Evaluating the international marketing management strategies of Graze for expansion in the Netherlands

Question

Task: Critically evaluate the option of entering into a direct arrangement with a leading supermarket chain of your choice in your chosen country.Provide evidence for your points and with clear links to your understanding of the consumer and the retail environment. Both secondary research from Passport and academic research should be used. State clearly any assumptions considered, if applicable. Identify TWO key global trends, which you find particularly relevant to Graze’s brand proposition. Write about segmentation, target and positioning (STP) strategy you intend to focus on in your chosen country. Briefly outline the marketing mix, especially focusing on marketing channels to be used in order to educate, engage and convert consumers in the chosen market. Also, include explanation as to why you believe these channels are effective and examine the extent to which social media communications need to be standardised or adapted in your chosen country.

Answer

Introduction

For any organisation which is operating successfully in its domestic market, the next step would be internationalisation. Graze is a brand which bears the flagship in offering healthy snack boxes, which tries to match up the desired tastes of the customers. Joanna Allen has been appointed as the new CEO of the company in 2020. This brand now aims at expanding into the European markets. The top two countries include the Netherlands and Germany, which offer maximum growth prospects to Graze. However, this report is focused on the expansion into the Netherlands. Before entering the foreign market, the market entry strategies for the nation, the global trends and its application in the domestic environment of the nation and the communication channels to be used in the nations, will be analysed.

Market Entry Strategy

Graze has been operating successfully in its domestic market. Now, it is time for the company to enter a new foreign market. The company is therefore, planning to enter into a direct arrangement with the number one supermarket of the Netherlands, Albert Heijn. Thisdirect sales arrangement with the two country’s leading supermarket chain would facilitate exclusive rights for selling the products of Graze in the physical supermarkets or retail stores.

The company has chosen the Netherlands as a market for expansion because it has a ready market which creates demand for healthy snacks. The country has good accessibility and the tastes of the products of Graze suit the preferences of the people of the Netherlands. The products of Graze can be customised as it would perfectly match the personal tastes of the customers of Netherlands. In the Netherlands, Graze would collaborate with Albert Heijn, the biggest supermarket of the country. The reason behind choosing this highly priced supermarket is that they offer only the premium quality products to their customers. Graze making a place in the supermarkets of Albert Heijn would create a positive brand image. The customers can trust the quality of the products of Graze when it comes through Albert Heijn. The health conscious customers are attracted to the healthy food items of Graze along with the sustainable model at Albert Heijn. Graze can capture a substantially high market share in Netherlands through its healthy snacks as fried and sweet-based snack consumption is less in the country (Huitinkett al. 2020). Frequency of unhealthy snack consumption is quite low among the customers. Supermarkets like Albert Heijn are focusing on sourcing healthy snacks for promoting healthy diet among the population. The market expansion scope is high and supermarkets would foster the growth of Graze in Netherlands.

The Netherlands is a growing market for Graze. In the country, the company can also think of expanding its online presence. The expansion into Netherlands would be an additional sales channel for Graze. The products would now be available at the physical stores. Graze can create a customer base in Netherlands. The brand familiarity among the customers of Netherlands would increase and work as an advantage for Graze. The customers of Netherlands seem to love the twist in flavours through application of fibre and plant protein in snacks. In Netherlands, Graze could also collaborate with Aldi, the second largest supermarket chainafter Albert Heijn(Feddema and Yen, 2019). This discount retailer is extremely popular in Netherlands and other European nations. There are several stores of Aldispread all across Europe, which offers easy accessibility to the products of Graze. A tie up with Albert Heijn and Aldi would offer Graze a huge customer base. The market in Netherlands is inclined towards low calorie foods. The evolution of the healthy food or snacks has created its own customer base in the country. The quick availability and the affordability of the healthy snacks in Netherlands has boosted the demand for healthy snacks. The market of Netherlands would offer scope for easy distribution of the products of Graze. The online platform could provide added advantagetoGraze along with the collaboration with Albert Heijn and Aldi. This would ensure higher revenue and sales, giving a tough competition to its competitors. The market demand in Netherlands is too high, thus, the products being physically sold at Albert Heijn and Aldisupermarkets would help Graze to capture an increasing market share. The advantage of selling through supermarkets also includes the high footfall at the supermarkets and discount stores (Mihaylova et al. 2022). As more people visit these top supermarkets, more customers are likely to know about Graze and purchase its products. The existing popularity of Albert Heijn and Aldiwould work to the advantage of Graze in Netherlands.

Global Trends and Their Application in the Local Environment

The two major global trends that are particularly relevant to brand positioning of Graze are as follows:

Health prioritization: Sugar diminishing and special diets

The significance of food in the form of medicine as well as preventive health has profited functional food, with individualstrying to improve their immune systemand keen to vigorouslydeal with their physical along with mental wellbeing. Mozaffarian(2020) stated that mobility of customers has largely reduced in addition to containment measures related to Covid19 as well as home seclusion. As a result, lifestyle diets that includes paleo, low-carb as well as keto has been thriving in this context that will be advantageous for Graze. The intake of sugar has also gradually reduced by individuals to remain healthy and avoid gaining weight. This trend is relevant to Graze as introducing high-quality savoury snack will increase profit for the company. The after effects of Covid19 has altered preferences of customers over the years (Riazi et al., 2019). Customers are desiring for a healthy lifestyle due to lengthy local lockdown. The increasing level of obesity in certain areas the preference of customers has been shifting towards healthier snacks that are wholesome as well as guilt-free.

In the year 2021, restricting sugar intake turned out to be a major medical recommendation by doctors. This particular trend has been emerging as an imperative aspect in Netherlands. Individuals are shifting their demand in snacks due to ease in restrictions. The residents of Netherlands have been impacted negatively due to Covid19, persuading the government to leave only negligeable restrictions in place as of March 2022 (Hilderink et al., 2020). Dutch customers are looking forward for snacks that contain low-fat and low-sugar. In the year 2022, the products on trail mixes, nuts as well as seeds showed no growth in volume.

Recommendations

Product: Beside providing healthy snacks, Graze should make sure that they provide something more flavourful as well as convenient to the customers.

Price: Graze should make the customers feel that they are paying a fair price while purchasing the products. The snacks should be healthier but at the same time it should be different from the one made by the competitors. This will attract more customers and make them feel that they are purchasing high-quality items at reasonable cost.

Hometainment and digitalization

Consumption of snackshas been shifting from out-of-home instinct to at-home indulgence. Circumstances under lockdown as well as work-from structure has shifted the preference of customers where they prefer having snacks while watching TV as well as streaming services. This trend is relevant to Grazeas providing online services will increase its business. The development of e-commerce has been one of the majorresults of the pandemic ((Saguy, 2022). As a result, Graze requires to are embrace the new digital ecosystem not only to upsurge sales, but also to comprehend and involve with customers.

In Netherlands, the number of individuals doing work-from home has increased. Due to Covid19, almost 42.5 percent has been doing work from home that in turn has increased at-home indulgence.

Recommendations

Place: It is recommended that the products should available online to attract more customers.

Promotion: The promotion that has been recommended includes promoting the products through social media as well as other online media platforms.

Segmentation, Target and Positioning (STP) strategy

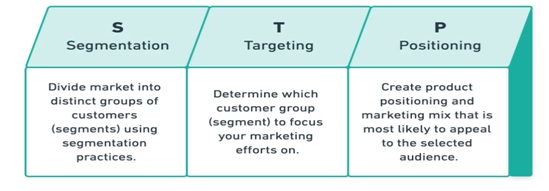

In Netherlands, the segmentation of snacks includes savoury snacks, salty Snacks, snack bars and confectionary. The geographic segmentation shows that Graze has almost 1.67 percent core audience in Netherlands. The demographic segmentation shows mostly 49.71 percent target audience are male whereas, 50.29 percent are females. The target market of snacks in Netherlands includes young adult women as well as men in addition to boys who are under the age of 16.Due to pandemic the demand for healthy snacks has also increased. The offline as well as online businesses are targeted in Netherlands to position the snacks products. Graze has mostly focused on global brand positioning that rolled out across geographies on every communication as a part of strategy (Wang et al., 2018). This includes website, PR, packaging, advertising as well as social media platforms.

(Source: Wang et al., 2018)

Country-Specific Communications

Marketing Channel

The marketing mix is a model which uses themarketing tools for pursuing the marketing goalsin the target market. There are mainly four P’s in the marketing mix, which include price, product, place and promotion (Morgan et al. 2019). Graze has to ensure that these P’s of marketing mix are aligned to the marketing objectives of the company in each of the two markets.

Products: Graze mainly offers its customers healthy snack products. The products to suit the needs of the customers of Netherlands, should introduce twisting flavours including healthy ingredients.

Price: There is demand for healthy snacks in Netherlands. However. The company has to set affordable prices for its products to capture larger market share and get more loyal customers.

Place: In Netherlands, Graze can start operating through supermarkets as well as online platforms. After expansion, Graze will start physical sales in Netherlands through Albert Heijn and Aldi. The company will sell its products in these supermarkets and retail stores.

Promotion: There are various modes of promotion. However, the target customers of Netherlands can be reached best through social media marketing, sponsoring sports events, offline traditional marketing, etc.

There are different marketing channels like free, paid, traditional and digital. Graze should resort to digital marketing for better reach and use paid promotional means. The company can use influencers of social media, paid ads, etc. to promote its brand (Kurdi et al. 2022). This will help Graze to educate the customers about healthier snacks, engage them in following healthy dietary routine and convert them from unhealthy snack consumers to health conscious consumers. They can further utilise affiliate marketing channels. This would help Graze to remain dynamic in the market. In affiliate marketing, Graze would compensate the third party partners for promoting its products and bringing good business (Desai, 2019). Graze could focus on affiliate marketing as well as social media promotions in Netherlands.

Social Media Communications

Social media communications are significant in both social promotions as well as affiliate marketing. The social media communication would facilitate Graze to interact with the customers, influencers and affiliate marketers. The information about the brand and its products could be shared easily through social media. The virtual customers’ community can get relevant information and exchange their ideas about the brand (Enke and Borchers, 2021). The social media communications would be shared through LinkedIn, Instagram, Facebook, YouTube and Twitter. In Netherlands, the paid promotions on Facebook and Instagramshould be used as social promotions. The affiliate marketing can also be facilitated through social media, digital modes and online platforms.

Conclusion

It can be concluded that the market entry strategy analysis for choosing the right entry mode is useful because it facilitates better growth and business. Graze needs to understand the culture, the market demand and the economic situations, in each of the two countries to plan their entry and operations in the foreign markets. The company will be able to identify the strengths of each market, its market scenario and communication channel, while acknowledging the threats of each market. The Netherlands has a market which offers a good future to Graze because the marketand its customers prefer good and healthy food. The advantage of having a ready customer base would be fostered when supported by supermarkets.

References

Desai, V., 2019. Digital marketing: A review. International Journal of Trend in Scientific Research and Development, 5(5), pp.196-200.

Enke, N. and Borchers, N.S., 2021. Social media influencers in strategic communication: A conceptual framework for strategic social media influencer communication. In Social Media Influencers in Strategic Communication (pp. 7-23).Routledge.

Hilderink, H., Plasmans, M.H., Poos, M.J.J.C., Eysink, P.E. and Gijsen, R., 2020. Dutch DALYs, current and future burden of disease in the Netherlands. Archives of Public Health, 78(1), pp.1-10.

Huitink, M., Poelman, M.P., Seidell, J.C., Kuijper, L.D., Hoekstsra, T. and Dijkstra, C., 2020. Can healthy checkout counters improve food purchases? Two real-life experiments in Dutch supermarkets. International Journal of Environmental Research and Public Health, 17(22), p.8611.

Kabisch, S., Wenschuh, S., Buccellato, P., Spranger, J. and Pfeiffer, A.F., 2021. Affordability of Different Isocaloric Healthy Diets in Germany—An Assessment of Food Prices for Seven Distinct Food Patterns. Nutrients, 13(9), p.3037.

Kurdi, B., Alshurideh, M., Akour, I., Alzoubi, H., Obeidat, B. and Alhamad, A., 2022. The role of digital marketing channels on consumer buying decisions through eWOM in the Jordanian markets. International Journal of Data and Network Science, 6(4), pp.1175-1186.

Mihaylova, D., Popova, A., Goranova, Z. and Doykina, P., 2022. Development of Healthy Vegan Bonbons Enriched with Lyophilized Peach Powder. Foods, 11(11), p.1580.

Morgan, N.A., Whitler, K.A., Feng, H. and Chari, S., 2019.Research in marketing strategy. Journal of the Academy of Marketing Science, 47(1), pp.4-29.

Mozaffarian, D., 2020. Dietary and policy priorities to reduce the global crises of obesity and diabetes. Nature Food, 1(1), pp.38-50.

Riazi, K., Raman, M., Taylor, L., Swain, M.G. and Shaheen, A.A., 2019. Dietary patterns and components in nonalcoholic fatty liver disease (NAFLD): what key messages can health care providers offer?. Nutrients, 11(12), p.2878.

Saguy, I.S., 2022. Food SMEs’ open innovation: Opportunities and challenges. Innovation Strategies in the Food Industry, pp.39-52.

Wang, L., Liu, Y., Wu, Z. and Alsaadi, F.E., 2018. Strategy optimization for static games based on STP method. Applied Mathematics and Computation, 316, pp.390-399.