Information Technology Assignment: Current Regulatory Framework for Blockchain

Question

Task: Write a well-researched information technology assignment critically evaluating the strengths and weaknesses of the current regulatory framework for blockchain, with reference to two blockchain use cases.

Answer

Introduction

It is evident herein information technology assignment that currently, Blockchain technology acquires a number of public considerations as activists disagree that it represents the base for strictly trust-free financial dealings based on its exceptional features of the technology. This technology is beyond the most trending technologies and argued to disrupt several services of an intermediary. It gained fame as the technology fundamental Bitcoin but at present, it is growing to other application areas. Similarly, scholars are creating comparable between blockchain technologies and, for illustration, bubble memory concerning their innovative impact on business, recalling that bubble memory also never existed to the assumptions related to it. A number of scholars state the generally articulated matters that blockchain technology is a modern technology seeking for use cases. Though having great opportunities, currently, there is a lack of knowledge concerning how and where blockchain technology is efficiently executed and where it can generate mentionable communal effects.

However, the overall research paper is based on the Technology and Law, wherein a critical evaluation of the current regulatory framework of Australia for blockchain has been discussed with reference to two blockchain use cases.

Conceptual Background of BlockChain

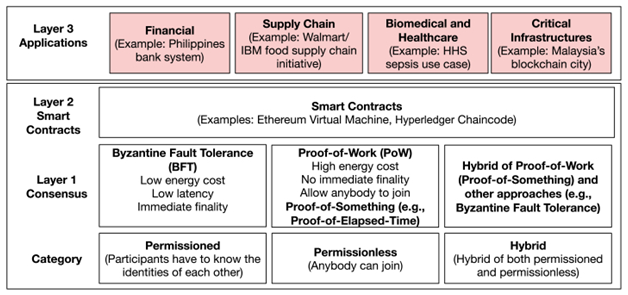

Blockchain is the technology that is generally utilized by the developers of cryptocurrencies, such as Bitcoin, to allow economic exchange coins among part takers in the absence of a loyal third party to make sure the transaction, such as is normally lead by the governments. Blockchain has developed to become a standard approach to accumulate and practice information in an advanced decentralized and protected method. All blockchains function to create decentralized nodes acquire a contract on the overall transaction order through cryptography and a fundamental agreement mechanism. Theoretically, blockchains commonly fall into one of two groups: permissioned or permissionless. Blockchains of permissionless enable any individual to take part, are said to be open, and have conviction delivered by algorithms. In comparison, blockchains of permissoned are generally consortium or private and all part takers' individualities are recognized but no participant requires to be confidential. In contrast, modifications exist where there is no evident line between different kinds of blockchains. For example, an in general block chain of permissionless called Ethereum can be installed as a private blockchain, which is known as the Ethereum private network. Efforts have also been formed to meet anonymity for permissioned blockchains .

Fig 1- Blockchains Overview

Sources-

Blockchain can be preoccupied into three distinct layers that have been shown above in the given figure. At the middle of blockchain in layer 1: it has shown the BFT consensus, which is generally known as replication of state machine and said to be a generic approach to manage the downfalls. BFT consensus has distinct forms that level from the protocols of conventional BFT to a consensus that is based on POW. Though basic differences in how consensus is acquired, any form should solve similar issues; how to allow nodes to meet consensus on the overall order that is the consistency of transactions submitted by clients in the request forms. When nodes meet a consensus concerning the order, the transaction operations are then processed as per the transactions. Consequently, allocated nodes functionally perform when there was one centralized node. This makes sure that there is only a single client transaction chain; hence, it is called the longest chain. Thus, considering the above figure, the blockchain layer 2 is the smart contract that is fundamentally a code of the software. A smart contract delivers an interface for the developers of blockchain to execute the transactions of a business. Also, it can be considered as a program that links the fundamental consensus protocols with the applications and uses cases of layer 3.

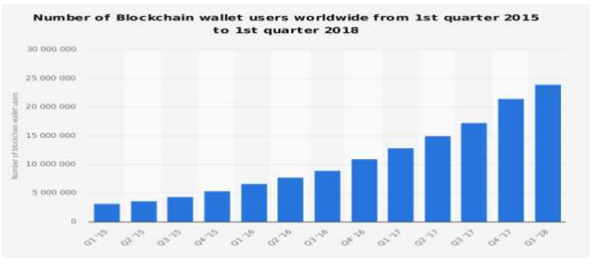

Fig 2- Number of Blockchain wallet users worldwide from 2015 to 2018

Sources-

Current Legal Framework of BlockChain in Australia

As per the research, it has been found that there is no particular or specific regulation that deals with blockchain technology or other distributed ledger technology in Australia. While there have been regulative amendments to put up the uses of cryptocurrencies and these have predominately determined on the transactional associations, for example, the process of issuing and exchanging and acts that involve cryptocurrencies instead of the cryptocurrencies themselves . The Australian Government has not considerably got involved in cryptocurrencies and associated acts; there has been a common explanation of the Australian regulatory rules to the sector. For instance, the Australian Government passed the Act in 2017 called the Anti-Money Laundering and Counter-Terrorism Financing Amendment (AML/CTF Amendment Act) that brought tokens and cryptocurrencies within the regime of anti-money laundering scope. This identified the movement towards digital currencies becoming a trendy way of paying for goods and services and shifting the value in the Australian financial system, yet also posing a considerable risk of terrorism finances and money laundering.

According to the research, it has been found that a key regulatory challenge for privacy and blockchain systems in Australia is required to meet the terms of the Privacy Act 1988. Because of the blockchain decentralized nature, there is often no liable part to figure out the solution from if privacy is violated and there are no other ways to eradicate personal information from the ledger when entered . Hence, two case study has been discussed below, wherein it will focus on the implementation of new regulations for DCE providers functioning in Australia and the investing in the Smart IP rights developments.

Regulation of AUSTRAC (Australian Transaction Reports and Analysis Centre) digital currency exchange provider- AUSTRAC applied new regulations for DEC (Digital Currency Exchange) providers functioning in Australia in April 2018. The laws of anti-money laundering and counter-terrorism financing (AML/CTF) control service providers who exchange cryptocurrencies that include bitcoin, for fiat currency, which is a legal tender and inversely . All the providers of DEC execute systems and controls that can reduce the criminals' risk by utilizing them for finance terrorism, money laundering, and severe financial crime that includes cybercrime. As per the research, it has been found that Australia was one of the first nations all around the world to introduce the regulations of AML/CTF for DCEs . Adams (2019)states that the laws have been granted by the providers of DCE, and serving to improve loyalty in cryptocurrencies and the same legislation is now being initiated around the globe. AUSTRAC is giving more emphasis on the observance of DCE providers and will endure examining the risks related to cryptocurrencies.

IP Australia Smart Trademark- IP Australia is financing in the Smarts IP rights development starting with the Smart Trade Mark. The rights of Smart IP are an intellectual property digital representation- an international first for IP offices, Hence, these can be practiced online to help in the avoidance of malicious and misuse behavior such as counterfeiting and passing-off. All these things are done through making a link between IP exact holders on the register of official IP and online services or digital or products that draw on the rights. The rights of Smart IP can make a data thread referring to the holders of IP, involving where it has been digitally used, authenticating who the official holder is, and delivering the data of bibliographic such as the picture on their right.

However, it can be said that fundamental standards for blockchain are important as the technology advances. Currently, there is a lack of interoperability among the platforms of blockchain, and several will need replacement in the coming future to stay competitive and to prevent security issues and obsolescence. Standards for blockchain will progress the confidence of the market and promote the blockchain systems through comprehensive rollout. According to the study, it has been identified that in order to figure out the issues, the Government of Australia contributes $350,000 to Standards by ISO. In 2016, on behalf of Australia, Standard Australia presented a proposal to the ISO in order to form a new technical committee of ISO for the topics of blockchain standards, including privacy, terminology, interoperability, security, and auditing. The Technical Committee of ISO 307, Blockchain and Distributed Ledger Technologies was formed as a consequence of Australia's leadership, and Standard Australia organizes the secretariat of the committee. Currently, the Technical Committee of ISO 307 is improving the standards of blockchain on the main subjects.

Evaluation of Strengths and Weakness of Blockchain Uses in Capital Market

Strengths

The current Cryptocurrency and Blockchain Regulation of 2021 proposed by the Australian government have changed the financial regulation, taxation, sales processes and money exchange operations. The implementation of such a framework has promoted and encouraged the industrial sectors and organizations to adopt Blockchain for business transformation, influencing markets and investment opportunities. The enactment of the Blockchain framework has a major impact on the Australian capital markets as it has revolutionized the financial operations, exchange values and market infrastructures. In accordance with Ludlow (2018), the Blockchain benefits various entities of the Capital market such as share issuers, investors, fund managers and regulators. Blockchain enables cheaper, easier and quicker access to capital and resources with programmable digitalized securities and assets. The securities and shares can be issued in less time along with automated and encoded rights and requirements. It also facilitates issuers to increase the rapidity of investing events.

According to Consensys (2021), Blockchain considerably condenses the blockade to issue new financial assets and capital and as the expenditure of the issuance of securities reduces, the issuers will modify new mechanisms to the requirements of each investor. The use of Blockchain mitigates risk and augments potential revenue and income. As stated by Consensys (2021), Blockchain enables the centralized trading of the resources and assets and processes rapid and transparent arrangements. The rapid processing aids the fund managers to possess limited operating capital and resourcefully utilize their current capital. The funds will also lessen the accounting, administration and allocation costs.In accordance with the Consensys (2021), the regulators and agencies can profit from the application of Blockchain by recording every capital and resources transaction of the day. The regulators can focus more on the analysis and threat prediction and also, prevent certain systematic hazards.

Weaknesses

The Australian Securities Exchange regarded as the leading financial exchange in the world is making decisions to replace its CHESS clearing and settlement technique with a DLT-based alternative. As per Wyman (2016), one of the major challenges in the case of blockchain application in capital markets is whether a smart contract solution can transform clearing houses in an effective manner. Regulators need to be satisfied that an automated or decentralized blockchain can meet the objectives. Recourse is considered as another major issue in the case of blockchain solutions. In case the transaction based on blockchain has been recorded in the ledger, it is not possible to roll back the ledger. Although the immutability of blockchain records is considered as the significant strength of the technology, in certain situations it is essential for the transactions to be rolled back.

Although adequate developments have been seen in the trade execution and pre-trade methods, the settlement and clearing of the prescribed exchanges mainly the post-trade method has not been done. According to Niranjanmurthy, Nithya and Jagannatha, (2019), several financial institutions that are not capitalizing the improved technologies, in such circumstances capital markets are left susceptible towards minimum levels of liquidity and maximized barriers to entry.

Evaluation of Strengths and Weakness of Blockchain Uses in Supply Chain Management

Strengths

As per Abou Maroun et al., (2019), the current regulatory framework of Blockchain has also infiltrated in the supply chain management of an industry. As its function is to procure, produce, distribute and retail, it necessitates tools and methods to facilitate organizations to better comprehend the occurrence of unforeseen disruptions. The implementation of Blockchain in the Australian organizations has helped to track process and enhance transparency along with accurate reporting and regulatory compliance. To achieve transaction statement and interoperable trade of business information in supply chain management, Blockchain has transformed and changed within the uses cases.According to Consensys (2021), transparency builds confidence by capturing essential information details such as assertions and certifications and also proffers unrestricted access to data. The supply chain transaction registered in the Blockchain can be authenticated by the third party deponents. The data can also be frequently validated and updated for the smooth operation of supply chain management.

As per Consensys (2021), traceability enhances business effectiveness by visualizing and mapping the organizational supply chains. The increase in consumers demand on sourcing data about the goods and services they consume has stressed the industrial supply chain to reveal the financial transactions. Blockchain facilitates the organizations to comprehend their supply chain management and involve consumers with verifiable, real and indisputable information.

In accordance with Consensys (2021), tradeability reconsiders and re-evaluates the usual and conservative marketplace ideology. The implementation of Blockchain splits assets into shares that automatically signify ownership. The fractional possession permits tokens to symbolize the value of the investors’ stake, much similar to the way a stock exchange permits operation of the Company’s shares. The tokens are exchangeable and the consumers can transfer proprietorship without any material assets and capital in hand.

Weaknesses

Blockchain may be significantly implemented in order to provide advantages to any industry. Taking into consideration the significant benefits of the advancing technology in case of governmental sectors and businesses, gradually the legal authorities are evolving the regulatory framework of the blockchain. Generally, the Commonwealth Government of Australia has been supportive in order to evolve transformations in the specified sectors of technology. As per Nwagwu (2015), it has been reviewed that there have been sustained innovations on blockchain in Australia taking into account several initiatives based on the blockchain. Supply chains are considered as a significant area for the application of blockchain technologies. Fintech businesses have also started to formalize use cases for blockchain mainly adequate management of supply chains, managing exchanges based on digital currency. The determination of stakeholders participating in a blockchain is difficult and it is regarded as a difficult issue for public blockchains. The significant challenge in logistics is to collaborate information exchange across several modes of transport and information systems. For the adequate quality and provenance of the supply chain, adequate information about the events of the supply chain must be created with proper responsibility.

Requirements of confidentiality based on supply chain information are not similar across industries. Integrity is considered as an efficient inherent attribute of the blockchain. Although, supply chain collaboration provides several benefits to organizations in Australia and it also difficult to implement due to the emergence of several obstacles. There is a lack of integrity among the partners in the Supply chain. Trust is considered as one of the significant attributes to be taken into account in case of supply chain collaboration. Hence, the absence of integrity results in sharing of minimum knowledge among the partners and inadequate developments of the overall supply chain. According to Durbha (2019), several complexities of bringing all parties in a supply chain with the objective of transforming it into the blockchain solution has also been demonstrated. As per the study, it has been identified that the technical issues has also been determined based on scalability in the application of blockchain technology. In order to retain an improved degree of security, a limited number of transactions is available to be dealt with in the prescribed period. One of the significant limitations in case of blockchain is the essential requirements that must be taken into account before the implementation. Several organizations generally find it difficult to review flexibility and stability within the supply chain. In case the weaknesses are not determined and resolved, it will be rather impossible for the industry to reach its best possible level.

Conclusion

In the assessment based on technology and law, several aspects have been discussed such as the conceptual background of BlockChain, the present legal structure of BlockChain in Australia, the activities based on government regulation. However, the significant strengths and weaknesses of the present regulatory framework of blockchain in accordance with the two blockchain application cases. At present, there are no prescribed legislation or regulations based on blockchains in Australia. Blockchain possesses the efficient capacity to disrupt the entire society and economy in a unique manner by simplifying the transformation of digital assets among individuals. In the present business environment, though there is the availability of significant opportunities, there is the absence of prescribed knowledge on the manner in which the block chain technology is effectively executed. As per the research and estimates, it has been reviewed that the Australian Government is not involved in associated acts and cryptocurrencies. Moreover, it can be recommended that fundamental standards for blockchain are as significant as the advancements in technology. The two cases that have been selected for blockchain application are capital markets and the management of the supply chain. In accordance with the selected cases, the probable strengths and weaknesses of the current regulatory framework of blockchain in Australia have been analyzed.

References

Adams, Carlisle, “A Privacy Preserving Blockchain with Fine Grained Access Control” [2019] Security and Privacy

Clavin, James et al, “Blockchains for Government” (2020) 1(3) Digital Government: Research and Practice 1

ConsenSys, “Blockchain in Capital Markets,” ConsenSys

ConsenSys, “Blockchain in Supply Chain Management,” ConsenSys

Daneshgar, Farhad, Omid Ameri Sianaki and Prabhat Guruwacharya, "Blockchain: A Research Framework For Data Security And Privacy", (Webpage, 2021)

Durbha, M, “StackPath,” www.mhlnews.com (2019)

Maroun, Abou, “(PDF) Blockchain in Supply Chain Management: Australian Manufacturer Case Study,” ed E Daniel, J Zowghi and AT Khoei, ResearchGate (20AD)

Niranjanmurthy, M, “Analysis of Blockchain Technology: Pros, Cons and SWOT | Request PDF,” ed BN Nithya and S Jagannatha, ResearchGate (2019)

Nwagwu, U, A SWOT ANALYSIS on the USE of BLOCKCHAIN in SUPPLY CHAINS (, 2015)

Regulation and standards, “Regulation and Standards,” Department of Industry, Science, Energy and Resources (December 16, 2019) https://www.industry.gov.au/data-and-publications/national-blockchain-roadmap/regulation-and-standards

Wang, Xu et al, “Survey on Blockchain for Internet of Things” (2019) 136 Computer Communications 10

Wood, Gavin,“Ethereum: A Secure Decentralised Generalised Transaction Ledger. Ethereum Project Yellow Paper 151 (2014), 1–32.”

Wyman, O, Blockchain in Capital Markets the Prize and the Journey (, 2016)