Finance Assignment Case Analysis

Question

Question 1

(a) Biloela Resources (BR), a Queensland based mining company, is considering developing a copper mine in Brazil. It plans to use a subsidiary, Bahia Mines, to develop the mine. BR has a 90% share in Bahia Mines with the remaining 10% owned by the government of the state of Bahia. BR has completed exploration and feasibility studies and has spent the last few years in the process of acquiring permits to begin development. The proposed mine has “proven and probable reserves” of 50 million tonnes of copper. BR has so far spent USD 200 million and will need an additional USD 800 million to complete the developmental phase of the mine. The plan is to use open pit mining and use “heap leaching”, a process that involves using chemicals to extract copper from crushed ore. It is being considered because it is a low cost process with recovery rates of around 70%. The planned life of the mine is 20 years.

Given the recent Samarco disaster, in the nearby state of Minas Gerais, where the tailings dam at the iron ore mine burst resulting in the loss of lives and the pollution of the Doce river, local community interest groups have become more vocal in their opposition to the mine. These local stakeholders have raised concerns about the potential damage to the tourism sector and to the environment if the use of cyanide contaminates aquifers.

BR estimates that the mine will create jobs and inject billions of dollars into the Brazilian economy and over $2 billion directly to the treasury of the state of Bahia. However, BR is concerned about this escalating political issue affecting its stock price and the chances of final approval for the project. Given its declining cash reserves it is keen to get started on the developmental phase of the project. The NPV approach indicates that the mining project has a positive valuation and this value is robust to sensitivity analyses done utilizing various key inputs such as cost of capital, royalties paid to the state of Bahia, quantity of reserves, price of copper etc. Despite this upbeat assessment, BR is concerned about its financing needs. The project is currently funded entirely by equity. Its stock is currently trading at around 75 cents.

How can Bahia ensure it receives the final approval for the mine? If the project is approved, what do you believe, based on understanding of the benefits/costs of various types of financing, is the best way to finance its CAPEX needs?

(b) In March 2020, the Australian Treasurer announced that the Foreign Investment Review Board (FIRB) would assess all foreign proposals to acquire Australian firms. He said in a statement that “These measures are necessary to safeguard the national interest as the coronavirus outbreak puts intense pressure on the Australian economy and Australian businesses.” (Reuters March 30, 2020). Evaluate the argument that the Australian government should impose restrictions because a depreciation of the Australian dollar offers a significant financial advantage to foreign bidders for Australian firms/assets. (5 points; 250 words)

(c) Suppose the Australian dollar is worth €1.6372. If the one year Euro bonds are yielding 9.8% and the one year Australian Treasury bonds are yielding 6.5%, at what end-of-year exchange rate will the dollar returns on the two bonds be equal? What amount of appreciation or depreciation of the Euro does this exchange rate at the end of the year represent?

Question 2

Assume Isuzu produces a car in Japan for ¥1.8 million. On June 1, when new models are introduced, the exchange rate is ¥150/USD. Consequently, the automaker sets the sticker price for the car at USD 12,000. By August 1, the exchange rate has dropped to ¥125/USD. Isuzu is worried that it will receive fewer Yen per sale ($12,000 × 125 = ¥1.5 million).

1. (a) What scenario(s) could explain the trajectory of the exchange rate?

2. (b) What alternative options does Isuzu have to mitigate the effect of exchange rate changes?

3. (c) What strategy would you recommend for this car company?

4. (d) Suppose the Bank of Japan intervenes in early October to push down the value of the Yen which subsequently moves to ¥225/USD. What problems and/or issues does it present for Japanese and American car companies?

Question 3

You have landed a coveted internship at a prestigious money manager in Singapore. For your first assignment your supervisor has asked you to do the calculations needed to convince a valued client on the benefits of international diversification. You have been assigned this task instead of the other intern, because of your impeccable understanding of the principles of finance, especially that of diversification and the role that of currencies play in international investments.

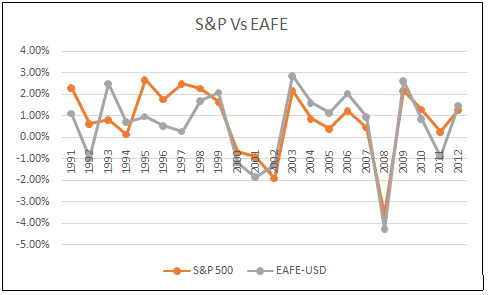

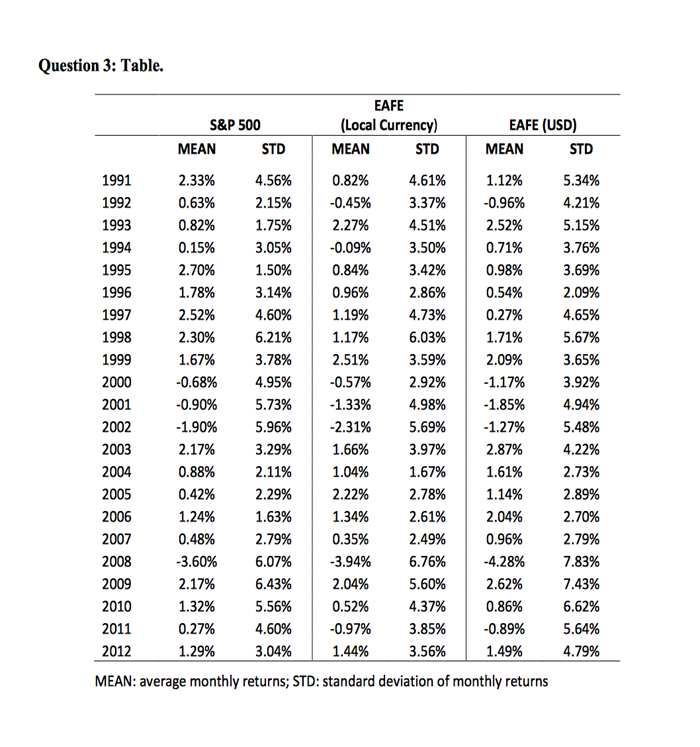

The data given to you in the following table (on the next page and the CSV file) contains the average monthly returns and standard deviations for the S&P 500 index (in USD) and, EAFE index (in Local currency and USD) for the period 1991 to 2012.

The correlation between S&P 500 and the EAFE (Local currency) over the entire period is 0.7927 (for local currency). The correlation between S&P 500 and the EAFE (USD) over the entire period is 0.7805. You are asked to present three computations:

1. (a) The currency effect of investing in these market indices over the entire period.

2. (b) Risk and performance of the indices over the entire period.

3. (c) Graphically depict the benefits the investor derives from investing in these market indices (S&P 500 and EAFE) assuming both are denominated in USD. You should show your workings.

Formatting suggestion: This graph may be generated using a spreadsheet program or other software. If you hand-draw the graph, take a picture of the graph and insert the gif/jpeg file into your submission document before converting it into a PDF file.

Answer

Answer-1 (a)

In regards to the approval of the project examined in this finance assignment, the most concerning issue is the impact on the environment and the society. The local people from Bahia has raised concerns over this mining project as it is anticipated that this project may damage the environment by causing water pollution and it may also endanger the lives of the people. However, the positive side of the project is its strong economic feasibility. The project is expected to enhance the jobs in the local area as well as it would contribute to the state in the form of taxes a huge sum which could be used for betterment of the society. It is estimated that this project would directly add $2 billion to the treasure of the government of Bahia. Further, the results of feasibility study also reflect soundness of the project and good possibilities of its being implemented successfully. Therefore, the company can put the positive side of the project in front of the stakeholders to get it approved.

Regarding financing of the project done within this finance assignment, it is being observed that the project is currently financed by equity solely. Financing in this way does not seem to be proper. The financing through equity is always the most costly option. On the other hand, it reduces the owner’s power and stake which could be detrimental to the decision making process with more people coming in power. The company should use debt as an alternative for financing the project. The use of debt increases leverage which reduces the cost of debt. Thus, debt is probably the least expensive source of finance. The only problem with raising debt is that it increases the risk of solvency. However, Biloela Resources (BR) is an established company with low debt and hence it can raise debt without giving rise to the risk of solvency. Apart from this, the company can also think of using a mix of debt and equity for financing the project. In this case of finance assignment, the risk and return both the things can be managed.

Answer-1 (b)

As part of temporary measures to fight with the economic downturn due to corona virus outbreak, the Australian treasurer has announced changes in the foreign investment framework. The aim of these changes discussed in this finance assignment is to prevent the sale of Australian firms to the foreign investors at cheaper rates due to devalued Australian currency. The Australian dollar is at decline and hence it creates the opportunities for the foreign investors to buy business in Australia at cheaper rates. Thus, the rules and regulations in terms of acquiring an Australian firm would be more stringent now. For instance, now an application has to be made to FIRB (foreign investment review board) regardless of any monetary limit. Each and every acquisition has to be approved by FIRB. Further, the statutory review period has been increased from 30 days to 6 months.

The primary reason for making the rules and regulations more stringent is to stop the inflow of foreign investment. If the inflow of foreign investment does not stop, it will impact the Australian economy adversely.

Answer-1 (c)

The end of year exchange rate is as under:

|

Spot rate |

€ 1.6372 |

|

Rate on Euro bonds |

9.80% |

|

Rate on Australian Treasury bonds |

6.50% |

|

|

|

|

1 year Forward rate: |

1.68793 |

|

1.6372*(1+9.8%)/(1+6.5%) |

|

The Australian dollar has appreciated and the amount of appreciation is as under:

|

Appreciation in AUD |

3.10% |

|

(1.6879-1.6372)/1.6372 |

|

Answer-2 (a)

The foreign exchange rates keep changing on a daily basis and this movement in the foreign exchange rates brings the exposure for the firms dealing in the cross border transactions. There are many factors that cause changes in the foreign exchange rates such as interest rates, inflation rate, export and import policies etc. The rise in the interest rates would cause the devaluation in the home currency and hence the foreign exchange rate would increase. Similar analogy is applicable to the inflation rate. In the current case of finance assignment, Isuzu is a car maker in Japan which is considering exporting car to a US dealer. The company would bill the car for USD 12,000. Currently, the foreign exchange rate for YEN/USD is ¥150/USD which is anticipated to drop to ¥125/USD in future. Thus, the company stands at the risk of losing money on account of decrease in the foreign exchange rate. At the current rate, the company would receive ¥1.8 million while if the rate decrease, the company would receive only ¥1.5 million which would result in a loss of ¥0.30 million.

Answer-2 (b)

As explained above within this finance assignment, Isuzu would be bearing the risk of losing money in the foreign exchange transactions if it is not hedged properly. The risk of loss due to adverse movements in the foreign exchange rates can be mitigated through various hedging strategies. For this purpose, there are many tools or techniques that can be employed by a firm. For instance, there are derivative contracts which can be used by Isuzu to hedge this risk. The derivative contracts are available in the form of options and future contracts. The option contracts can be used both ways either to sell the foreign currency or to buy. There are two types of options contract noted in the finance assignment namely call and put which entitle the holder of the option contract to buy and sell foreign currency respectively. In the current case, the company would receive the foreign currency (USD) in the form of sale consideration of the car. Thus, the company would sell the received foreign currency. Hence, it can go to opt the put option. Further, there is future contract in which the company can fix the rate of foreign currency which will be exchanged in future at the agreed rates. Apart from these two mentioned within this finance assignment, there are forward rate agreements and money market hedge tools also available. The forward rate agreement is done with the bank to lock in the foreign currency rate for future transaction. Thus, the company can enter into a forward rate agreement with the bank to lock the rate at ¥150/USD. The bank would convert the USD to Yen at this rate in future regardless of the fact that the foreign exchange rate has fallen down to ¥125/USD. In the money market hedge, the company can create payables in USD as it has receivables in the US. The maturity period of payment of payables should match with the time of payment from receivables. The loss on receivables would compensate the profit on payable and hence in this way the company can safeguard itself from the foreign exchange loss.

Answer-2 (c)

As Isuzu is at the risk of losing money due to adverse movement in the foreign exchange rates of Yen/USD thus it should adopt a hedging strategy. The company has receivables in USD against the card sold to a US based customer. The risk herein finance assignment is of decrease in the rate of USD against Yen. If the rate of USD against Yen decreases, the company would incur a loss. There are anticipations that the rate of Yen/USD would fall from 150 to 125 which signify that the company is exposed to the risk of loss due to adverse move in the foreign exchange rate.

As part of hedging strategy, it is recommended for the company to go for forward rate agreement or money market hedge. The forward rate agreement is done with the bank in which the bank would agree on to fix the rate of Yen and USD exchange in the future time period. The company would fix the rate at ¥150/USD and the bank would give Yen to the company at this rate in future when company gets its money back from the customer. Now, even if the rate drops to 125, it would not affect the amount of yen to be received by the company.

Another strategy illustrated within this finance assignmentwould be hedge through money market instruments. In this scenario, the company would create payables in USD by raising loan from there. The loan amount in USD would be converted to Yen at the spot foreign exchange rate and then this converted amount would be invested in Japan. The period of investment would be same as the credit period allowed to the customer. The company would receive the invested amount after the stipulated period time in the local currency from the bank. On the other side, it would have loan and interest outstanding on it payable to the bank in USA. This USD amount of payable and receivable would get squared off at the transaction date.

Answer-2 (d)

In the present case scenario of finance assignment, the bank of Japan has made efforts to devalue the Japanese currency against USD which means that export to USA would be beneficial and imports from there would be expensive. The rate now has jumped to ¥225/USD. The payment in USD would be expensive now thus, the car makers in Japan would face rise in the cost of cars if raw material is being imported from the USA. However, the car exports to USA would be beneficial. For the American Car companies, the imports from Japan would become cheaper and the export of cars to Japan would be expensive.

Answer-3 (a)

In order to know the currency impact, comparison can be made between local currency and foreign currency returns and risk data herein finance assignment. The local currency returns on EAFE index for the overall period of 22 years is 0.49% per annum with standard deviation of 3.99%. While the USD returns on this index is 0.60% with standard deviation of 4.55%. Thus, the foreign currency return is higher than the local currency return. The impact of foreign currency on the return of the index is positive. But at the same time, it has also give rise in the risk (standard deviation), the standard deviation has risen up from 3.99% to 4.55%.

Answer-3 (b)

The risk is measured by standard deviation and performance is measured by returnswhich can be taken as mean return over the period time. The risk and performance of the indices discussed in the finance assignment are as follows:

|

|

S&P 500 |

EAFE (Local currency) |

EAFE (USD) |

|||

|

|

Mean |

STD |

Mean |

STD |

Mean |

STD |

|

1991 |

2.33% |

4.56% |

0.82% |

4.61% |

1.12% |

5.34% |

|

1992 |

0.63% |

2.15% |

-0.45% |

3.37% |

-0.96% |

4.21% |

|

1993 |

0.82% |

1.75% |

2.27% |

4.51% |

2.52% |

5.15% |

|

1994 |

0.15% |

3.05% |

-0.09% |

3.50% |

0.71% |

3.76% |

|

1995 |

2.70% |

1.50% |

0.84% |

3.42% |

0.98% |

3.69% |

|

1996 |

1.78% |

3.14% |

0.96% |

2.86% |

0.54% |

2.09% |

|

1997 |

2.52% |

4.60% |

1.19% |

4.73% |

0.27% |

4.65% |

|

1998 |

2.30% |

6.21% |

1.17% |

6.03% |

1.71% |

5.67% |

|

1999 |

1.67% |

3.78% |

2.51% |

3.59% |

2.09% |

3.65% |

|

2000 |

-0.68% |

4.95% |

-0.57% |

2.92% |

-1.17% |

3.92% |

|

2001 |

-0.90% |

5.73% |

-1.33% |

4.98% |

-1.85% |

4.94% |

|

2002 |

-1.90% |

5.96% |

-2.31% |

5.69% |

-1.27% |

5.48% |

|

2003 |

2.17% |

3.29% |

1.66% |

3.97% |

2.87% |

4.22% |

|

2004 |

0.88% |

2.11% |

1.04% |

1.67% |

1.61% |

2.73% |

|

2005 |

0.42% |

2.29% |

2.22% |

2.78% |

1.14% |

2.89% |

|

2006 |

1.24% |

1.63% |

1.34% |

2.61% |

2.04% |

2.70% |

|

2007 |

0.48% |

2.79% |

0.35% |

2.49% |

0.96% |

2.79% |

|

2008 |

-3.60% |

6.07% |

-3.94% |

6.76% |

-4.28% |

7.83% |

|

2009 |

2.17% |

6.43% |

2.04% |

5.60% |

2.62% |

7.43% |

|

2010 |

1.32% |

5.56% |

0.52% |

4.37% |

0.86% |

6.62% |

|

2011 |

0.27% |

4.60% |

-0.97% |

3.85% |

-0.89% |

5.64% |

|

2012 |

1.29% |

3.04% |

1.44% |

3.56% |

1.49% |

4.79% |

|

Average |

0.82% |

3.87% |

0.49% |

3.99% |

0.60% |

4.55% |

Herein finance assignment, the average return over the period of 22 years on S&P 500 is 0.82% with standard deviation of 3.87%. As compared to this, the USD returns on EAFE is 0.60% with standard deviation of 4.55%. The return on S&P 500 is higher than EAFE and the risk is also lower. Thus, S&P 500 is superior in terms of risk and return.

Answer-3 (c)