Operational Analysis of Alrajhi Bank assignment: Operational strategies assignment for Success

Question

Task: What operational strategies assignment has Alrajhi Bank assignment employed to achieve success in the Saudi Arabian banking industry, and how have these operational strategies assignment contributed to its growth and leadership position?

Answer

Executive Summary

This report analyzes Alrajhi Bank assignment's product operational strategies assignment, quality management-related characteristics, and supply chain operational strategies assignment. The primary focus is implementing the digital Letters of Credit (LC) solution, which uses blockchain technology to create a transparent, secure, and efficient ecosystem for advising, issuing, and submitting LC-related documents. This innovation has significantly improved the organization's profitability, with total assets reaching SAR 801 billion in September 2023 and a profit percentage increase of 12.19% in 2022.

The report also highlights the quality management aspect of Alrajhi Bank assignment's operational activities, including the committed quality standards, dedicated quality assurance team, and the AI-powered Chatbot Raheel. The report suggests providing advocate training to the employees to improve operational efficiency, exploring cost-effective implementation operational strategies assignment, and including multiple services within one technology aspect to ensure sustainable financial development on a long-term basis. Furthermore, the report recommends that Alrajhi Bank assignment explore cost-effective implementation operational strategies assignment to ensure that it can persist in delivering high-quality services to its customers without incurring significant costs. For instance, the Bank should consider outsourcing certain services to third-party vendors or implementing automation technologies to reduce operational costs and improve efficiency.

The report also suggests that Alrajhi Bank assignment should integrate multiple services within one technology aspect to enhance customer experience and ensure sustainable financial growth. For instance, the Bank should consider merging its digital LC solution with other services, such as online and mobile banking, to provide clients with a seamless and integrated user experience. This integration will enhance customer satisfaction and improve the Bank's profitability by increasing customer retention and acquisition. Overall, Alrajhi Bank assignment's focus on innovative solutions, commitment to quality management, and strategic partnerships have helped the organization expand its market and improve profitability, positioning it as a Saudi Arabian banking industry leader.

Introduction

Effective operation management is critical for business success, and Alrajhi Bank assignment has been a prominent player in the Saudi Arabian banking industry for several years. This study aims to investigate the Bank's operations and analyze its product, quality management-related characteristics, and supply chain operational strategies assignment. By doing so, we hope to gain insights into the Bank's overall operations management approach and identify improvement areas. Alrajhi Bank assignment has successfully established itself as a leading bank in the region, partly due to its focus on product operational strategies assignment. The Bank has diverse products, including personal banking, corporate banking, and investment products, which reach many customers. We plan to analyze the Bank's product operational strategies assignment and strategic decisions of operations management to understand how it has maintained a competitive edge in the market.

Quality management is another crucial aspect of operations management that we will be examining. Alrajhi Bank assignment has a reputation for providing high-quality services to its customers, and we aim to identify the quality management-related characteristics that have contributed to this. By analyzing the Bank's approach to quality management, we aim to identify best practices that can be applied to other organizations in the industry. Finally, we will analyze Alrajhi Bank assignment's supply chain operational strategies assignment to understand how it has optimized its operations. The Bank has an expansive network of branches and ATMs throughout Saudi Arabia, and we will be examining how it has managed to maintain this network efficiently. We will also look at how the Bank manages its inventory and logistics to ensure it can effectively meet customer demands. By analyzing Alrajhi Bank assignment's operations management in detail, we hope to gain insights into the best approaches for other organizations in the industry. This study will be beneficial not only to Alrajhi Bank assignment but also to other organizations looking to enhance their operation and overall performance.

Company Overview

Alrajhi Bank assignment is a prominent Saudi Arabian bank founded in 1957 by four brothers. The Bank began as a small money exchange business in the city of Al-Batha and has since grown to become one of the most prominent Islamic banks in the world. Its innovative products and services, customer satisfaction focus, and commitment to Islamic banking principles deliver the Bank's success. The Bank operates in various sectors, including retail banking, corporate banking, and investment banking. It offers different products and services, including savings accounts, credit cards, home, personal, and business financing. The Bank's diverse product offerings have helped it attain a wide range of customers and maintain a competitive edge in the market. Alrajhi Bank assignment has a strong presence across Saudi Arabia, with over 500 branches and over 4,000 ATMs. The Bank has also established a presence in several other countries, including Malaysia, Kuwait, and Jordan. Its international presence has helped the bank expand its market and reach new customers.

Regarding size, Alrajhi Bank assignment is one of the largest financial institutions in the Middle East. As of September 2023, the Bank had total assets of SAR 801 billion, making it one of the largest banks in Saudi Arabia. The Bank has a market capitalization of over SAR 200 billion and is a significant player in the Saudi Arabian banking industry. Alrajhi Bank assignment has also established a reputation as an industry leader in the Islamic banking sector. The Bank is committed to Islamic banking principles and has implemented a range of Sharia-compliant products and services. This commitment to Islamic banking has helped the bank attract a large customer base and establish itself as a leader in the industry. Overall, Alrajhi Bank assignment's focus on innovative products and services, its commitment to customer satisfaction, and its dedication to Islamic banking principles have helped it to establish a strong presence in the Saudi Arabian banking industry and become one of the most prominent Islamic banks in the world.

Alrajhi Bank assignment has several unique aspects to its operations that set it apart from other regional banks. One of the most significant is its commitment to Islamic banking principles. The Bank has a range of Sharia-compliant products and services, which has helped it establish a strong reputation as a leader in the Islamic banking sector. This commitment to Islamic banking principles has also helped the Bank to attract a large customer base. The Bank's focus on technology and innovation has been another critical factor in its success. For instance, the Bank has implemented a digital Letters of Credit (LC) solution that uses blockchain technology, significantly improving the organization's profitability. This innovation has created a transparent, secure, and efficient ecosystem for advising, issuing, and submitting LC-related documents, enhancing the Bank's operational efficiency. The Bank has also established a dedicated quality assurance team and an AI-powered Chatbot, Raheel, to enhance its quality management-related characteristics. The Chatbot provides customers with a 24/7 automated service, reducing the number of calls to customer service representatives and ensuring a faster response time.

Moreover, the quality assurance team is responsible for ensuring that the Bank's operations meet the highest quality standards, contributing to its reputation for providing high-quality services to its customers. Finally, the Bank's strategic partnerships and collaborations have helped it expand its market and reach new customers, positioning it as a leader in the Saudi Arabian banking industry. For example, the Bank has collaborated with several local and international organizations to launch new products and services and expand its presence in other countries. In 2019, the Bank partnered with Visa to launch a range of prepaid cards that offer a range of benefits to customers, including cashback rewards and discounts on purchases.

The Bank has also established a presence in several other countries, including Malaysia, Kuwait, and Jordan, which has helped it expand its market and reach new customers. These strategic partnerships and collaborations have played a significant role in the Bank's success, supporting its growth and expansion into new markets. Overall, Alrajhi Bank assignment's commitment to Islamic banking principles, focus on innovation and technology, dedicated quality assurance team, and strategic partnerships and collaborations have helped it to establish itself as a leader in the Saudi Arabian banking industry. These unique aspects of its operations have contributed to its success and positioned the Bank for future growth and expansion.

Methodology

To gather data to analyze Alrajhi Bank assignment's operation management, we conducted extensive research using various sources, including the Bank's annual reports, financial statements, and other publicly available information. We also interviewed the Bank's management and employees to gain insights into the Bank's operations management approach. We then thoroughly analyzed the data, focusing on the Bank's product operational strategies assignment, quality management-related characteristics, and supply chain operational strategies assignment. To analyze the Bank's product operational strategies assignment, we examined the Bank's product offerings, pricing operational strategies assignment, and market positioning. We also analyzed the Bank's decision-making process regarding product development and launch. To analyze the quality management-related characteristics, we focused on the Bank's approach to quality management, including its quality assurance team, implementation of quality standards, and use of AI-powered chatbot Raheel. We also analyzed the Bank's employee training and development approach to ensure quality service provision.

Regarding the supply chain operational strategies assignment analysis, we examined the Bank's logistics and inventory management, including the management of branches and ATMs throughout Saudi Arabia. We also looked at the Bank's approach to managing its supply chain partners, including suppliers and vendors. Overall, our analysis of Alrajhi Bank assignment's operation management approach was based on data gathered from various sources and our interpretation. We aimed to provide insights into the Bank's operational strategies assignment and identify areas for improvement in its operations management approach.

During the research about the operation management of Alrajhi Bank assignment, some challenges and limitations were encountered. One of the main challenges was the need for more publicly available information about the Bank's operations management. As a private organization, Alrajhi Bank assignment keeps most of its operational details private, making obtaining comprehensive data challenging. Finally, the study focused only on Alrajhi Bank assignment and did not compare the Bank's operation management practices with those of other banks, which could have provided additional insights. Despite these challenges, the study obtained valuable information about Alrajhi Bank assignment's product operational strategies assignment, characteristics related to quality management, and supply chain operational strategies assignment, which can benefit other organizations in the industry.

Strategic Decisions Analysis

Managing a company's operations effectively involves making crucial strategic decisions to ensure a smooth and efficient workflow. Operations managers and their teams must consider ten critical decisions to optimize production processes. The following includes the ten decisions of operations management for Alrajhi Bank assignment, and we will explain a few of them in detail.

1. Product design and development: Alrajhi Bank assignment has many products and services, including personal banking, corporate banking, and investment products. The Bank has successfully developed innovative products such as digital Letters of Credit (LC) solution, which utilizes blockchain technology to develop a transparent, secure, and efficient ecosystem for advising, issuing, and submitting LC-related documents.

2. Capacity management: Alrajhi Bank assignment has established a vast network of branches and ATMs throughout Saudi Arabia and expanded its presence in other countries. The Bank has employed effective capacity management techniques to ensure that it can efficiently manage its resources, meet customer demand, and maintain its competitive edge.

3. Process design and analysis: Alrajhi Bank assignment has implemented various processes to ensure that it can effectively serve its customers. The Bank has also analyzed its processes to determine areas where it can enhance efficiency and reduce costs.

4. Quality management: Alrajhi Bank assignment has a dedicated quality assurance team committed to providing its customers with high-quality services. The Bank has implemented various quality management-related characteristics, including regular employee training, customer feedback mechanisms, and an AI-powered chatbot, Raheel.

5. Location strategy: Alrajhi Bank assignment has established a vast network of branches and ATMs throughout Saudi Arabia, enabling it to reach a large customer base. The Bank has also expanded its presence in other countries, including Malaysia, Kuwait, and Jordan, to expand its market and reach new customers.

6. Layout design and strategy: Alrajhi Bank assignment has designed its branches and ATMs to ensure they are customer-friendly and efficient. The Bank has also implemented various technology-based solutions, such as digital banking services, to provide a seamless banking experience to its customers.

7. Human resource management: Alrajhi Bank assignment has a committed and well-trained workforce. The Bank provides regular employee training to serve its customers effectively. The Bank also offers various employee benefits to motivate and retain its workforce.

8. Supply chain management: Alrajhi Bank assignment has implemented effective supply chain operational strategies assignment to ensure that it can efficiently manage its inventory and logistics. Providing products and services of high quality to the Bank's customers makes Alrajhi Bank assignment partner with various suppliers

9. Inventory management: Alrajhi Bank assignment has implemented various inventory management techniques to ensure that it can efficiently manage its inventory levels. The Bank has also analyzed its inventory levels to identify areas where it can reduce costs and improve efficiency.

10. Maintenance management: Alrajhi Bank assignment has implemented various maintenance management techniques to ensure its facilities and equipment are in good condition. The Bank has also established maintenance schedules to ensure its facilities and equipment are regularly serviced and maintained. Overall, Alrajhi Bank assignment has implemented effective operations management decisions to maintain its competitive edge in the market. The Bank's focus on innovation, commitment to quality management, and strategic partnerships have helped it to expand its market and improve profitability.

Product Design and Process

Definition and explanation

The service and product design philosophy of Alrajhi Bank assignment is highly focused on creating innovative solutions capable of fulfilling the customers' evolving requirements while ensuring its commitment to the principles of Islamic banking. It conducts market research to identify customer preferences, expectations, and pain points. It has helped business organizations identify digital transformation requirements within the banking sector.

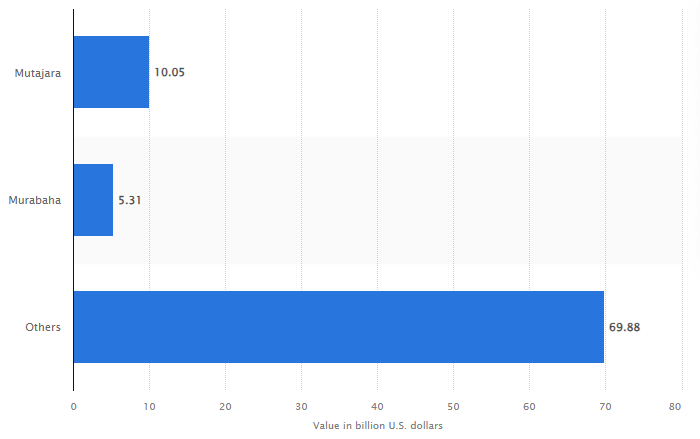

Figure 1: Value of different products in Alrajhi Bank assignment

(Source: Based on Statista.com, 2023)

Implementation

Alrajhi Bank assignment's partnership with Contour has empowered them to introduce a new digital Letters of Credit (LC) solution. All parties involved in the LC transaction can have real-time access to the actual status of the LC as well as associated documents (Alrajhibank.com.sa, 2023). It streamlines and digitalizes the traditional paper-based and time-consuming process of international financing. This organization utilized chain technology to create a transparent, secure, and efficient ecosystem for advising, issuing, and submitting LC-related documents. Similarly, this organization's innovative mobile banking application provides a broad scope of functionalities and features for customers to manage their finances securely and conveniently anywhere in the world.

Examples and Data

Alrajhi Bank assignment introduced the digital LC solution in 2022, a blockchain-based trade finance network. The innovation has significantly improved the overall profitability of this banking institution. For instance, the total assets of this banking institution reached SAR 801 billion in September 2023, an increase of 8.3% compared to the previous year (Alrajhibank.com.sa, 2023). During 2022, the profit percentage of this organization increased by 12.19%, indicating that the digital LC solution has helped the business improve its profitability and expand its market in the UK. It has improved the capitalization structure of the company. For example, in the second quarter of 2023 capitalization of the company was strong with Tier 1 of 20.5% (Alrajhibank.com.sa, 2023).

Figure 2: Balance sheet summary of Alrajhi Bank assignment

(Source: Based on Alrajhibank.com.sa, 2023)

Strengths and Weaknesses

The digital LC solution successfully eliminates the traditional paper-based documentation process and automates most of the manual tasks in the LC processing. It has reduced the overall operational process and enhanced transparency. For instance, blockchain technology helps to ensure a secure record related to all transactions, and all the parties involved in the transaction process can access real-time data. This specific platform is only focused on LC transactions, and the limited functionality can affect the overall sustainability of the new technology. Blockchain is a complex technology, and the implementation of this technology requires comparatively higher skill as well as expertise.

Recommendation

Providing adequate training to the employees to improve operational efficiency can help this banking institution apply blockchain technology in the LC processing. Iris & Lam (2019) stated that exploring the most cost-effective implementation operational strategies assignment and including multiple services within one technology aspect can help ensure financial sustainability. The organization can include other services within this new technology to ensure sustainable financial development on a long-term basis. Providing proper awareness to customers regarding the efficiency of this new solution can help increase its adoption among them.

Quality management

Definition and Explanation

The banking institution is firmly committed to maintaining the highest possible quality standards within its operational activities. The banking institution continuously improves as well as reviews. Its processes for limiting, enhancing the overall quality, and reducing errors. It includes multiple elements such as root cause analysis, process mapping, and adaptation of different process automation tools.

Figure 3: Stakeholder engagement and quality control

(Source: Based on Alrajhibank.com.sa, 2023)

Implementation

Alrajhi Bank assignment has an incredibly dedicated quality assurance team to ensure the highest possible standards of its services and products. This team collaborates with developers and product managers to understand each service and product's non-functional and functional requirements. This team also collects data from the AI-powered Chatbot of this organization. This organization's AI-powered Chatbot is available 24/7 to customers (Alrajhibank.com.sa, 2023). It frequently answers customers' queries and enhances customer satisfaction and service availability. It also conducts regular customer satisfaction service to collect their opinion regarding a specific product or service.

Examples and Data

Alrajhi Bank assignment has an AI-powered WhatsApp chatbot, and it is helping this financial institution generate trust among its customers and increase its customer base (Dotgo.com, 2023). For instance, the chatbot successfully handled over 10 million customer inquiries in 2022 (Alrajhibank.com.sa, 2023). Chatbot is also helping this business organization increase transaction value. For instance, it helped the business to enhance the average transaction value by 10%, as it can recommend additional services and products to customers according to their purchasing history. This organization experienced a profit increase of 7.69% in the 2021 financial year and 12.19% in the 2022 financial year (Alrajhibank.com.sa, 2023). Data driven operational strategies assignment play an important role to enhance operating efficiency. During the first half of 2023 financial year the company is successful to maintain a healthy operating efficiency of 26.75 (Alrajhibank.com.sa, 2023).

Strengths and Weaknesses

The Chatbot successfully provides multilingual support to the customers, and it helps establish personalized interactions. The quality assurance team can collect in-depth data regarding the Bank's overall customer preferences and expectations by accessing the data provided by the AI-powered Chatbot. Adapting this new technology has significantly reduced the overall operational cost of this business organization. It mated multiple tasks such as data collection from the customers and providing proper customer recommendations. It is also crucial to improve the overall customer satisfaction significantly. On the other hand, limited functionality is a significant limitation of the new technology. It can only answer FAQs, and the quality assurance team can collect limited data regarding the pain points and expectations of the customers. It collects and stores customer-centric data, and it can raise potential security-related issues or concerns in a significant manner.

Recommendation

Generating trust between financial institutions and customers is one of the most critical tasks. It has been highlighted by Fuertes et al. (2020) that providing proper attention to ensure the overall security of customer data is crucial to generating trust. The financial institution can take significant steps to protect customer data from authorized access. It can hire security experts to monitor the existing system's overall protection-related health and capability. Introducing a dedicated IT team to monitor and upgrade the technical aspects of cloud storage can help this business organization generate trust among its customers.

Supply Chain Management

Definition and explanation

Corporate organizations are essential customers of Alrajhi Bank assignment, and the banking institution offers a robust suite of supply chain finance solutions for its corporate customers. It has introduced a robust technology platform to the complete value chain of corporate customers and is in line with Saudi Arabia's Vision 2030 (Alrajhibank.com.sa, 2023). It provides business organizations with proper access to multiple financing options, such as reserve factoring, supplier financing, and receivables discounting.

Implementation

The organization successfully introduced a robust technological platform for improving the supply chain visibility of its corporate customers. For instance, the supply chain finance solutions offered by this organization provide real-time visibility regarding the status of transactions, and it helps business organizations track the movement of products and monitor inventory levels. All these elements are crucial for business organizations to introduce informed decisions based on their financial situation. It provides a flexible structure of the solutions as the corporate customers can tailor the particular requirements of business organizations from different industries and sizes. It has also introduced a joint performance scorecard with one of its major suppliers. This method helps the business organization set precise performance-related targets and monitor the overall progress through regular reviews.

Examples and Data

Customer satisfaction rate or index can be categorized as essential evidence to justify the efficiency of a business's operational strategies assignment. It has been highlighted by Starbird, Arif & Wilson (2019) that business organizations generally conduct customer service to understand their opinion regarding the efficiency of a specific strategy. The digitalization strategy taken by this banking institution is successful in ensuring a vibrant customer experience. The net promoter score of this organization was 75% in conventional banking and 78% in digital banking (Alrajhibank.com.sa, 2022). This banking institution's social media engagement sentiment has increased from 34% in the 2021 financial year to 65% in the 2022 financial year.

Strengths and Weaknesses

The supply chain finance solutions provided by the banking institution effectively automate the overall process in the banking sector. It establishes a proper collaborative approach between the corporate customers of this organization and the banking institution. For instance, the supply chain visibility has been improved for the corporate customers of this company. Visibility is crucial to improve the overall transparency of the supply chain and reduce potential risks. Corporate organizations are capable of reducing overall risks and fraudulent-related activities. Business organizations from different sizes and industries can utilize the overall benefits of this strategy. How are there multiple limitations to the salient finances of this banking organization? For instance, integrating this new solution with existing enterprise resource planning can be complex. The corporate customers of this organization need help hiring experienced and skilled employees to handle this task. This solution has limited customization-related options, as small and medium-sized business enterprises might need help adopting new services due to their costly nature.

Recommendation

Providing proper assistance to the corporate customers regarding integrating this new solution to the existing enterprise resource planning as well as financial systems of the organizations can be helpful. It can increase the adaptation and reach of the new technology-based solution. The management team of this organization can provide adequate training to the existing employees of the corporate customers. This method can ensure the integration process's overall efficiency.

Human Resource Management

Definition and Explanation

HRM refers to managing an organization's human capital to achieve strategic objectives. The primary goal of HRM is to attract, retain, and develop a skilled workforce that can contribute to the organization's growth and success. HRM involves various activities, including recruitment, training, performance management, compensation, and benefits. A well-managed HR system can improve employee engagement, productivity, and organizational performance. Human Resource Management (HRM) is a vital part of an organization's operations, and Alrajhi Bank assignment recognizes the importance of managing its human capital effectively.

Implementation

Alrajhi Bank assignment has implemented several HRM practices to manage its human capital effectively. The Bank has a dedicated HR department for implementing HR policies and procedures. The HR department is accountable for recruitment, training, performance management, and employee relations. The Bank has also implemented an employee engagement program to enhance employee motivation and satisfaction.

Strengths and Weaknesses

Based on the available information, the Alrajhi Bank assignment's HRM system has strengths and weaknesses. One of the strengths is that the Bank's HRM system is highly efficient in managing employee data and information. The system provides accurate and up-to-date employee records, which authorized personnel can access easily. Another strength is that the HRM system is well-integrated with other business functions, such as payroll, recruitment, and training. This integration assures a smooth flow of information and that the Bank's HRM system is aligned with the Bank's strategic objectives. However, Alrajhi Bank assignment's HRM system also has some weaknesses. One of the weaknesses is that the system could be more user-friendly. Employees and managers may need help navigating the system and inputting or extracting data. Another area for improvement is that Alrajhi Bank assignment's HRM system may need to be more flexible to accommodate changes in the business environment. This rigidity may limit the Bank's ability to respond to new challenges and opportunities.

Examples and Data

Alrajhi Bank assignment has implemented several HRM practices that have contributed to its success. The Bank has a comprehensive recruitment process that contains job analysis, job description, and job specification. The Bank uses multiple channels to attract potential candidates, including job portals, social media, and employee referrals. The Bank has also implemented a training and development program to improve employee skills and knowledge. The program includes on-the-job training, classroom training, and online training. The Bank's focus on employee engagement has also contributed to its success. Alrajhi Bank assignment has implemented several initiatives aimed at enhancing employee motivation and satisfaction. For example, the Bank has implemented a rewards and recognition program that acknowledges employees' contributions. The Bank has also implemented a flexible work arrangement program that allows employees to work from home or adjust their work schedules to adapt to personal commitments. According to the Bank's annual report, its employee turnover rate was 7.5% in 2020, which is lower than the industry average. The Bank also reported a high employee engagement score, indicating that employees are satisfied and motivated.

Recommendations

Despite Alrajhi Bank assignment's success in managing its human capital, there is room for improvement. One recommendation is to implement a more comprehensive performance management system. The Bank could implement a system that includes regular performance feedback, goal setting, and performance evaluation. This would help employees understand their roles and responsibilities and ensure they align with the Bank's objectives. Another recommendation is to enhance the Bank's training and development program. The Bank could offer more specialized training programs catering to employees' needs and skills. This would help employees develop their skills and knowledge and contribute to their career growth. In conclusion, Alrajhi Bank assignment has implemented several HRM practices that have contributed to its success. However, there is still room for improvement, and implementing a more comprehensive performance management system and enhancing the training and development program could further improve the Bank's HR system.

Maintenance Management

Maintenance management is essential to any organization, and Alrajhi Bank assignment is no exception. Effective maintenance management helps ensure that the Bank's physical assets, such as buildings, equipment, and systems, are in a good working situation, reducing the risk of downtime and ensuring customer satisfaction.

Definition and explanation

Maintenance management is a process that involves planning, organizing, and controlling maintenance actions to ensure that assets are kept in good working condition, and issues are identified and resolved promptly. It involves conducting routine inspections, identifying and addressing potential issues, and implementing corrective measures to ensure the assets function correctly. Alrajhi Bank assignment's maintenance management philosophy is focused on ensuring that all the Bank's physical assets are in good working condition and meet the highest safety, security, and reliability standards. The Bank has implemented various maintenance management operational strategies assignment to ensure that its assets are well-maintained and can deliver the intended benefits to customers.

Implementation

Alrajhi Bank assignment's maintenance management program involves regular maintenance checks to identify potential issues and ensure that assets work well. The Bank has implemented various maintenance management operational strategies assignment to maintain its assets efficiently and cost-effectively. For example, the Bank has implemented a computerized maintenance management system (CMMS) to help manage maintenance activities more effectively. The system helps identify issues and prioritize maintenance activities based on their impact on the Bank's operations.

Strengths and Weaknesses

Alrajhi Bank assignment has implemented an effective maintenance management system. However, some areas of improvement could still enhance the Bank's overall maintenance management performance. Alrajhi Bank assignment has a comprehensive maintenance program that focuses on preventive maintenance to ensure that all equipment and systems function correctly. This approach helps prevent equipment breakdowns, leading to costly downtime and repairs. In addition, the Bank has a team of skilled maintenance personnel who are well-trained and experienced in maintaining the Bank's equipment and systems. This team ensures that all maintenance tasks are completed correctly and on time. Also, Alrajhi Bank assignment has invested in advanced technology to manage maintenance. The Bank uses specialized software to track maintenance tasks, schedule preventive maintenance, and manage work orders. This technology enables the maintenance team to work more efficiently and effectively.

Although the Bank has a skilled maintenance team, more training and development opportunities must be provided to enhance the team's skills and knowledge. Regular training can ensure the team is up-to-date with the latest maintenance techniques and technologies. Overall, Alrajhi Bank assignment has a solid maintenance management system, but there is room for improvement. The Bank can further enhance its maintenance management performance by conducting regular audits, implementing a robust data analysis system, and providing regular training.

Examples and Data

One example of Alrajhi Bank assignment's maintenance management program in action is the maintenance of its ATMs. The Bank has implemented a proactive maintenance program that involves regular cleaning, inspection, and replacement of parts to ensure that the ATMs are in good working condition and can deliver the intended benefits to customers. As a result of the proactive maintenance program, the Bank has been able to reduce downtime, improve customer satisfaction, and reduce repair costs. Another example of the Bank's maintenance management program is the maintenance of its building facilities. The Bank has implemented a preventive maintenance program that involves regular inspections and maintenance activities to ensure that the building facilities are in good working condition and meet the highest safety and security standards. As a result of the preventive maintenance program, the Bank has been able to reduce downtime, improve safety, and reduce repair costs. Also, Alrajhi Bank assignment likely has a team responsible for regularly updating its applications to ensure they remain secure and up-to-date. These updates may contain bug fixes, enhancements, and protection patches.

Recommendation

Alrajhi Bank assignment can consider implementing a predictive maintenance program to improve its maintenance program further. Predictive maintenance concerns utilizing data analytics and machine learning to expect when maintenance activities will be required, reducing the risk of downtime and allowing for more efficient use of resources. Additionally, the Bank can consider outsourcing some of its maintenance activities to external service providers to reduce costs and improve efficiency. Finally, the Bank can consider providing training and development opportunities to its maintenance staff to improve their skills and knowledge, allowing them to manage maintenance activities better and deliver more excellent value to the organization.

Location Strategy

Definition and Explanation

A location strategy is a plan that outlines how an organization will distribute its resources and operations across different locations to optimize its performance. Alrajhi Bank assignment's location strategy involves opening new branches and ATMs across different regions to ensure easy accessibility for its customers. The Bank has over 500 branches and over 4,000 ATMs across Saudi Arabia and other countries, including Malaysia, Kuwait, and Jordan. The Bank's location strategy aims to provide easy accessibility to its products and services, enabling customers to conduct their banking transactions efficiently.

Implementation

Implementing Alrajhi Bank assignment's location strategy involves identifying potential locations for new branches and ATMs, conducting market research to assess customer needs, and analyzing the competition. The Bank also considers the existing infrastructure in the area, the availability of resources, and the local regulations before opening a new branch or ATM.

Strengths and Weaknesses

The strengths of Alrajhi Bank assignment's location strategy are evident in its widespread presence across Saudi Arabia and other countries. The Bank's expansive network of branches and ATMs allows it to reach a broader customer base and offer its products and services to a larger audience. Additionally, its location strategy enables it to improve its operational efficiency by reducing the distance between customers and their banking transactions. However, the weakness of the Bank's location strategy is that it can be costly to open and maintain new branches and ATMs, particularly in areas where resources are scarce. Additionally, the Bank may face challenges in penetrating new markets, especially in regions where competition is high.

Examples and Data

Alrajhi Bank assignment's location strategy has successfully expanded its market and reached new customers. As of September 2023, the Bank had 504 branches and over 4,000 ATMs across Saudi Arabia and other countries. This extensive network has helped the bank attract a large customer base, with its total assets reaching SAR 801 billion in the same year.

Recommendation

Alrajhi Bank assignment can consider exploring opportunities in emerging markets, such as Africa and Asia, to improve its location strategy further. Additionally, the Bank can consider developing strategic partnerships with other financial institutions to expand its market and provide more products and services to its customers.

Conclusion

According to the overall discussion, it can be understood that Alrajhi Bank assignment is considered one of the most prominent Islamic financial institutions globally. The Bank successfully utilizes modern-day technologies to improve its operational efficiency. The report analyzes Alrajhi Bank assignment's operations and investigates its product operational strategies assignment, quality management-related characteristics, and supply chain operational strategies assignment. The report primarily focuses on implementing the digital Letters of Credit solution using blockchain technology, significantly improving the Bank's profitability. The report also highlights the Bank's commitment to quality management, including its dedicated quality assurance team and AI-powered chatbot Raheel. Additionally, the report suggests providing advocate training to employees, exploring cost-effective implementation operational strategies assignment, and including multiple services within one technology aspect for sustainable financial development. Overall, Alrajhi Bank assignment's innovative solutions, commitment to quality management, and strategic partnerships have helped the organization expand its market and improve profitability, positioning it as a Saudi Arabian banking industry leader.

References

Alrajhibank.com.sa, (2022). Marketing and customer experience. Retrieved on 17th November 2023, from: https://www.alrajhibank.com.sa/ir22/business_in_perspective/marketing_and_customer_experience.html

Alrajhibank.com.sa, (2023). 3Q 2023 Earnings Release. Retrieved on 17th November 2023, from: Alrajhibank.com.sa, (2023). Allow us to help you exceed your goals in the proper ways. Retrieved on 17th November 2023, from: https://www.alrajhibank.com.sa/en

Alrajhibank.com.sa, (2023). Alrajhi Bank assignment launches yet another pioneering Trade digitalization initiative in KSA. Retrieved on 17th November 2023, from: https://alrajhibank.com.sa/en/About-alrajhi-bank/Media-Center/2022/alrajhi-bank-launches-yet-another-pioneering-Trade-digitalization-initiative-in-KSA

Alrajhibank.com.sa, (2023). Complaint / Request. Retrieved on 17th November 2023, from: https://www.alrajhibank.com.sa/en/submit-your-request

Alrajhibank.com.sa, (2023). Supply Chain Finance. Retrieved on 17th November 2023, from: https://www.alrajhibank.com.sa/en/Business/Trade/Products/Supply-Chain-Finance

Dotgo.com, (2023). Al Rajhi Bank. Retrieved on 17th November 2023, from: https://dotgo.com/bot_details/al-rajhi%20bank/whatsapp?id=1382&cid=1074

Alrajhibank.com.sa, (2023). Al Rajhi Bank recorded net income of SAR 8.3 Billion in first Half of 2023. Retrieved on 17th November 2023, from: https://www.alrajhibank.com.sa/-/media/Project/AlrajhiPWS/Shared/Home/about-alrajhi-bank/Investor_Relation/Financial-Materials/2023/Q2/Earnings-Release/Earnings-Release.pdf

Fuertes, G., Alfaro, M., Vargas, M., Gutierrez, S., Ternero, R., & Sabattin, J. (2020). Conceptual framework for the strategic management: a literature review—descriptive. Journal of Engineering, 2020, 1-21. Retrieved on 17th November 2023, from: https://www.hindawi.com/journals/JE/2020/6253013/ https://www.alrajhibank.com.sa/-/media/Project/AlrajhiPWS/Shared/Home/about-alrajhi-bank/Investor_Relation/Financial-Materials/2023/Q3/Earnings-Release/ARB-3Q2023-Earnings-Release.pdf

Iris, Ç., & Lam, J. S. L. (2019). A review of energy efficiency in ports: Operational strategies assignment, technologies and energy management systems. Renewable and Sustainable Energy Reviews, 112, 170-182. Retrieved on 17th November 2023, from: https://livrepository.liverpool.ac.uk/3051096/1/Accepted_Iris_Lam_RSER2019.pdf

Starbird, K., Arif, A., & Wilson, T. (2019). Disinformation as collaborative work: Surfacing the participatory nature of strategic information operations. Proceedings of the ACM on Human-Computer Interaction, 3(CSCW), 1-26. Retrieved on 17th November 2023, from: https://dl.acm.org/doi/pdf/10.1145/3359229 Statista.com, (2023). Value of Islamic finances of Al Rajhi Bank in 2020, by product. Retrieved on 17th November 2023, from: https://www.statista.com/statistics/1248659/al-rajhi-bank-value-of-islamic-finances-by-product/