Strategic Analysis Assignment: Implications of SDG 13 on Alinta energy

Question

Task

Your task is to conduct a critical research and prepare a detailed strategic analysis assignment discussing the implementation of SDG 13 in reducing strategic issues of finance and CSR in Alinta Energy.

Answer

Executive Summary

The report on strategic analysis assignment has been exemplary in analysing the possible strategic implications of SDG 13 on Alinta energy. The paper has made use of the secondary data collection method. The findings of the paper suggest that the SDG 13 has definite influence on the financial performance of the company by decreasing the operational cost. The results of the paper also indicate that the SDG has a strategic significance on developing the CSR programs for businesses. The report has made assertive use of the strategic analysis tools such as PESTLE and Porter Five Forces.

Introduction

Background

Alinta Energy is one of the leading firms in the Australian energy sector. It was founded in 2011. The CEO of the organisation is Jeff Dimery. The employee base of Alinta Energy comprises of 800 employees and the headquarters are located in Sydney. The annual sale of Alinta Energy is $2.33 billion (Dnb, 2021).Sustainable Development Goal 13 (SDG 13) addressed climate action, as the United Nations had categorized climate action as one of the sustainable development goals in 2015. The goals include a broad variety of topics related to climate change. The SDGs aim to incorporate climate change interventions into national policies, strategies, and planning.

Aim and research question

The aim of this research study is to investigate the implications of SDG Goal 13 in financial and CSR issues at Alinta Energy in Sydney, Australia.

The following research questions have been taken under consideration to explore in the study:-

- What might be the implication of SDG 13 on financial issues of Alinta Energy?

- What is the role of SDG 13 within the Alinta Energy operation for expanding CSR programs?

- What are the cost minimizing solutions that can be achieved in Alinta Energy operation after implementing SDG 13 in its function?

Problem Statement

Global warming is projected to increase by 35% in 2025 due to increased release of greenhouse gases by business operations and is understood to increase financial investment by 22%. The rise in such investment might be attributed to the business’s liability of implementing climate change mitigation measures that is proposed by SDG 13. Hence, the absence of implementing SDG 13 within the business practises of organisation poses as the problem and the purpose of the paper aims at providing a clear insight about the financial implications of SDG 13 on business operations.

Literature review

Concept of SDG 13

According to Louman et al. (2019), one of the most important components of the Sustainable Development Goals is the disparity in societies' knowledge of the need to ensure sustainability and transition economies and society to concentrate more on renewable energy sources and must be viewed as a responsibility that should be emphasized in international accords, particularly the Paris Climate Treaty. Gomez-Echeverri (2018) has supported while the Sustainable Development Goals as a whole have major implementation constraints, the Paris Climate Treaty must be regarded essential for achieving SDG 13: Climate Action. Adopting the Sustainable Development Goals may allow for a more holistic approach to tackling climate change. Hence, it can be implied that sustainable Development Goal 13 (SDG 13) addressed climate action, as the United Nations had categorized climate action as one of the sustainable development goals in 2015.

Strategic implication of SDG on decreasing operational cost

In the findings of van der Waal, Thijssens & Maas (2021), it is suggested that Multinationals can tailor their investments and operations to support the achievement of the SDGs through enhancing positive externalities and in turn reduce the expenses that are associated with business operations. However, Van Zanten & Van Tulder (2018) has argued that despite its attraction, this concept appears to contradict theoretical justifications for restricting a firm's externalities to preserve competitiveness or separating high-positive-externality investments from the firm's activities. Hence, it can be analysed that multinationals, as huge corporations that operate and control their financial resources across borders, can boost prosperity in their host nations, reducing operation expenditure inequities. The paper also highlighted that SDG 13 is concerned with the positive externality of enhancing a company's wealth by lowering its operational costs. Several researchers have advocated that multinational corporations in host countries limit technology's beneficial externalities. Multinationals frequently bring more advanced technology and inventions to the host nation, which unintentionally spread to local enterprises through spillovers. Hence, it can be implied that multinationals' executives may devise ways to minimize such dispersion to others by integrating SDG 13 within the business strategy, as it provides competitive advantage.

Influence of SDG on CSR

According to Carroll, & Buchholtz (2015), the 17 SDGs, reflect the view of CSR as a business response to international concerns, which proposes a stronger commitment from firms via their management, as well as the creation of projects that add to social and ecological progress and becoming responsible corporate citizen. However, Varela, Lopez, & Fornes (2015) have argued that there is a lot of disagreement over why firms should pursue CSR strategy. Hence, it can be analysed that the business objectives for implementing a CSR strategy are motivated by instrumental factors and that the primary goal is to improve the company's reputation in adopting SDG. Furthermore, the findings of the paper suggest that firms have included the results of their commercial activities, as well as the assessment of the business's effects, in sustainable reporting and corporate websites. Hence, it can be inferred that the global contribution to the SDGs has been extensive. Furthermore, López, & Monfort (2017) have supported Companies create value by taking into account the expectations and demands of their stakeholders, SDG and responding with CSR initiatives. Therefore, it can be assessed that businesses incorporate the global needs outlined in the SDGs into their business actions, which include a variety of commitments through CSR programs.

Methodology

Research Approach

Research approach that has been taken under consideration for the study is the deductive approach. It is because the research involves the use of diverse strategic analysis framework such as PESTLE, Porter’s five forces and such integration of theoretical frameworks can only be accommodated by deductive approach as it excels in implementing theoretical framework to analyse research findings. Hence, the use of deductive approach is justified.

Data Collection

Secondary data collecting procedures has been used, with the researcher gathering information from trustworthy and accessible sources. In the research, the secondary data collection has been selected as the project guidelines strictly restricts the use of primary data collection method and such restriction renders the Secondary data collection as the solitary alternative for collecting information. Secondary data on Alinta Energy has been gathered from the firm's official website, where financial reports and other pertinent information have been gathered for usage. The majority of the data for SDG Goal 13 has come from the UNDP's official website. Different academic papers and articles have also been retrieved utilizing search engines such as Google Scholar in order to obtain potentially relevant data relating to the main topic. Data integrity, data interpretations, detecting patterns and relationships of theories employed, and interpreting from the analysis to explore the research question has been a part of the thematic data analysis technique (Snyder, 2019).While collecting data inclusion criteria was to select those articles that could provide relevant information on climate change as one of the strategy of SDG. An exclusion criterion of the research was to eliminate those articles that have focused on the other strategies except climate change.

Data analysis

Thematic analysis has been conducted by using the various journals and scholarly articles that has been resourced from online libraries such as Google scholar. The data that has been resourced from news articles and financial reports has been used to complete the strategic analysis. The strategic analysis has been conducted with the strategic analysis tools of PESTLE, SWOT and Porter’s Five forces.Because the data gathered from multiple secondary data sources has been descriptive, analyzing the data will has been assisted using a thematic data analysis technique. This has aided in the study's development of appropriate insights on the importance of SDG- Climate Action on Alinta Energy. Since the researcher has been analyzing secondary data gathered from multiple reputable sources to address the research questions that have been established, the technique of qualitative data analysis for this research has resulted in the introduction of thematic analysis.

Findings

Strategic analysis

PESTLE

Political

From the analysis of political perspective, it is identified that the adoption of the SDG 13 has positive financial implication, as it will help Alinta Energy to build strong socio-political relation with the Australian Labour party and in turn might exempt Alinta Energy from financial issues of paying high import duties. It is because the Australian Labour party (Labor) envisions a drastic drop in the greenhouse gas emission and adoption of SDG 13 will reflect on meeting such envisioned objectives. It is evidenced by the fact that Bill Shorten, leader of Labour has promised to cut down greenhouse gas emissions by 45% (Morton, 2019). Hence, it can also be analysed that the implementation of SDG 13 within Alinta Energy might have positive impact on financial issue.

Economic

Through the assessment of economic factors, it is understood that the adoption of SDG 13 will reduce energy consumption expenses as the Target 13.3 of SDG 13 suggests the use of renewable energy for climate change mitigation and the solar in feed electricity tariff rates are less expensive as compared to the convention energy sources. It is evidenced by the fact that Solar feed-in tariffs is 7.3 cents per kWh as compared to the conventional tariff rates of9.5 cents per kWh (Energysaver, 2021). Hence, the low Solar feed-in tariffs has posed as the cost effective solution of SDG 13 that will benefit Alinta Energy.

Social

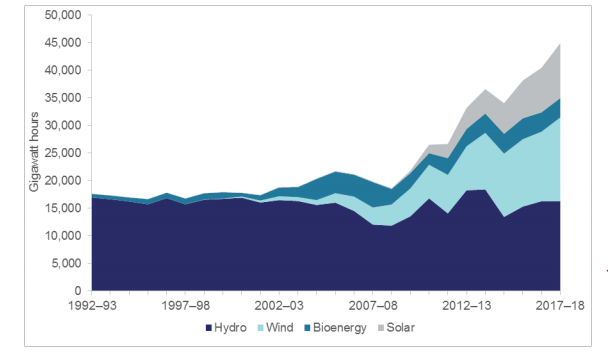

The purchase trends of the renewable energy solution have increased by 25% in Australia in 2018 (Energy, 2021). Target 13.1 of SDG 13 focuses on non-renewable energy solution through Derisking Renewable Energy Investment (DREI). From the social perspective, it is analysed that the adoption of SDG 13 in Alinta Energy will help company to meet the needs of the consumers who are adopting renewable energy solutions and will have positive impact on financial issues of low annual profit generation at Alinta Energy’s as business objectives of expanding renewable energy market would increase annual profits.

Figure: Increase in customer purchase of renewable energy solutions in Australia

(Source: Energy, 2021)

Technological

The adoption of SDG 13 will reflect on the improvement in the photovoltaic cell technology and enhance renewable energy technology at Alinta Energy.

Legal

From the legal standpoint, it is understood that the adoption of SDG 13 will benefit Alinta to expand the long-term objectives of CSR program as the SDG 13 provides the framework that the organisation could implement for CSR programs in an attempt to meet the statutory guidelines that are proposed by the Environment Protection Act 1970.

Environmental

The adoption of SDG 13 will have long-term environmental benefits to Alinta Energy’s operation as SDG 13 have the capacity to achieve the organisational aim of reducing the carbon footprint by 30% by 2025. It is evidenced by that SDG 13 aims to reduce the greenhouse gas emission by 45% by 2030 (UN, 2021). On top of that, SDG 13 will play a major in accomplishing the long term objectives of Alinta Energy in terms of expanding CSR programs

Porter Five Forces

Threat of the new entrants

The threat of the new entrants is low. It is because the initial infrastructure cost of deploying renewable energy technology for adopting SDG 13 is quite high and poses as an entry barrier to new companies. It is evidenced by the fact that the infrastructure cost for setting solar power plants in Australia have increased by 25% (Arena, 2021). This, in turn, assures a positive impact on the financial performance at Alinta Energy.

Bargaining power of the suppliers

The bargaining power of the suppliers is low. It is because Alinta Energy has the capacity of manufacturing their own photovoltaic cells and solar panel components in large scale for adopting SDG 13 in energy solutions and does not have to heavily rely on suppliers.

Bargaining power of customers

The bargaining power of customers is low. It is because the high brand identity of Alinta Energy has amassed a loyal customer base over the years in Australian energy sector, which, in turn, signifies the influence of their positive brand image on increasing the customer switching cost. It is evidenced by the fact that customer in Alinta Energy has grown by 11% in 2019 (Alintaenergy, 2021).

Threat of the alternatives

The threat of the alternatives is low. It is because the loyal customers at Alinta Energy indulges in availing quality services that are not vested with sudden power outages and are not going to change their purchase habits as they prefer quality services to cheap alternatives.

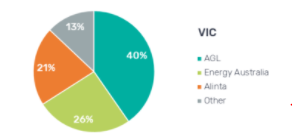

Threat of the competitive rivalry

The threat of the competitive rivalry is high as AGL Energy is providing intense competition to Alinta Energy in the Australian energy sector. It is supported by the fact that the market share of AGL Energy has increased to 36.7% (Mullane, 2021).

Figure 2: Comparison of Market share between AGL Energy and Alinta Energy

(Source: Energysynapse, 2021)

SWOT analysis

|

Strength

|

Weakness

|

|

Opportunity

|

Threat

|

TABLE: SWOT Analysis

(Source: Learner)

Thematic analysis

Theme: Impact of SDG 13 on reducing financial issues of business

In the works of Montiel et al. (2021), it is identified that the adoption of SDG 13 in the businesses has a positive influence as a means of reducing strategic issues and plays a major role in reducing investment. The paper has also highlighted on the fact that the implications of the SDG is of significant importance to the business as it helps in improving financial performance by streamlining expenses in the business processes and reduce financial issue. According tovan der Waal & Thijssens (2020) more than 39% of the companies have been adopting SDG 13 and have been observed to impart positive inclinations to the strategic financial planning for the organisation. The paper has further emphasised the fact that the economic benefits of reducing business process costs is one of the major underlying reasons for adopting SDG 13. Hence, it can be analysed that the impact of SDG 13 has a definite positive relation to the growth of the financial asset and decreasing financial issues of the companies.

Theme: Contribution of SDG on CSR programs of businesses

According to Lopez (2020), CSR means that a company's success is measured not only by its services, goods, and revenues, but also by the influence it has on social well-being and the national and global environment. This has raised the demand on businesses to meet sustainable development goals, especially in environmental and social goals. This was recently mirrored in Europe's 2013 meat adulteration scandal, which made public the discovery of horse flesh in items labeled as beef in 13 European countries. SDG is described as development that meets current demands without jeopardizing future generations' ability to meet their own needs. Belen & Nuria (2017) have opined CSR entails higher output, but not at the expense of the environment or social cohesiveness. As a result, the manner in which the output is created becomes important to the concept of sustainable development, bringing it back to the concept of CSR (at the business level). Hence, it can be analysed that CSR is an analogy to the corporate counterpart of sustainable development.

Discussion of findings

Through the strategic analysis, it has been observed that the SDG 13 will play a critical role in reducing the operational expenses of the SDG 13 as the Target 13.3 provides critical information about the cost effective solution at institutional capacities to adhere eco friendly solutions. Similar findings have been observed in the thematic analysis as the findings affirm the influence of the SDG 13 on reducing the operational cost and financial issue of the company by streamlining the expenses significantly. Both the findings from thematic and strategic analysis has been understood to be in alignment with the illustrations of literature review as several authors has confirmed the contribution of SDG 13 in the reduction of the investments and financial issues by enhancing the positive externalities. It is because the positive externalities refer to the condition of receiving benefits without paying for the technology spillover and the use of the renewable energy technological solutions within the business process of Alinta Energy reduces the energy consumption expenses and high infrastructure investment issues for the company. Hence, it can be implied that the use of the SDG 13 might have a positive influence on the decrease of financial issues at Alinta Energy.

From the strategic analysis, it can be observed that the use of SDG 13 might benefit the company in achieving the long-term objectives of deploying extensive CSR programmes that reduces greenhouse gas emission and eradicate the prominence of CSR issues. It is because the target 13.2 of the SDG 13 implies effective CSR programmes as a means of integrating climate changes measures within the policies and strategies at institutional level and addresses various issues in terms of lack of program efficacy and targets. Similar finding has been observed within the results of thematic analysis as the researchers have been understood to frame CSR as an analogical corporate counterpart of sustainable development goals, which is aimed at reducing the adverse impact of greenhouse gases. Both of the findings from the thematic and strategic analysis has been in coherence with the results of the literature review as various scholars have opined that CSR has been one of the integral part of the company’s initiative for aligning the business practices with the SDG. Hence, it can be analysed that the SDG 13 might be depicted as the instances that enterprise initiative has aimed at integrating CSR at institutional level and might be beneficial for Alinta Energy as it has definite role in reducing CSR issues.

Conclusion

From the research, it has been identified that the impact of SDG 13 on reducing financial issue of Alinta energy is significant and, in turn, has been able to solve the research question that has been aimed at identifying the extent of impact of SDG 13 on reducing financial issues at Alinta Energy. The report has identified that the low solar feed in electricity tariffs has posed as the cost-effective solution of SDG 13 that benefits and into energy. This, in turn, has accomplished the research objectives of recognising the cost-effective solution that are proposed by SDG 13 while being deployed within the business practices of Alinta Energy. From the research, it can be concluded that the SDG 13 will be beneficial for the company when it comes to achieving its long-term objective of enhancing CSR programs that mitigates climate change. The findings of such nature have been assertive in answering the research question of identifying the role of SDG 13 in CSR programs at Alinta Energy. The report has been significant in analysing the SDG 13 on the business prospects of the company. The use of secondary data collection has been extremely beneficial for the research and has emerged as one of the major strengths of the paper. The integration of critical literature review has been significant in increasing the quality of the research paper. The integration of thematic analysis has been exemplary in drawing out credible research inferences that signify the implications of SDG 13 as the strategic measure for the organisation.

Strategic recommendations

The organisation is recommended to develop extensive solar electricity generation network for adopting SDG 13 within the business practices of Alinta Energy. It is because the Target 13.A of SDG 13 implies the importance of effective use of financial resources while mitigating the climate change and such efficiency in financial investment can only be achieved through Solar electricity network as it has affordable electricity feed in tariffs. The organisation is also recommended to increase CSR programmes that promote and educates the social about the benefits of climate change mitigation measures. It is because Target 13.3 of SDG 13 signifies the importance of improving education and awareness about the climate change mitigation among the society and such extensive education can only provided by conducting awareness campaigns through CSR programs. Therefore, the recommendation of conducting extensive CSR programmes will be beneficial for Alinta Energy.

Reference list

Alintaenergy.com. (2021).Alinta Energy Sustainability Report. Retrieved from https://www.alintaenergy.com.au/-/jssmedia/alinta-website/documents/about/ae-sustainability-report

Arena.au. (2021). Retrieved 28 May 2021, from https://arena.gov.au/renewable-energy/large-scale-solar/

Belen, L., &Nuria, V. (2017). Corporate competitiveness based on Sustainability and CSR values: Case studies of Spanish MNCs. In Strategic Innovative Marketing (pp. 309-314).Springer, Cham.

Carroll, A. B., &Buchholtz, A. K. (2015). Business and society: Ethics, sustainability, and stakeholder management. Cengage Learning case studies of Spanish MNCs. In Strategic Innovative Marketing, Springer, Cham, pp. 309-314

Dnb.com. (2021). alinta_energy. [online] Available at: Energy.au. (2021). Retrieved 28 May 2021, from https://www.energy.gov.au/sites/default/files/australian_energy_statistics_2019_energy_update_report_september.pdf Energysaver.au. (2021). Feed-in tariff rates. (2021). Retrieved 28 May 2021, from https://energysaver.nsw.gov.au/households/solar-and-battery-power/feed-tariff-rates Energysynapse.au. (2021). Five minute settlement rule change. (2018). Retrieved 28 May 2021, from https://energysynapse.com.au/five-minute-settlement-rule-change-energy-market/ Gomez-Echeverri, L. (2018). Climate and development: enhancing impact through stronger linkages in the implementation of the Paris Agreement and the Sustainable Development Goals (SDGs). Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences, 376(2119), 20160444. Lopez, B. (2020). Connecting business and sustainable development goals in Spain. Marketing Intelligence & Planning. López, B., &Monfort, A. (2017). Creating shared value in the context of sustainability: The communication strategy of MNCs. Strategic analysis assignment Corporate Governance and Strategic Decision Making, 119-135. Louman, B., Keenan, R. J., Kleinschmit, D., Atmadja, S., Sitoe, A. A., Nhantumbo, I., ...& Morales, J. P. (2019). SDG 13: climate action–Impacts on forests and people. Sustainable Development Goals: Their Impacts on Forests and People; Cambridge University Press: London, UK, 419-444. Montiel, I., Cuervo-Cazurra, A., Park, J., Husted, B. W., &Antolin-Lopez, R. (2021).Implementing the United Nations' Sustainable Development Goals in International Business. Available at SSRN. Morton, A. (2019). How Australia’s election will decide its role in climate change. (2019). Retrieved 28 May 2021, from https://www.nature.com/articles/d41586-019-01543-6 Mullane, J. (2021). Largest Energy Companies in Australia – Canstar Blue. Retrieved 28 May 2021, from https://www.canstarblue.com.au/electricity/largest-energy-companies-australia/ Snyder, H. (2019). Literature review as a research methodology: An overview and guidelines. Journal of Business Research, 104, 333-339. UN.org. (2021).Climate Change. (2021). Retrieved 28 May 2021, from https://www.un.org/sustainabledevelopment/climate-change/ van der Waal, J. W., &Thijssens, T. (2020). Corporate involvement in sustainable development goals: exploring the territory. Journal of Cleaner Production, 252, 119625. van der Waal, J. W., Thijssens, T., & Maas, K. (2021). The innovative contribution of multinational enterprises to the Sustainable Development Goals. Journal of Cleaner Production, 285, 125319. Van Zanten, J. A., & Van Tulder, R. (2018). Multinational enterprises and the Sustainable Development Goals: An institutional approach to corporate engagement. Journal of International Business Policy, 1(3), 208-233. Varela, J. C. S., Lopez, B., &Fornes, G. (2015). Corporate social responsibility in emerging markets: case studies of Spanish MNCs in Latin America. European Business Review. Appendix Theme Topic Author Year Impact of SDG 13 on strategic initiatives of business Implementing the United Nations' Sustainable Development Goals in International Business Montiel, I., Cuervo-Cazurra, A., Park, J., Husted, B. W., &Antolin-Lopez, R. 2021 Corporate involvement in sustainable development goals: exploring the territory van der Waal, J. W., &Thijssens, T. 2020 Contribution of SDG on CSR programs of businesses Connecting business and sustainable development goals in Spain van der Waal, J. W., &Thijssens, T. 2020 Corporate competitiveness based on Sustainability and CSR values: Case studies of Spanish MNCs Belen, L., &Nuria, V. 2017 TABLE: Thematic findings (Source: Learner)