Financial Management Assignment: Financial Position Analysis OfNovartis pharmaceutical company

Question

Task: Financial Management Assignment Task You are an investment analyst in a new brokerage firm. The firm is interested in adding a new investment to its current portfolio of equity investment offerings and has decided to examine an entity that operates in the pharmaceutical industry. You have been asked by your supervisor to prepare an analytical review of the financial position of a company with a view to making a recommendation on whether an equity position should be taken in the potential investment.

Your analytical review report may address the following:

-An examination of the common sized Income Statements for the most recent two (2) years/periods. Observations should be made as it relates to three (3) major expenses and their impact on the firm’s profitability in each of the (two) 2 years under review.

-An examination of the common sized Balance Sheets for the most recent two (2) years/periods. Observations should be made as it relates to the two (2) major elements in the asset category and the liabilities category for each of the two (2) years under review.

-Analysis of the financial strengths and weaknesses revealed by key ratio categories (profitability, liquidity, asset management/utilization and leverage) for the most recent two (2) years/periods. Three (3) ratios (at a minimum) should be presented in each of the previously mentioned categories.

-A review of the capital market perception (i.e. stock price) of the company and its price performance for the periods under review and any other measures deemed relevant by you, the analyst. The principal focus of the report should be on the financial analysis and the strengths and weaknesses it reveals. Your work should focus on financial issues and be grounded in the published financial reports provided. Note that while it is impossible to entirely separate the financial aspects from the strategic and wider management issues of the firm, the primary focus of the assignment remains financial. You may use other information that is publicly available as long as you appropriately acknowledge the sources of the information. This is more an exercise in using financial information intelligently rather than simply performing calculations. The overall aim of the assignment is to show your understanding of the key issues which financial analysts find significant in carrying out a financial review of the performance and financial position of a business. The assignment emphasises the application of the analytical techniques you have studied and shows how financial information can be used to aid decision making primarily by investors.

Answer

Introduction

The report on financial management assignment presents an analytical review of the financial position of the organisation i.e. Novartis pharmaceutical company, and providing recommendations upon the equity position that can be taken in the potential investment. The report includes an examination of the common-sized Income Statements for the last two years, and the three major expenses which are observed are stated in the report. Based on the impact upon the profitability of the two years, the review of Novartis Pharmaceutical Company is provided. In the next part of this report, based on the examination of the common-sized Balance Sheets for two years, observations are made with the two major elements upon the asset category and liabilities category which is for the tenure of two years. Further, an analysis of the financial strengths and weaknesses by key ratio categories which includes profitability, liquidity, asset management/utilisation, and leverage for two years, in which a minimum of three ratios are presented for the categories that are mentioned. Lastly, a review of the capital market perception of Novartis Pharmaceutical Company which includes stock price and price performance for that period is presented.

An examination of the common sized Income Statements for the most recent two years

The common size analysis can be also termed vertical analysis and is considered as a tool that helps in analysing financial statements. Using the analysis, it will evaluate the financial statement by expressing the item as per the percentage of the base amount for that period. Through this analysis, it will help in understanding the impact of financial statement.

In Millions of USD except Per Share

|

In Millions of USD except Per Share |

|

|

|

|

|

12 Months Ending |

312/2019 |

31/12/2020 |

Year 2019 |

Year 2020 |

|

Revenue |

49,039.00 |

50,172.00 |

100.00% |

100.00% |

|

+ Sales & Services Revenue |

47,498.00 |

48,659.00 |

96.86% |

96.86% |

|

+ Other Revenue |

1,541.00 |

1,513.00 |

3.14% |

3.14% |

|

- Cost of Revenue |

13,930.00 |

14,400.00 |

28.41% |

28.41% |

|

+ Cost of Goods & Services |

11,533.00 |

11,465.00 |

23.52% |

23.52% |

|

+ Depreciation & Amortization |

2,397.00 |

2,935.00 |

4.89% |

4.89% |

|

Gross Profit |

35,109.00 |

35,772.00 |

71.59% |

71.59% |

Table 1: Common size income statement

(Source: As given in the Annual Report)

Analysis of revenue for Novartis Pharmaceutical Company

The Novartis Pharmaceutical Company income statements in the table are provided above for the years 2019 and 2020. Firstly, from the common size income statement, it can be observed that there is an increase in sales and service revenue. By looking at the statement, it can be seen that the sales have changed from 47,498 to 48,659.

In Millions of USD except Per Share

|

+ Other Operating Income |

497 |

329 |

1.01% |

1.01% |

|

- Operating Expenses |

24,131.00 |

23,574.00 |

49.21% |

49.21% |

|

+ Selling, General & Admin |

14,319.00 |

14,093.00 |

29.20% |

29.20% |

|

+ Selling & Marketing |

14,319.00 |

14,093.00 |

29.20% |

29.20% |

|

+ General & Administrative |

0 |

0 |

0.00% |

0.00% |

|

+ Research & Development |

8,436.00 |

8,548.00 |

17.20% |

17.20% |

|

+ Other Operating Expense |

1,376.00 |

933 |

2.81% |

2.81% |

|

Operating Income (Loss) |

11,475.00 |

12,527.00 |

23.40% |

23.40% |

|

- Non-Operating (Income) Loss |

184 |

610 |

0.38% |

0.38% |

|

+ Interest Expense, Net |

605 |

778 |

1.23% |

1.23% |

|

+ Interest Expense |

850 |

869 |

1.73% |

1.73% |

|

- Interest Income |

245 |

91 |

0.50% |

0.50% |

|

+ Other Investment (Inc) Loss |

-12 |

-18 |

-0.02% |

-0.02% |

|

+ Foreign Exch (Gain) Loss |

0 |

0 |

0.00% |

0.00% |

|

+ (Income) Loss from Affiliates |

-659 |

-673 |

-1.34% |

-1.34% |

|

+ Other Non-Op (Income) Loss |

250 |

523 |

0.51% |

0.51% |

Table 2: Company analysis based on the financial information

(Source: As given in the Annual Report)

From the above statement, it can be observed that the cost of goods sold for the organisation has increased from the year 2019 to 2020. The cost of goods sold do includes direct labour cost and cost of direct materials which are used in process of production. The reason behind the increase in the cost of goods sold is due to an increase in sales. As per the common size income statement, it displays that there is an increase in the percentage of the cost of goods sold which indicates the cost for both purchase and direct expenses has increased. Through this, it suggests that the Novartis Pharmaceutical Company is providing quality material at the time of production and lowering the direct expenses.

In terms of non-operating expenses, which include the interest expense is paid upon the organisational debt. From the income statement, it can be seen that there is an increase of deprecation it can be assumed that the Novartis Pharmaceutical Company has purchased new fixed assets and debt financing is used. In terms of net profit, there is a decrease from the year 2019 to 2020. As per the analysis, it can be considered as an impulsive decline for tenure in one year and the shareholder of Novartis Pharmaceutical Company will question the management about the wrongdoing. Management must handle the situation to increase the COGS, including the administrative expenses and increase of sales cost.

Three major expenses and their impact on the firm’s profitability in each of the two years

The company has gone through several operations and activities within the last few years. In this section some of the major activities have shown that has huge contribution to the profitability of the company. in 2011 the company has acquired Alcon inc for 52 billion., this has a huge contribution in today’s financial position of the company. However, the company is now operating as a standalone company. in 2019 Novartis company’s shareholders gets a part of the dividend that is 4691 million. Also, the company has spent a huge part of their operating expenses on research and development (Finance.yahoo.com. 2021). Near about 1.9% of their operating expenses reported as research and development expenses. This also has a huge contribution to the profitability of Novartis. On an average $3426 million has incurred by the company as an operating expense. This operation has helped the company to increase their functional smoothness as well as profitability.

Analysis of the financial strengths and weaknesses by key ratio categories for two years

|

Profitability ratio |

2019 |

2020 |

|

Gross profit ratio |

70.37% |

69.70% |

|

Net profit ratio |

24.10% |

16.18% |

|

Return on equity |

21.15% |

14.26% |

Table 3: Profitability ratio analysis

(Source: As given in the Annual Report)

All the above mentioned ratios can be used to show the profitability of the company. After the calculation it can be seen that the company has a good profitability position. Gross profit and the net profit and the net profit of the company are very high. As the cost of revenue and many others operating cost are comparatively low, helps the company to generate higher revenue for the past two years (Nalurita, 2017). However, from the above table it can be seen that the profitability performance of the company has reduces as compare to the past year, suggests a deprivation of the performance. Return on equity is also become low as compare to the past year. Here the company needs to improve their profitability to keep, their previous financial position.

|

Liquidity ratio |

2019 |

2020 |

|

Current ratio |

1.04 |

0.90 |

|

Quick ratio |

0.83 |

0.68 |

|

Cash ratio |

0.40 |

0.34 |

Table 4: Liquidity ratio analysis

(Source: As given in the Annual Report)

Liquidity ratio is the ratio that shows the financial sphere or the operational efficiency. If they have proper liquidity, then they can freely operate their business and also they will be able to mitigate any kind of uncertain risk. All the liquidity measuring ratios are suggesting that the company has lower liquidity. They have to increase the liquidity to face any uncertain risk (Fatimah, Toha&Prakoso, 2019). Cash ratio is also lower than the industry standard. It can be mentioned that the company’s liquidity position is weak; they have to struggle to pay any short-term debt obligations.

|

Liquidity ratio |

2019 |

2020 |

|

Current ratio |

1.04 |

0.90 |

|

Quick ratio |

0.83 |

0.68 |

|

Cash ratio |

0.40 |

0.34 |

Table 5: Assets management of Novartis AG

(Source: As given in the Annual Report)

The above table is showing the financial ratios that the company’s operating efficiency in managing their company assets in generating higher revenue. Inventory turnover ratio is 2.41 and 2.12 times in the last two previous years. The value of the ratio suggests that the company is unable to use the inventory in generating revenue. If the value increases, then they gave to incur lower cost for maintaining stock. Similarly, the receivable turnover ratio is also comparatively low. However, the value of the ratio has increased as compare to the past year. It’s a value adding factor to the company. Nonetheless, the assets turnover ratio is also too low for the company. As the value of the ratio is too low, suggest that the company is not that efficient in utilisation of assets (Afrino&Erni, 2019).

|

Leverage ratio |

2019 |

2020 |

|

Debt to equity ratio |

79.52% |

98.87% |

|

Debt capital |

44.30% |

49.71% |

|

Debt to total assets ratio |

37.27% |

42.37% |

Table 6: Leverage ratio analysis

(Source: As given in the Annual Report)

As mentioned by Pedrosa (2019), leverage ratios are also used to show the financial health, that is strength and weakness of a company. Debt and equity ratio of the company is too high, suggests that, lower part of the capital is financed from debt capital. Hence it has a lower capital risk. Debt ratio is also a leverage ratio, used to check the capital adequacy. In the entire capital formation, the company is using less debt capital. However, their percentage of use of debt capital to the overall capital is very near to a standard form.

Dent to total assets ratio is the ratio used to show the contribution of a company’s shareholders in the total assets of the company compared to the total debt (Fatimah, Toha&Prakoso, 2019). Standard value of the ratio lies 40 to 60. As in the mentioned company, the value of the ratio is lower side suggests a better condition or the most of the portion of the assets are financed by the shareholder’s fund.

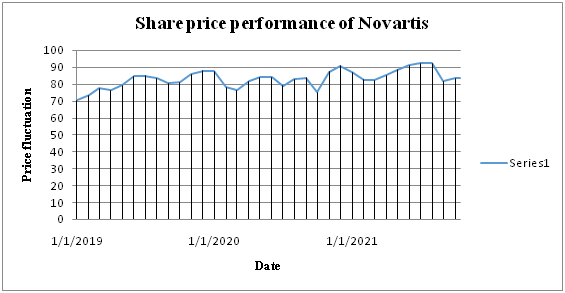

A review of the capital market perception

Novartis AG is a company, manufactures pharmaceutical products. Market capital of the company is 187.28billion at present. Current market value of each share is 76. Price earnings ratio of the company is 21. Generally, the value of the ratio remains at 23 considered as good. Here the current value of the ratio is comparatively good. Price to book value of the stock is 3.45. price to book value of the ratio is very poor (Bloomberg.com, 2021). The value of the ratio suggest lower price of the company assets as compare to the share price and net worth. Hence the value of the share is comparatively overpriced.

Price-performance for the periods

Figure 1: historical share price performance of Novartis

(Source: Finance.yahoo.com, 2021)

The above chart is showing the change in share price for the last 3 years of the company stock. Stock price of Novartis lies from 72 to 92. Very low-price volatility can be seen to the price of the stock. In the 2nd quarter of the current year, the company has the highest increase in the price for the last 3 three years (Finance.yahoo.com. 2021). Thus, the company’s shareholders can expect a handsome rate of dividend. This will help in increasing their goodwill. Also, investment in this stock or inclusion in a portfolio will reduce risk as the price volatility is too low.

Conclusion

After the financial analysis of the company, their financial performance and the financial position can be analysed. Some of the financial factor makes the company efficient. However, the operational and functional efficiency of the company is poor. The company has to increase their efficiency in using assets to generate more revenue and income. Also, the market performance of the company is average. The company stock has not higher efficiency in generating profit to their shareholders. However, from the financial statement of the company it can be seen that profitability of the company is high, nut the share price and the return rate are comparatively low.

Reference list

Afrino, J., &Erni, M. (2019). Effect of Profitability Ratio, Solvency, Market Ratio, Andrisk Ratio on Stock Return. Volume, 97, 602-606. https://www.atlantis-press.com/article/125918399.pdf

Bloomberg.com. (2021). Bloomberg - Are you a robot. Retrieved 16 October 2021, from https://www.bloomberg.com/quote/NOVN:SW

Fatimah, F., Toha, A., &Prakoso, A. (2019). The Influence of Liquidity, Leverage and Profitability Ratio on Finansial Distress:(On

Real Estate and Property Companies Listed in Indonesia Stock Exchange in 2015-2017). Financial management assignmentOwner: RisetdanJurnalAkuntansi, 3(1), 103-115. http://owner.polgan.ac.id/index.php/owner/article/view/102

Finance.yahoo.com. (2021). Yahoo is now a part of Verizon Media. Retrieved 16 October 2021, from https://finance.yahoo.com/quote/NVS/financialsp=NVS

Nalurita, F. (2017). The effect of profitability ratio, solvability ratio, market ratio on stock return. Business and Entrepreneurial Review, 15(1), 73-94. https://www.trijurnal.lemlit.trisakti.ac.id/ber/article/view/2080

Pedrosa, Í. (2019). Firms’ leverage ratio and the Financial Instability Hypothesis: an empirical investigation for the US economy (1970–2014). Cambridge journal of economics, 43(6), 1499-1523. https://academic.oup.com/cje/article-abstract/43/6/1499/5475942