Strategic Triumph: Unveiling Team Green's Cesim Banking Game Journey and Key Insights

Question

Task: How did Team Green achieve strategic triumph in the Cesim Banking Game, and what were the key insights gained from their journey?

Answer

Introduction

With five members who each have unique talents that complement one another, Team Green is the perfect example of synergy. Each member is a crucial cog in the mechanism that propels strategic success in the Cesim Banking Game. Utilising the varied experience of its members, this harmonic team works as a cohesive unit to create well-rounded judgements that lead the group to the highest level of shareholder value maximisation. Within this group, Vishwanth Etekala's strategic planning paves the way for long-term goals, Yamini Madireddy's attention to personnel dynamics assures an environment favourable to achievement, Pooja Deshpande's market insight propels customer-centric strategies, Harinderjit Kaur's analytical skill closely monitors market trends, and Nazia Mohammadi's financial acumen strengthens risk management (Bocken & Geradts, 2020). By combining these varied skill sets and views, Team Green is able to bring diverse points of view together into a cohesive plan that will help the group navigate the complex Cesim Banking Game with accuracy and competence.

Group Description

1. Harinderjit Kaur uses a data-centric strategy that digs deeply into economic statistics, competitive research, and market trends. This gives the team a rigorous and analytical advantage. Her observations serve as the cornerstone for well-informed, data-driven strategic decision-making, guaranteeing that the group stays in step with the constantly changing market environment.

2. Nazia Mohammadi, who has vaste experience in risk management and financial planning. Her capacity to strike a balance between risk and profitability is extremely essential, particularly when negotiating the ambiguities of different economic situations. The team's stability and financial resilience are greatly enhanced by Nazia's observations.

3. Pooja Deshpande, is skilled in comprehending consumer behaviour and market dynamics. Her areas of competence include identifying consumer preferences, assessing satisfaction, and developing cutting-edge product offers. Pooja's efforts are crucial in helping the team get a competitive advantage in the marketplace.

4. Vishwanth Etekala concentrated on long-term goals and development opportunities. His capacity to strategically plan matches the team's activities to overall objectives, guaranteeing stability and maximising expansion prospects for long-term advancement.

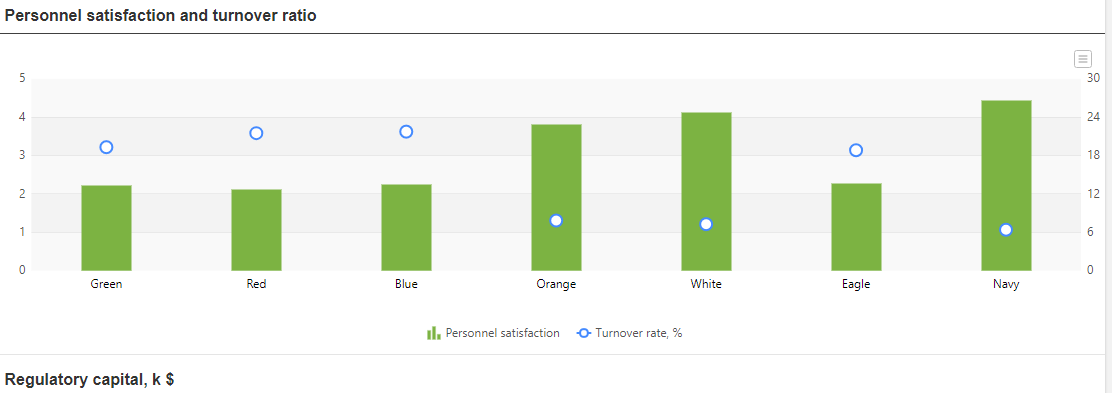

5. Yamini Madireddy, focused on stakeholder satisfaction and staff management, coordinates the team's internal cohesiveness. Yamini keeps a close check on stakeholder involvement and staff morale to maintain a positive and productive work environment, which is essential for optimising team performance and accomplishing common goals (Mikalef et al., 2021).

Inputs

When together, Team Green leverages a wide range of priceless abilities and perspectives, combining their unique contributions:

The team benefits from Harinderjit's keen attention to competition and market studies, which helps to identify important outside variables that affect decision-making. Her thorough research helps the team identify market trends and competition actions so they may make well-informed strategic decisions.

The foundation of the team's efforts in risk assessment and financial planning is Nazia's financial knowledge. Her skill helps the team analyse loan and investment risks, which helps to shape their cautious approach to making financial decisions during uncertain times.

Pooja's focus on the consumer plays a crucial role in understanding market demands and formulating innovative product strategies. Her keen awareness of client preferences guarantees that the team's products and services are in line with industry demands, providing a competitive advantage through creative solutions.

Vishwanth's strategic acumen directs the group towards long-term goals and makes sure that each action is in harmony with the overall objectives of the company. His careful preparation and vision offer a path for steady expansion and stability in the face of shifting market conditions.

Yamini's unwavering concentration on stakeholder satisfaction and people management serves as the team's binding agent. Her efforts to maintain solid stakeholder connections and cultivate a healthy work environment strengthen internal cohesiveness, ensuring that the team works cohesively to accomplish common goals.

Together, Team Green's many skill sets and perspectives work in concert to create well-thought-out solutions. Their combined efforts successfully strike a balance between growth and risk, maximising shareholder value in the complex and cutthroat Cesim Banking Game (Beddoes, 2020).

Round 1

Assumptions

• In order to give extensive insights, Harinderjit Kaur focused his efforts on conducting a thorough research of industry trends, giving particular weight to data-driven decision-making.

• Nazia Mohammadi played a key role in the development of first risk management standards, emphasising the establishment of a fundamental structure for managing possible hazards.

• By providing insight into early consumer preferences and market expectations, Pooja Deshpande assisted in steering the team in the direction of customer-centric product initiatives.

• Vishwanth Etekala took the lead in outlining the first long-term planning strategies and charting the path for subsequent targets and goals.

• Yamini Madireddy focused his efforts on team chemistry, hoping to create a cohesive and unified group from the very beginning.

Calculations

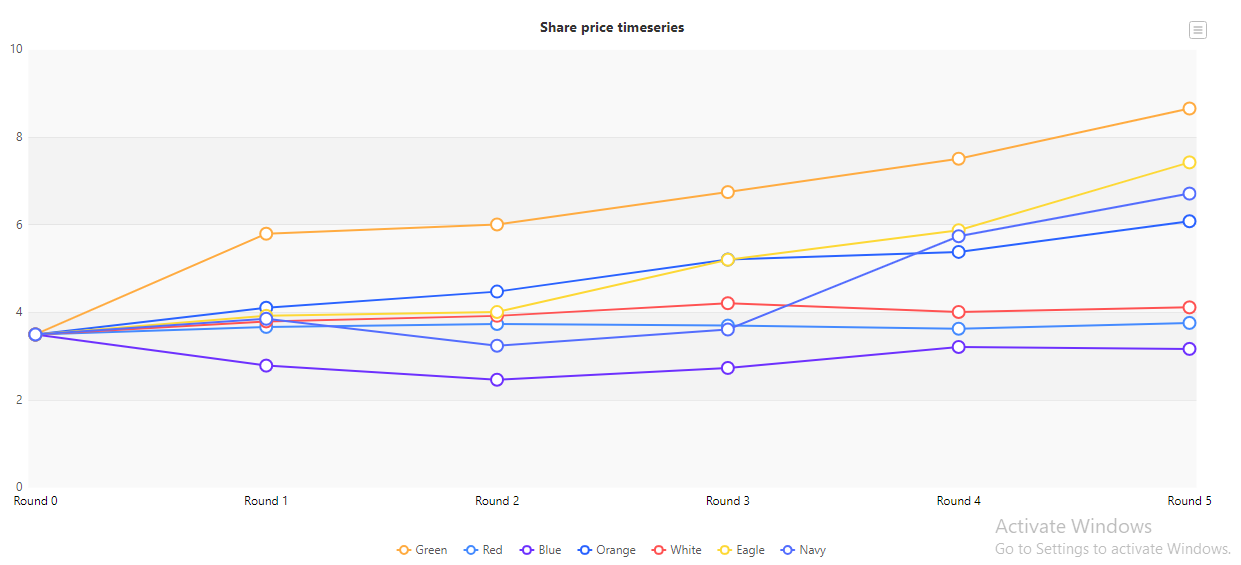

Total income for week one for reported at 5,701

Results

• Based on preliminary market trends and risk assessments, the team developed basic but fundamental strategies as they set out to play the Cesim Banking Game.

• It's possible that the focus was on laying the foundation for customer-centric goods by matching early offerings to early-identified client preferences.

• It may have been primarily focused on establishing long-term goals and plans, laying the groundwork for decisions and actions in later rounds.

Round 2

Assumptions

• In order to improve the team's strategy, Harinderjit dug further into competition analysis, concentrating on obtaining thorough insights into rival tactics, strengths, and shortcomings.

• To make sure the team was prepared to handle any risks, Nazia took on the duty of fine-tuning risk management tactics depending on changing market conditions.

• Pooja gave a thorough and polished presentation of consumer feedback, offering more nuanced insights into the preferences and needs of the audience for improved product creation.

• The team's long-term plans were improved by Vishwanth, who made them more precise and flexible in response to shifting market conditions.

• Yamini also focused on team-building activities, fostering better team relationships, and sustaining a cohesive workplace culture.

Total income for week two was reported by green team at 7,426 which had risen 1,725 points up from 5,701 in week 1. This accounts for 30.26% rise in the total income.

Results

• The team may have strengthened their entire risk management strategy by refining their methods, especially in risk assessment, by utilising increased market information.

• The provision of more thorough customer input may have improved customer-centric initiatives by enabling a more exact alignment with consumer preferences and market expectations.

• It is possible that long-term planning has grown more focused and flexible in order to better prepare for next rounds and to keep up with changing market conditions.

• Yamini's emphasis on team-building activities might have improved the team relationships and made the workplace more cohesive and productive.

Round 3

Assumptions

• In order to keep the team updated about market dynamics and competitor actions, Harinderjit persisted in giving them thorough market insights.

• Nazia concentrated on improving risk models in response to shifting economic circumstances and modifying risk-management plans to efficiently reduce possible dangers.

• Pooja made sure the team stayed in line with changing consumer preferences by tailoring products and services to their changing needs.

• In order to ensure that the team's strategy could be modified in response to shifting economic conditions, Vishwanth modified long-term plans in light of developing market trends.

• Yamini made sure that the team stayed cohesive and productive even in the face of adversity by preserving team cohesiveness and harmony.

Total income for week three was reported by green team at 9,618 which had risen 2,192 points up from 7,426 in week 2. This accounts for 30% rise in the total income.

Results

In order to stay competitive, the team probably quickly modified their plans in reaction to changes in the economy. This demonstrated flexibility in their decision-making.

Their competitiveness may have been sustained in large part due to their customer-centric strategies, which allowed them to successfully match their products with shifting consumer needs.

The team's emphasis on thorough risk assessment and management probably protected them against future downturns and ensured their resilience even in the face of difficult financial circumstances.

Round 4

Assumptions

Harinderjit provided important insights into the changed environment by modifying her analysis to take into account the impact of the recession on competitor behaviour and market trends.

Given the elevated risks brought on by the economic slump, Nazia upped the rigour of her risk management plans.

In order to maintain the team's financial stability and meet changing client demands throughout the recession, Pooja redesigned the offerings.

In order to keep things stable in an unstable economic climate, Vishwanth made adjustments to long-term plans that would guarantee the team's efforts were directed towards attaining sustainable growth.

Yamini concentrated on preserving a strong team culture to make sure the group stayed together and inspired in spite of the difficult market circumstances.

Total income for week four was reported by green team at 7,874 which had dropped -1,744 points from 9,618 in week 3. This accounts for -18% drop in the total income for week four

.Results

The group may have managed the recession well because of its ability to adapt, which reduced risks while maintaining consumer satisfaction.

The team's steady success during the crisis may have been attributed to the redesigned goods and robust strategy, demonstrating their capacity to handle difficult financial circumstances.

Round 5

Assumptions

Harinderjit focused on updated market trends and competitor behaviours in the improved environment and modified her assessments to reflect the stabilising economy.

In response to the evolving situation, Nazia modified risk models to better reflect the improved economic conditions and achieve a more ideal balance of risk.

Pooja streamlined the team's offerings to better meet the reviving market needs and adapt to the shifting tastes of her clientele.

Vishwanth adjusted long-term plans to pursue chances for expansion brought about by the economy's stabilisation while maintaining long-term stability.

Yamini maintained team morale and engagement, making sure that the group was cohesive and driven to take advantage of new chances.

Total income for week five was reported by green team at 5,113 which had dropped -2,761 points from 7,874 for the 2nd week running in week 4. This accounts for -35% drop in the total income for week five.

Results

The group most likely took advantage of the economy's stabilisation by adjusting its tactics as needed to take advantage of growth prospects.

Effectively striking a balance between risk and growth may have been a crucial result, boosting shareholder value in spite of the difficulties brought on by the erratic economic climate.

Conclusions

Throughout the Cesim Banking Game, Team Green has demonstrated strategic flexibility, agility, and an unwavering dedication to maximising shareholder value. The team continuously shown a dynamic approach throughout the five rounds, efficiently adapting to the unstable economic and market situations.

During the first few iterations, the team established a solid base by prioritising data-driven choices, risk mitigation, customer-focused tactics, long-range planning, and cultivating a harmonious team atmosphere. They refined these tactics as the game went on, adjusting products, matching long-term goals with shifting economic circumstances, and going further into rival analysis.

Notably, Team Green showed resiliency and prudent risk management during recessions, skillfully negotiating difficulties to preserve steady performance and client satisfaction. The group took advantage of chances when the economy steadied, modifying expansion plans, skillfully managing risk, and generating increased shareholder value in spite of challenges.

Key Learning Outcomes:

1. Adaptability and Flexibility: The group's capacity to quickly adjust to shifting economic conditions and market dynamics is a noteworthy learning achievement. Their ability to quickly change tactics made sure they were always competitive and adaptable.

2. Balancing Risk and Opportunity: An important lesson was striking a balance between strategic growth objectives and risk aversion. In times of market favorability, Team Green capitalises on possibilities while skillfully managing risks during downturns.

3. Continuous Improvement: It was crucial to place an emphasis on ongoing observation and adjusting plans in light of new facts. It emphasised how crucial it is to be informed and make timely, well-informed judgements.

4. Stakeholder Management: Another important lesson was realising the importance of stakeholder satisfaction, which includes both internal and external stakeholders. The team's overall performance was greatly influenced by their attempts to keep a positive working relationship.

5. Strategic Planning and Execution: One essential learning outcome that has emerged is the ability to effectively link short-term strategies with long-term goals. A team's capacity to strike a balance between short-term choices and long-term objectives was essential to long-term success.

Team Green's trip highlighted key ideas necessary for success in the complex world of banking and finance throughout the Cesim Banking Game. The group's capacity to quickly adjust to shifts in the economy and the market proved to be a key component. Because of their skill in risk management, they were able to maintain stability throughout downturns and overcome obstacles while maintaining client satisfaction. Prioritising the happiness of stakeholders—internal and external—showed how important building connections is to long-term success (Quines & Albutra, 2023). Using insights from real-time data, the team was able to make well-informed judgements thanks to continuous improvement initiatives. Furthermore, their emphasis on the strategic alignment of short-term tactics and long-term goals highlighted the need of striking a balance between current actions and broader aims. These learned experiences and concepts are priceless, giving a road map for upcoming projects in the banking and financial industry and a structure for flexibility, resilience, and long-term expansion.

Bibliography

Beddoes, K., 2020. Interdisciplinary teamwork artefacts and practices: a typology for promoting successful teamwork in engineering education. Australasian Journal of Engineering Education, 25(2), pp.133-141 retrieved from https://www.tandfonline.com/doi/abs/10.1080/22054952.2020.1836753.

Bocken, N.M. & Geradts, T.H., 2020. Barriers and drivers to sustainable business model innovation: Organization design and dynamic capabilities. Long range planning, 53(4), pp.1-23 retrieved from https://www.sciencedirect.com/science/article/pii/S0024630119301062.

Mikalef, P., van de Wetering, R. & Krogstie, J., 2021. Building dynamic capabilities by leveraging big data analytics: The role of organizational inertia. Information & Management, 58(6), pp.1-17 retrieved from https://pdf.sciencedirectassets.com/271670/1-s2.0-S0378720621X00055/1-s2.0-S0378720620303505/main.pdf?X-Amz-Security-Token=IQoJb3JpZ2luX2VjEB0aCXVzLWVhc3QtMSJIMEYCIQCQEXFER5KHZr70APZAIq44%2BNoNVeu blXYsSccALl3rXgIhALPcSKHuqw4%2F%2Boju97.

Quines, L.A. & Albutra, D.A., 2023. The mediating effect of normative commitment on the relationship between instructional coaching skills and teamwork of teachers. European Journal of Education Studies, 10(3), pp.1-21 retrieved from https://oapub.org/edu/index.php/ejes/article/view/4713/7348. Cesim Banking Game