Monetary Policy Assignment: How The Rba Influences The Level Of Interest Rates In The Economy?

Question

Task: Prepare monetary policy assignment on the topic “How the RBA influences the level of interest rates in the economy?”

Answer

Introduction

The main focus of monetary policy assignment is on analysing the several aspects of the Reserve Bank of Australia (RBA) which is solely accountable authority for influencing the monetary policy of Australia. This monetary policy encompasses setting the interest rates in the money market, change in the cash rate so as to influence the interest rate, the behaviour of the lenders and the borrowers, level of inflation and the different forms of economic activity. It is the duty of the bank to contribute towards the full employment, the welfare of the people of Australia, full employment level as well as the economic prosperity (Reserve Bank of Australia, 2019). Interest rate is one of the most vital things carried out by the central bank because they lay more effect on the inflation, level of job creation and economic growth. The low level of interest rates helps the businessman to borrow money from cheaply and thus hire more people through expansion. On the other hand, the higher rate of interests lies opposite effect and thus it discourages the consumers and the businessman from making further investment and purchasing things (Karp, 2019). This is likely to make the goods more expensive, pushing the price at a much higher rate. This report on monetary policy assignment will highlight the role of RBA in influencing the interest rate. The role of interest in the broadcasting of the monetary policy will be highlighted in a systematic way. The exchange rate and interest rate, cash flow rate and exchange rate and the measures taken by the RBA in order to boost the interest rate have also been discussed in this monetary policy assignment.

Discussion

Role of interest rate in the broadcasting the monetary policy

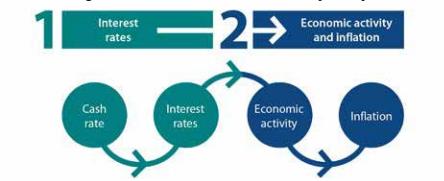

The transformation of the monetary policy in Australia takes place in two stages i,e. the change in the cash rate affecting the rate of interest in the economy. On the other hand, the changes in the interest rate affect inflation and economic activity to a much larger extent. There are different types of effects on the reduction as well as the increase in the interest rate and these effects are regarded as complex (Wong & Cheung, 2016). The cash rate illustrated in the sections of monetary policy assignment can be regarded as the interest rate between the different types of financial institutions for overnight loans in the economy.

Fig: Transmission of the monetary policy

Source: RBA (2019)

This can be regarded as the standard of the interest rate through which the funds are generally lent or borrowed in the financial market. There are different types of sources for bank funding in Australia and thus it lays impact on the funding cost of the different financial organisations. Moreover, the cash rate determined by RBA is likely to lay a strong influence on the deposit rate and the lending rate (Demirgüç-Kunt et al., 2017). The extent through which the changes in this flow of cash rate affecting the rate of interest in the economy is known as the “interest rate pass-through”. For example, RBA determines the cash rate in Australia with the help of monetary policy and influence the other interest rates in the economy. It does this by interacting with the commercial banks in domestic money market. Further, there are other related factors and conditions in the financial market outlined in the context of this monetary policy assignment that affects the interest rate determination such as a change in the level of competition as well as the risk associated with different types of loans in the economy.

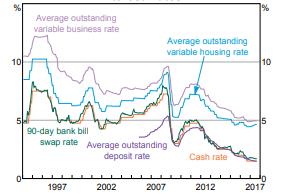

Fig: Interest rate

Source: APRA: Australia Branch; Bloomberg: Financial Reports, RBA UBS AG

The speed at which this interest rate passes through the businesses and the households in Australia depends on the deposits and the loans and how it affects the variable or the fixed rate of interest in the market. The readings used to prepare this monetary policy assignment mentions that these deposits and loans that are affected by the variable interest rate find it easy to manage the changes in the cash rate accordingly (Loukoianova et al., 2019). In Australia, it has been found that a large section of the loan is influenced by the changes in the cash rate in a short span of time. This interest rate on the existing level of fixed-rate loans is not so affected by the changes in the cash rate (Kirchner, 2019). On the other hand, this has also been observed in this monetary policy assignment the rate of interest might also vary over time and thus it does not only imply the effectiveness of the monetary policy. It is the responsibility of the Reserve Bank Board of Australia to take into consideration the funding costs as well as the lending rate into account and this will determine the level of the cash rate.

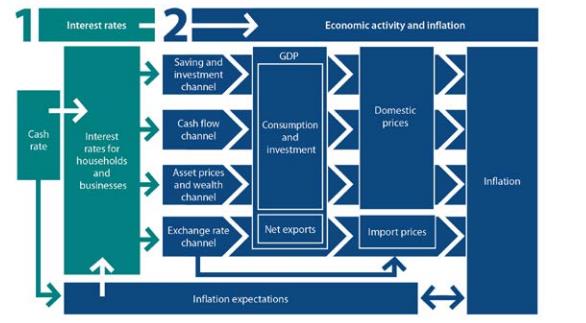

Fig: Channels of Transmission of the Monetary Policy

Source: RBA (2019)

The second stage of transmission examined in this monetary policy assignment indicates the change level in the interest rate and how this affects the employment, economic activity and the inflation rate. The most important difference between the different channels outlined in the context of this monetary policy assignment is how the rate of interest lays impact on the economic activity. Savings and investment channels are considered to play an effective role in this aspect. Interest rate also affects the economic activity by shifting the level of incentives for the businessman and the households. A reduction in the level of interests lowers the incentives for the households in order to encourage other individuals to borrow (Hofmann & Peersman, 2017). There are higher level of incentives for households in order to spend at the current situation rather than spending later. This will stimulate spending on durable goods. Further, it has been found that a lower rate of interests is generally associated with the consumption of the household and the investment level. On the other hand, the lower rate of interest encourages the businesses to increase the spending on the investment level. The cost of borrowing is likely to decline as the interest rate falls and thus there will be a higher return on investment. This indicates that an individual has the capacity to go ahead with the task (Atkin & La Cava, 2017). Thus, it can be said that a lower rate of interests is associated with an increase in the investment level. For example, in Australia the Reserve Bank is seen to lower the interest rates to stimulate economic growth and employment. In this respect as well the bank uses monetary policy as the tool where RBA is seen to cause smooth fluctuations in business cycle and create short term growth.

The cash flow and interest rate

In the case of cash flow channel discussed in the context of this monetary policy assignment, it has been found that lower rate of interests also affects the spending decisions of the businesses and the households through reduction of the interest and thereby paying the debt. This interest is generally received on the deposits and thus it affects the disposable income to a great extent. The cash flow is regarded as an important channel for both lending and borrowing. However, it can be said that the cash flow is stronger for the borrowers of the money for two vital reasons. The Australian housing sector can be regarded as a net debtor. Further, the borrower tries to hold the money twice or thrice and this depends on the variable rate debt in the economy (Reserve Bank of Australia, 2019). Therefore, it has been found from the research on monetary policy assignment that lower rate of interest leads to a higher level of cash flow in the economy.

Exchange rate and interest rate

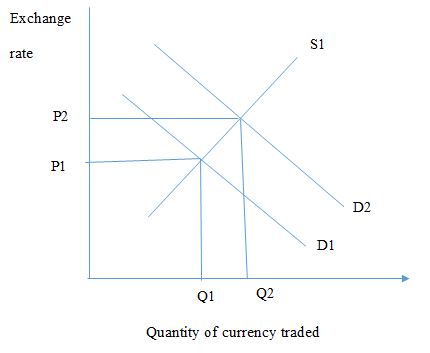

The influence of interest rate has a notable consequence on the inflation level and economic activity. This is likely to take place in an open economy and thus it is stronger for other sectors of the economy. Moreover, this channel can also be regarded as export-oriented and thus it is exposed to higher level of competition in case of imported goods. The level of exchange rate has direct impact on the inflation rate. Analysing the example provided in this segment of monetary policy assignment, it is seen that the decline in the level of cash rate affects the interest rate in Australia in relation to the rest of the world. This is likely to reduce the return on Australian assets and thus it results in lower demand of dollars. Further, a fall in the cash rate is related to the depreciation of the exchange rate. This depreciation in the exchange rate is likely to increase competitiveness among the domestic producers in the host country. This is possible through reduction in the price of the goods in relation to the foreign country. On the other hand, this has also been noted in this monetary policy assignment that the depreciation in the exchange rate of the country also leads to higher level of demand for the domestic production of goods and services. This is likely to affect the import volume of the country (Reserve Bank of Australia, 2019). There might be higher level of demand for the domestic production of goods and services and thus it affects the demand for the expensive Australian products.

Fig: Currency demand and supply and how rising interest rate creates inflow of hot money

Source: Author’s creation

There are different inevitable risks in shifting funds across different international markets. This might happen if the currency is left in the market and thus it will help in improving the bank account. The value of the investment will depreciate the value of the US dollar. There are different types of risks involved in the exchange of the US dollar and this will help in uplifting the government bonds. The investors consider the risk adjusted rate of return from different types of financial investments and returns. Thus, this will lead to lower level of import volume. Therefore, this lower rate of interest is generally related to the increase in the volume of exports and reduction in the level of imports to a large extent.

What are the measures taken by RBA to boost up the interest rate in the context of this monetary policy assignment?

It is necessary to check that when the monetary policy exerts influence on the economy, the interest rates are kept unchanged. In such a situation, the cash rate might not have changed at different periods of time but it affects the interest rate to a greater extent. The RBA decided to try quantitative easing policy for example to purchase the government bonds in order to boost up the economy when the official interest rate drops to 0.25% (Shane, 2019). Further, quantitative easing is also likely to boost up RBA when there is cut in the interest rate as well as the failure of the fiscal stimulus to boost up the economy accordingly. According to the report of the Guardian.com (2019), it has been found that RBA has also failed to fulfil the inflation target rate of 2-3% for the 20th successive quarters and thus it is bound to purchase the bond of $200bn in order to handle the financial system. This creation of money is likely to reduce the borrowing cost of the government and thus this will create money in some other sectors of the economy. Further, it has been suggested in this monetary policy assignment that structural and fiscal policies can be a better approach when there are problems in the economy on the supply side. This is because monetary policy on that time will not be able to drive long-run growth. It has been suggested that purchasing government bonds by the RBA over other assets will help them to experience the advantage because risk free interest rate is seen to affect all asset prices. One more instrument that would help RBA to manage the interest rate is conventional monetary policy. This is seen in the exchange rate, in asset prices and in the work of boosting aggregate household disposable income. Through these the Reserve Bank of Australia will help to create money and allow the economy to boost up by managing the interest rate (Karp, 2019). This is important for the economy like Australia because in case the RBA fails to take any measure the interest rates may drop to negative and at that time the banks have to pay to the customers for borrowing money from the institutions. This can only be done by the RBA by quantitative easing so that they purchase government bonds and flood the financial system with money that the economy needs. This will give a boost to the interest rate in the economy by lowering the borrowing costs for the government.

Conclusion

From the above analysis on monetary policy assignment it can be concluded that RBA has a very important role to play when it comes to influencing interest rate in the economy. It is the reserve bank that decides strategy so that they can maintain the interest rate at the level they want. Further, it is seen from the study examined in the monetary policy assignment that the lower the rate of interests the more it affects the spending decisions of the businesses and the households through reduction of the interest and thereby paying the debt. Further interest rate level is also affect the exchange rate in the economy which is set by the RBA. This is because lower rate of interest is generally related to the increase in the capacity of exports and reduction in the level of imports to a large extent. The interest rate is also impacted by the flow in cash or cash rate and is identified as interest rate pass-through. Thus, considering the overall findings obtained from the monetary policy assignment it is seen that the RBA has some or the other role to play to impact the interest rate in the economy. Recently RBA has planned to take quantitative easing to prevent further cuts in interest rate and stop it from being negative.

References

Atkin, T., & La Cava, G. (2017). Monetary policy assignment The Transmission of Monetary Policy: How Does It Work?. RBA Bulletin, September, 1-8.

Demirgüç-Kunt, A., Horváth, B. L., & Huizinga, H. (2017). Foreign banks and international transmission of monetary policy: evidence from the syndicated loan market. The World Bank.

Hofmann, B., & Peersman, G. (2017). Is there a debt service channel of monetary transmission?. BIS Quarterly Review, December.

Karp, P. (2019). Monetary policy assignment Reserve Bank may create money to boost economy when rates drop to 0.25%. Retrieved 29 November 2019, from https://www.theguardian.com/australia-news/2019/nov/26/reserve-bank-may-create-money-to-boost-economy-when-rates-drop-to-025

Kirchner, S. (2019). When interest rates approach zero, the RBA must rethink monetary policy| ABC.net. Retrieved 29 November 2019, from https://www.abc.net.au/news/2019-10-07/rba-interest-rates-approach-zero-quantitative-easing/11574590

Loukoianova, M. E., Wong, Y. C., & Hussiada, I. (2019). Household Debt, Consumption, and Monetary Policy in Australia. International Monetary Fund.

RBA. (2019). Retrieved 29 November 2019, from https://www.rba.gov.au/monetary-policy/

Reserve Bank of Australia. (2019). Monetary policy assignment Retrieved 29 November 2019, from https://www.rba.gov.au/education/resources/explainers/what-is-monetary-policy.html

Shane, D. (2019). Australia’s central bank holds interest rates at record low | Financial Times. Retrieved 29 November 2019, from https://www.ft.com/content/f582c58e-b803-11e9-8a88-aa6628ac896c

Wong, A., & Cheung, D. (2016). Put All the Eggs in the Same Basket–An Empirical Examination of US Monetary Policy Stance and Asian Stock Markets Integration. Monetary policy assignment Available at SSRN 2828598.