children, and they showed them their complete financial situation and how they can get rid of them. This married couple has no medical issue and they have no medical claim. In case of any danger, they do not know how to get rid of the danger because they do not have any kind of medical insurance. Researchers estimate that their medical cost is $20000 and if they have an accident or become physically ill, they don't know how to get out of that situation and they have to pay all these expenses out of their pocket because they do not have any medical. They will enroll their two children in Secondary School after 12 years and they have saved some money for it.

Since their little boy is physically disabled so they want to save some money for his future. The researchers have given a complete idea about their financial condition and they have tried to give all the details on how they can solve this problem permanently as well as they also focused that couple how much money want to spend for their children. However, on the accomplishment of this limited SOA, some recommendations have been made to Bruce and Samantha, such as, it is recommended to Bruce Lee that he should replace his life and TPD insurance that stands for total and permanent disability insurance, retain his insurance regarding income protection, along with that extract trauma insurance, along with that, Samantha Lee has been suggested for increasing the cover amount during her life, along with the TDP insurance as well as extracting trauma insurance.

Reference list

Black, M.E., (2018). Employability Assessment in Total and Permanent Disability Insurance Claims.https://ses.library.usyd.edu.au/bitstream/handle/2123/18772/Black_ME_Thesis.pdfsequence=1

Clark, G.L., McGill, S. and Cuñado, J., (2018).Migrant workers, self reliance, and the propensity to hold income protection insurance by country of residence. Geographical Research, 56(2), pp.139-153.https://www.geog.ox.ac.uk/research/transformations/cewf/wpapers/wpg17-01.pdf,

Clark, R., Ygen Capital Inc, (2018). System and method for optimizing the selection of permanent life insurance policies for use in leverage life insurance structures. U.S. Patent Application 15/848,710.https://patentimages.storage.googleapis.com/63/f6/52/51c0a475a78153/US20180182040A1.pdf

Haberman, S. and Pitacco, E., (2018). Actuarial models for disability insurance. Routledge.https://books.google.co.in/bookshl=en&lr=&id=Tj73DwAAQBAJ&oi=fnd&pg=PP1&dq= total+and+permanent+disability+insurance&ots=8EpfHW74-p&sig=nxZh43cdUWMQu1BajOzvM5xhP60&redir_esc=y

Harris, T.F., (2017). Life Insurance: Nudges and Adverse Selection.https://uknowledge.uky.edu/cgi/viewcontent.cgiarticle=1026&context=economics_etds

Jara, H.X., Sutherland, H. and Tumino, A., (2016). The role of an EMU unemployment insurance scheme on income protection in case of unemployment (No.EM11/16).Estate planning assignment EUROMOD Working Paper.https://www.econstor.eu/bitstream/10419/197597/1/877356467.pdf

Jiménez-Martín, S., Mestres, A.J. and Castelló, J.V., (2019).Great Recession and disability insurance in Spain. Empirical Economics, 56(5), pp.1623-1645.https://repositori.upf.edu/bitstream/handle/10230/26838/1519.pdfsequence=1&isAllowed=y

Low, H. and Pistaferri, L., (2020). Disability Insurance: Theoretical Trade Offs and Empirical Evidence. Fiscal Studies, 41(1), pp.129-164.https://onlinelibrary.wiley.com/doi/pdf/10.1111/1475-5890.12215

Mousa, A.S., Pinheiro, D. and Pinto, A.A., (2016). Optimal life-insurance selection and purchase within a market of several life-insurance providers. Insurance: Mathematics and Economics, 67, pp.133-141.https://fada.birzeit.edu/jspui/bitstream/20.500.11889/4012/1/Optimal%20life-insurance%20selection%20and%20purchase%20within%20a%20market%20of%20several%20life-insurance%20providers.pdf

Scott, J.W., Upadhyaya, P., Najjar, P., Tsai, T.C., Scott, K.W., Shrime, M.G., Cutler, D.M., Salim, A. and Haider, A.H., (2017). Potential impact of ACA-related insurance expansion on trauma care reimbursement. The journal of trauma and acute care surgery, 82(5), p.887.https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5468098/

Stanford, J., (2017). The Consequences of Wage Suppression for Australia’s Superannuation System. Sydney: Centre for Future Work.http://taxwatch.org.au/wp-content/uploads/2017/09/Wage_Suppression_and_Superannuation_Final.pdf

Taylor, K., (2019). Does higher superannuation reduce workers’ wages. McKell Institute.https://mckellinstitute.org.au/app/uploads/Does-higher-superannuation-reduce-wages.pdf